March dairy market review

Thursday, 20 April 2023

Milk production

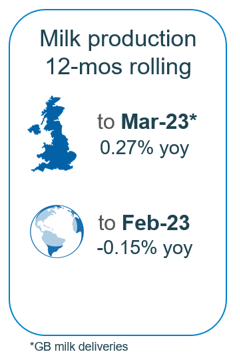

GB milk deliveries continued to record year on year growth through March, with estimated volumes up 1.2% on the year at 1,088m litres. Seasonal growth is in line with typical patterns for the time of year.

This brings the GB estimate for the 2022/23 season to 12.39bn litres, a marginal increase of 0.2% compared to the previous season and in-line with our forecast.

The growth in milk production has been driven by a favourable milk to feed price ratio over the autumn and winter, with favourable weather last Autumn. However, the reductions in milk prices since the beginning of 2023 could start to impact on yields in the latter part of the year, especially if input costs remain high.

With yields expected to remain high through spring, we have forecasted marginal growth for milk deliveries in the 2023/24 season (+0.5%). However, this heavily depends on the extent of milk price declines, as tightening farm margins could potentially lead us to see higher destocking rates.

Global milk production in February grew by 0.8% year-on-year, averaging 816.6m litres per day. Increased deliveries were recorded in all key regions with the exception of Australia and Argentina. However, production in February 2022 was relatively muted, which will impact on the annual comparisons.

EU are forecasting a drop of 0.2% in milk production for 2023. This is in response to a declining dairy herd and lower prices forecast to drive a decline in production in the second half of the year, despite good yield growth.

Chinese demand, thought to be the catalyst for growth for global demand, remains soft but potential for upside going forwards. Following heightened import volumes in 2021 to ensure food security, imports fell by around 19% in 2022. The drop was in part a response to the high stock levels, but will also have been impacted by China’s zero-Covid policy, low GDP growth, and lower consumer spending on the back of high prices. Based on predicted economic growth of 4.5% for 2023 and 2024, import volumes would be expected to increase by around 6.7% per year. While imports in the first two months remain below previous year levels, it is expected that demand will recover through the year, pulling up import demand.

Wholesale markets

Prices on dairy wholesale markets have been weakening in all key markets since the summer of 2022. With the northern hemisphere flush approaching, the general view is this trend will continue into the first quarter of 2023. EU product prices were anywhere from 25% to 35% lower year on year. The exception to this is in cheese prices, which have declined in recent months but remain 16.1% above year earlier levels.

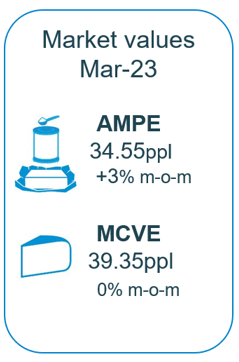

As of March, milk market values (which is a general estimates on market returns and the current market value of milk. based on UK wholesale price movements) in the UK are around 12ppl lower than a year earlier, with AMPE and MCVE down by 37% and 21% respectively.

Farmgate milk prices

The latest published farmgate price was for February, with a UK average of 48.1ppl. Since then however, market-related farmgate prices have been declining in response to the reduced market returns and higher milk availability.

In the first four months of this year, cuts to milk prices (excluding aligned) have ranged from 3.5ppl and 10.5ppl, with further cuts expected for May, although Freshways have held price for May while Tesco are returning to its cost model, increasing the milk price by 1.0ppl in May.

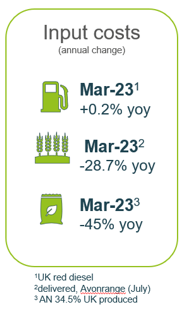

In general, inflation in key input costs has slowed in recent months, recording some significant drops for both feed and fertiliser, although prices for fuel, fertiliser and feed still remain relatively high in historic terms. The combination of high production costs and declining prices means farm margins will come under increased pressure through the season.

This is expected to lead to reduced yields later in the year, with GB milk production in the 2023/24 season to record minimal growth of 0.5%.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.