How the current high feed prices are impacting on livestock sectors

Thursday, 4 February 2021

By Charlie Reeve

The impact of rising feed costs across livestock sectors is starting to be noticed as the cost of on-farm feeding could put pressure on farm margins later in the year. With a bullish outlook for global grain markets due to relatively tight supply, there is concern that high prices are likely to remain in the coming months.

Feed prices have been on an upwards trajectory for several months now, and the most recent Feed Market Report shows UK ex-farm spot prices remaining high.

Both feed wheat and barley prices have been increasing, with feed wheat at a significant premium to feed barley due to tighter availability. As at 28 January, UK feed wheat (ex-farm) averaged £204.50/tonne, a 34% increase year-on-year, while feed barley was up 22% at £155/tonne.

Soyabeans have been on an upwards trajectory in recent months with harvest delays in South America and strong global demand from China helping to support markets.

On the basis of current feed prices, the calculated concentrated feed price reached £249/tonne in December, £25/tonne higher than the five-year-average.

What does this mean for the different sectors?

Dairy

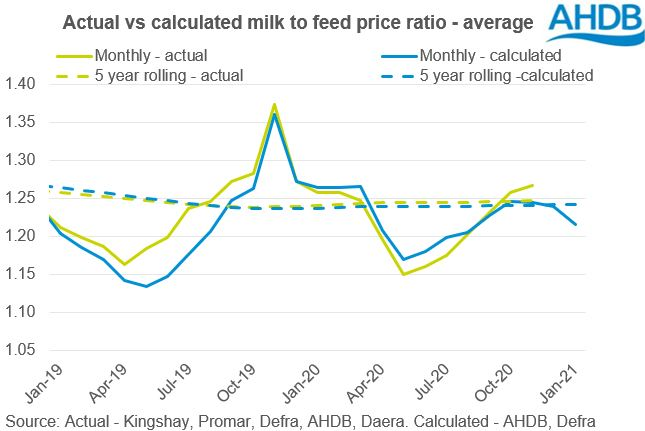

In dairy, we are starting to see a shift in the milk price to feed price ratio. In January, the average calculated milk to feed price ratio (MFPR) had dropped to 1.22, although it often takes some time for increases in feed prices to flow through into the ratio and further declines are expected over the coming months.

Historically when the ratio has fallen below a certain level, milk production has declined. If the ratio falls further, we would expect to see production start to decline during the summer months, as reliance on bought in feed increases

Red meat

Current high farmgate prices in both the beef and lamb sectors are helping to temporarily offset some of the increases in on farm feed costs. However, with ground conditions being poor in many regions of the UK due to prolonged rainfall, it is likely that less outwintering will be taking place. Therefore, there may be a heavier reliance on purchased feeds, which could increase costs based on current feed prices.

For the pork sector, they are facing pressure from both ends, with declining farmgate prices and rising feed costs.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.