January 2025 dairy market review

Thursday, 20 February 2025

Milk production

GB milk deliveries are estimated to have totalled 1,047 million litres in January, up 2.2% compared to the same period in 2024. Deliveries averaged at 33.8 million litres per day.

For this year’s milk season far (April-January), production totalled 10,376 million litres, a 0.8% increase compared to the previous season. Good dairy economics have supported production growth during the winter months.

Deliveries have showed year-on-year growth since September, as farmer confidence seems to have been rebuilding over the autumn and winter months. January deliveries remain well above the 5 year average for the month, despite the cold start.

We outlined expectations for production, prices and demand in the year ahead in our agri-market outlook for dairy. This is to account for the current market situation and the expectation is for the current calendar year to end at 1.1% above the previous year. We expect milk production to stay elevated through the flush before falling back towards next Autumn.

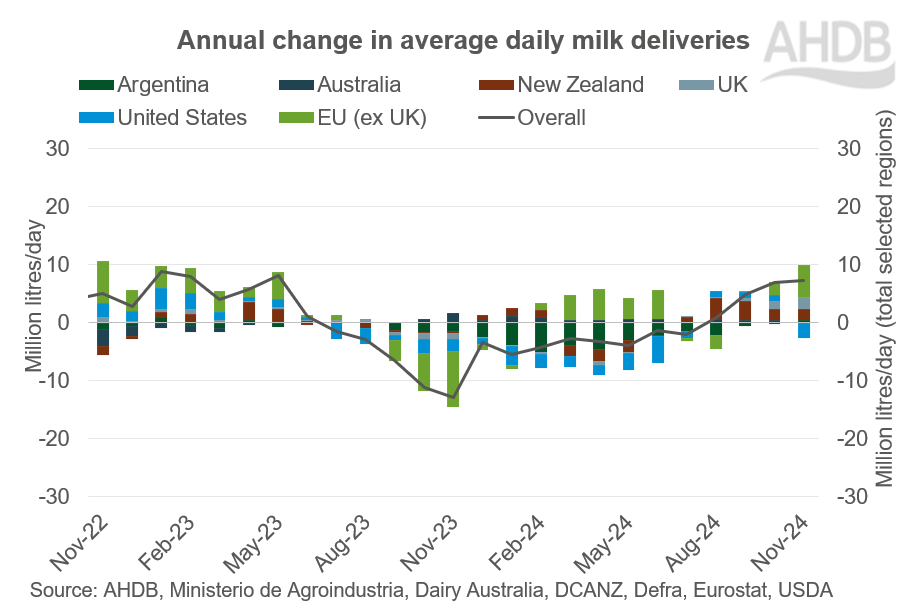

Global milk deliveries averaged 817.6 million litres per day in November, an increase of 7.3 million litres per day (0.9%) across the selected regions, compared to the same period last year. All regions except the US and Australia recorded year-on-year volume increase.

Milk deliveries in the EU averaged 358.3 million litres per day, an increase of 5.5 million litres per day (1.6%) compared to the same period last year. The greatest year-on-year volume increase was in Irish milk production, up by 128.3 million litres (33.6%). Production volumes in Poland and France were up by 37.7 million litres (3.9%) and 32.1 million litres (1.8%) respectively. Germany saw the largest decline of 45.6 million litres (-1.9%) followed by Italy, a decline of 11.2 million litres (-1.2%).

According to latest estimates, global milk production across the key producing regions is expected to come back to growth with a small increase of 0.6% year-on-year. This is higher than the 0.1% decrease recorded in 2024. The growth should come from every region, bar Australia (which will be highly weather dependent).

According to the Dairy Australia December 2024 report, farm margins have been pressured by lower farmgate prices and higher operating costs.

Milk production in Australia grew during the 2023/24 season, supported by strong farmgate prices. 2024/25 volumes saw some year-on-year growth in the first half, but as the season progresses, a slight drop is expected overall, as dry weather conditions and tighter margins challenge further growth.

Chinese milk production is showing signs of slowing and there is optimism for domestic demand growth. Lower supplies of milk are shifting trade dynamics for the largest dairy importing country in the world. China rapidly increased domestic milk production in recent years, with the goal of achieving self-sufficiency reached by 2023. This was followed by over-supply, leading to a sharp drop in imports.

However, 2024 saw domestic milk production progressively decline year-on-year, with Rabobank estimating a 5% reduction in production for the second half of 2024 as low farmgate prices and high production costs led to industry exits. Additionally, a heatwave in Q3 further impacted supplies. Production in 2025 is expected to fall by a further 1.5%, as low margins are forecasted to continue, with most of the reduction taking place in the first half of the year.

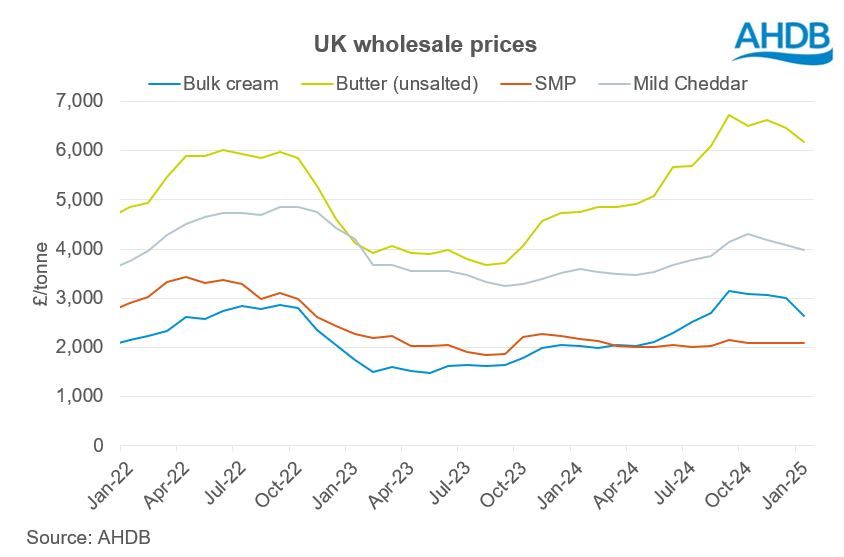

Wholesale markets

Commodity prices and demand entered the traditional post-Christmas slump in January, with volumes down after the peak festive period. Growing milk supplies, both domestically and on the continent have eased pressure on commodity prices for fats and cheese. However, the last week or so has brought some recovery meaning the slump could be short-lived.

Bulk cream eased almost £400/t month on month (or 13%), with some recovery later in the month while butter prices also softened off this month, falling by £290/t (or 4%). Stocks were reported to still be tight and buyers still concentrating on covering short-term needs rather than planning ahead with expectations of price falls coming into the Spring flush.

SMP prices were reported to be stable.

Cheese markets followed a similar pattern of dip and recover throughout the reporting period. The average price for mild Cheddar declined a further £90/tonne month on month.

As of January, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) decreased to 43.7ppl. AMPE lost 3%, MCVE lost 2%. AMPE is now ahead of a year ago by 18%, with MCVE up by 16%.

Farmgate milk prices

The latest published farmgate price was for December with a UK average of 47,1ppl, up by 0.8%, on the previous month. Latest announced farmgate prices for steady to lower in February except for one contributor of the AHDB League table making a positive announcement. Non-aligned liquid, cheese and manufacturing contracts all held steady with the exception of Wyke which gained 0.2ppl.

On retailer aligned contracts, prices lowered (held for some). Waitrose and M&S held on to their price for another consecutive month. M&S has been holding their price steady for the last six months. However, Co-op Dairy group and Sainsbury’s announced a decline of 0.18ppl and 0.01ppl, respectively. After holding steady for three months, Tesco moved their price lower by 0.42ppl in February.

Product availability

Stocks of butter in the UK in Q3 continued to be tight due to lower production. Milk powders continue to be in surplus for another consecutive quarter due to lower exports. Available supplies of cheese were at par with the same period in the previous year but exports and imports continue to be in growth.

Stocks in the EU followed a similar pattern. EU dairy product availability declined in Q3 2024 compared to the same period in 2023. Milk deliveries declined marginally by 0.2% in the third quarter year-on-year affecting the production of dairy products. Combined with increased exports, this tightened butter and cheese supplies. Lower production and imports also challenged the availability of milk powders. Consumers remain cautious in their buying approach and are hesitant to stock up.

Retail demand

During the 52 weeks ending 28 December 2024, volumes of cow’s dairy declined by 0.6% year-on-year (NIQ Homescan POD, Total GB). Spend on cow’s dairy grew 0.5% year-on-year, driven by growth in average prices of 1.0% (52 w/e 28 December 2024).

Spend on cow's milk continues to decrease (-5.4%) and despite an increase in shopper numbers, volumes purchased declined by 1.9% year-on-year (52 w/e 28 December 2024, NIQ Homescan POD, Total GB). Declines were seen for both semi-skimmed and skimmed cow’s milk, while whole milk continued to see volume growth (+2.5%) due to an increase in buyers.

Cow’s cheese remains in volume growth, up 4.5% year-on-year, and spend increased by 2.8% despite average prices decreasing by 1.6% (52 w/e 28 December 2024, NIQ Homescan POD, Total GB). Cheddar, which represents 41.8% of all cow cheese volumes, saw a 5.0% increase in volumes sold due to an increase in volumes purchased per buyer. Cheddar (+5.7%), specialty and continental (+3.8%) and stilton and British blue cheeses (+4.3%) were also seen to perform well at Christmas 2024 (4 w/e 28 December 2024, NIQ Homescan POD, Total GB), as we had anticipated in our pre-Christmas predictions.

Cow's butter, at a total level, saw a volume decline of 3.4% and a spend decline of 1.4% (52 w/e 28 December 2024, NIQ Homescan POD, Total GB), driven primarily by a decline in volume sales of butter spreads (-7.1%). Block butter, however, continued to see volume increases of 6.4%. Plant-based spread volumes also continued to increase (+8.2%), potentially driven by lower average prices.

Cow's yogurt, yogurt drinks and fromage frais volumes continue to grow (+6.3%), with spend increasing by 7.9% (52 w/e 28 December 2024, NIQ Homescan POD, Total GB). Virtually all yogurt products saw volume growth during the period. Healthy, fat-free, standard plain and standard flavoured cow’s yogurts, which represent 67.7% of cow yogurt volumes, all saw the greatest actual increases in volumes purchased of the category.

Cow's cream volumes grew by 2.5% year-on-year, primarily driven by increased frequency of purchase (52 w/e 28 December 2024, NIQ Homescan POD, Total GB). Double, sour cream and crème fraiche all experienced volume growth.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.