Feed markets hit by global price rally: Feed market report

Thursday, 28 January 2021

By Alex Cook

Grains

The early parts of January saw the rally in grain markets kick up a gear, after the release of key data. Most gains were seen in US maize markets, which lent support to global grain prices as a whole. Prices have since fallen back as global grain supply prospects improved.

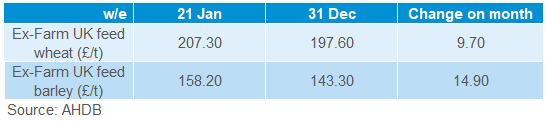

UK ex-farm prices increased with global markets. Spot UK feed wheat was quoted at £207.30/t, in the week ending 21 January, with UK feed barley worth £158.20/t. This is an increase of £6.30/t for feed wheat and £10.70/t for feed barley from week ending 7 January.

The USDA global supply and demand estimates report (WASDE) in the second week of January showed an 8.2Mt cut to US maize production this season. Global ending stocks (less China) for maize are now estimated at 92.2Mt, down 10.3Mt from last year and the lowest since 2013/14. Global feed consumption is estimated at its highest level on record, this season. As a result, the cut to US supply jolted markets into moving higher.

We could see reduced maize supply closer to home too. Ukraine has proposed a limit to maize exports, following an 18% fall in production year-on-year. Ukraine isn’t the only Black Sea exporter putting a cap on grain exports, with Russia imposing a tax on wheat, barley and maize exports from February and March onwards. The goal of the tax is to reduce domestic food and grain prices, amid rising inflation during the coronavirus pandemic.

Looking forward, price movement for grains will look to crop condition news and planting progress for the second (safrinha) maize crop in Brazil in February. Much needed rainfall during late December and January for Argentina and Brazil has improved soil moisture levels. This will aid conditions for the large maize crop due to be planted in February to early April. As such, grain markets did fall slightly, but, more rain will be needed for many areas.

Oilseeds

Throughout the later months of last year, a rally in global oilseed prices was evident with heavy buying of US soyabeans by China to feed its expanding pig herd. However in the second half of January, there have been signs that the rally has eased slightly

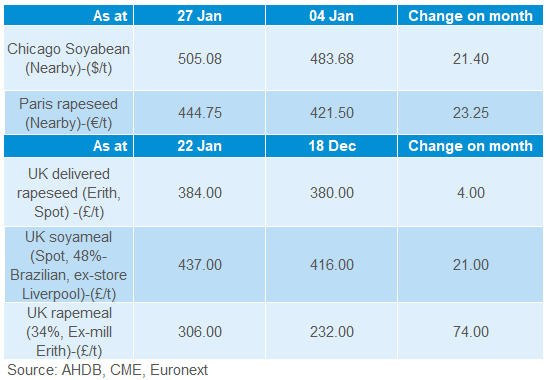

On Friday (22 Jan), Chicago soyameal futures (Mar-21) closed at $464.74/t (£339.62/t), down $8.60/t from 31 Dec. This is down $47.70/t on the contract-high of $513.02/t (£375.48/t), reached on 12 January.

The bulk of the soyabean harvest in Brazil will occur throughout February and March and is estimated to reach 133.7Mt according to Conab. So far, 0.9% has been harvested, versus 4.8% last year for this point, rates have been slowed by recent rainfall. If realised, this would be a record production figure for the country. Dryness concerns have followed the crop throughout its growing season, which provided support to markets. However, rainfall in key regions in December and January has added a degree of pressure as harvest nears.

Rapeseed prices have been tracking the gains in soyabeans. UK oilseed rape prices (delivered Erith, February) were quoted at £384.00/t on 22 January, up £4.00/t from 18 December. The arrival of the bumper Australian crop to markets following its 3.7Mt harvest could offer a degree of pressure to European rapeseed markets as availability increases.

Looking to next season, EU-27 + UK rapeseed production for 2021/22 is estimated 1Mt higher at 18.2Mt, according to Stratégie Grains. This is still 1Mt below the five year average. Up until harvest, crop condition reports will help determine the import requirement next season. A large import requirement for a third consecutive season will support prices.

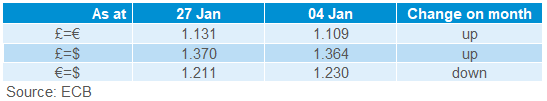

Currency

From 18 December to 25 January, sterling has strengthened against major currencies following the EU exit agreement. Sterling strengthened 2.3% against the Euro and 1.4% against the US dollar. The proposed coronavirus relief packages in the US have to an extent weakened the dollar, due to the risk of increased inflation.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.