- Home

- Cereals market outlook

Cereals market outlook

September 2025

Key points

- Following an overall smaller cereal harvest in 2024, the UK has a greater reliance on imported grain in the 2024/25 marketing year

- As the UK is a net importer, domestic grain prices continue to track movement on global grain markets. Currently a global grain deficit is predicted, though demand is uncertain

- Total UK cereals demand for animal feed in 2024/25 is expected to decline, with a fall in the amount of grain fed on farm outweighing an increase in usage by compounders

- Total UK cereals demand for human and industrial consumption is expected to decline this season, with particularly sluggish usage by brewers, maltsters and distillers

- Looking ahead to harvest 2025, UK wheat production is due to recover somewhat – though it is not expected to rebound back to average levels

Production

Global

Global grain production is forecast to rise by 72.6 million tonnes (Mt) in the 2025/26 season, reaching 2,379 Mt (USDA). The increase is largely driven by a 62.6 Mt uplift in maize output, with much of this growth coming from the USA.

Recent rainfall across the Great Plains in the USA has improved maize crop conditions, easing earlier concerns about poor yields caused by drought.

Maize production is also expected to rise in key exporting countries such as Argentina, Ukraine and Russia. These gains may be partially offset by lower output in Brazil, due to reduced yields, and in the EU, where a smaller area has been planted.

The expected rise in global maize production continues to weigh on grain prices in the short term. However, if we experience adverse weather conditions, particularly when crops are at their vital stage of development, we could see some support for prices.

In addition, we may see more momentum once major buyers like Mexico, Japan, the EU and China become more active in the market.

Global wheat production is projected to rise modestly, supported by larger crops in the EU and Russia. However, these gains are partially offset by declines in Australia and Ukraine, where adverse weather has impacted crops, and in the USA, where a smaller area had been planted to wheat.

European wheat prices have come under pressure in recent weeks, influenced by ongoing harvesting, strong supply prospects, currency fluctuations and weaker export demand.

However, changing weather patterns could alter market sentiment, particularly regarding maize development. Geopolitical risks are also expected to remain a key factor in the months ahead.

UK

In the UK, extremely variable and challenging conditions have remained throughout this year’s growing season. During the autumn/winter drilling period, conditions alternated between very wet and relatively long dry periods. In the spring, while drilling conditions were widely favourable, subsequent dry weather hampered crop development.

AHDB’s latest harvest progress report (including data to 20 August) indicated that harvest has been extremely difficult for many growers, with considerable variability in yields across the country, within regions and even within individual farms.

The results of Defra’s 2025 June Survey of Agriculture, released on 28 August, show a 9% increase in planted wheat area in England at 1.53 million hectares. When combined with figures for Scotland and Northern Ireland (as available) from our Planting and Variety Survey, total UK area would also be up 9% year-on-year. Where published figures are not available for Wales and Northern Ireland, the 2020–2024 average area is used.

Larger cropped areas often bring expectations of larger crops. However, this year the impact of highly challenging weather on yields means production is unlikely to rise in line with the gains in planted area.

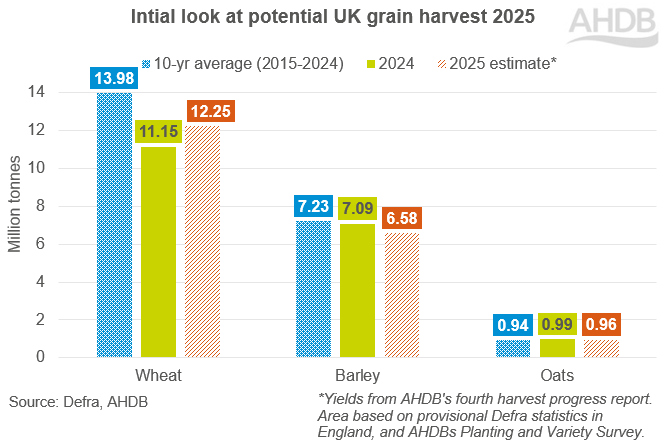

Our most recent harvest report points to an average UK wheat yield of c.9% below the 10-year average at 7.3 tonnes per hectare. As such, UK production currently looks to sit at around 12.2 Mt, up 10% from last year’s crop, but 12% lower than on the 10-year average.

With such variability this season, final UK yield and production remain subject to change as harvest nears an end.

Using the same method for barley and oats, the 2025 crop estimates would sit at close to 6.6 Mt and 963 thousand tonnes (Kt) respectively. However, with a proportion of these crops still left to be harvested in our most recent report, final yield data – and therefore production – could also vary.

Over the coming months, winter drilling will be in focus. Soil moisture levels will be key to initial crop establishment, though it is too early to give an indication of plantings for harvest 2026.

After two very difficult years, which will be challenging for arable farm profitability, more favourable weather is badly needed.

Trade

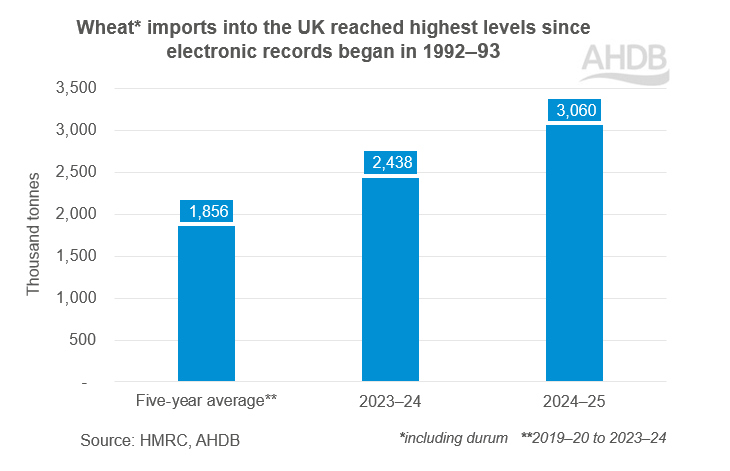

Wheat imports into the UK totalled 3.06 Mt in the 2024/25 season, up 26% on 2023/24 and 65% above the five-year average. The level of imports reflects a combination of a smaller domestic crop in 2024 and competitive global prices, with a significant share of the imports estimated to consist of high-protein milling wheat.

The outlook for 2025/26 wheat imports will largely depend on the final size and quality of the UK crop, when harvest results become clear. At the moment, millers remain well supplied, and larger imported wheat stocks are expected to be carried into the new season, which could reduce immediate import demand.

Additionally, import volumes will be influenced by how UK prices compare with the cost of milling wheat from key import origins such as Canada, Germany and France, which again can be affected by harvest results in these countries.

Wet conditions in Germany over the key harvest period are said to have impacted Hagberg Falling Numbers (HFN) in the country. Currency fluctuations can also impact how competitive imported wheat is against domestic prices.

As expected, UK wheat exports for the 2024/25 season were minimal, totalling 199.4 Kt, a 23% decrease compared to the previous year.

Despite gaining some momentum in the second half of the season, overall exports were constrained by a lack of competitiveness on the global market, driven by a historically tight domestic market and a strong pound sterling for much of the season.

Barley exports for the full 2024/25 season reached 706.6 Kt, down by 9% from 2023/24 and 39% below the five-year average.

As with wheat, the size of the 2025 barley crop will be a key driver of new season export potential, as well as results from barley crops on the continent. According to AHDB’s May balance sheet, end-of-season stocks are projected to be higher than last year, which could boost availability in the new season. Malting quality will also impact demand on the continent.

Oat exports in the 2024/25 season were sluggish, despite a heavier year-on-year supply and demand balance.

Full season data shows UK oat exports totalled just 63.2 Kt, a 46% decline on the previous year and the lowest volume since 2020/21. As mentioned above, the 2025 oat crop is estimated at c.963 Kt. Combined with the potential for above-average carry-over stocks, this could boost overall supply in the 2025/26 season, potentially supporting increased exports, provided the UK remains competitive and demand from continental markets improves.

Maize imports for the 2024/25 season reached 3.10 Mt, up 17% from the previous year and 27% above the five-year average.

This surge was driven by strong global availability, more competitive pricing compared to domestic wheat earlier in the season, and concerns over the RED II status of domestic grain supplies. However, as maize has become less price-competitive, import volumes are expected to slow as the new season unfolds.

Demand

Animal feed

Compound animal feed production rose slightly (1.6%) for a second consecutive season in 2024/25, following a considerable decline in 2022/23.

This increase was driven largely by a rise in cattle feed production (up 5.3%) and, to a lesser extent, firm demand for ewe feed at the start of the season. This uptick is despite a lower rate of cereal inclusion due to the relative price of cereals against alternative proteins.

The climb in cattle feed demand is largely due to supported beef and milk prices, with forage also variable across the UK. On the other hand, pig and poultry feed production fell last season.

Looking ahead – with many struggling with forage production over the spring and into the summer, and with firm market prices – it is likely that we will see firm cattle feed demand remain in at least the short term. Sheep feed demand will depend somewhat on grass growth over the winter period.

Throughout last season, imported maize featured more heavily in rations due to its relative price earlier in the season (and compounders buying forward raw materials).

While maize prices became less competitive later in the season, plentiful US maize supplies on the global market this season could alter the price relationship over the coming months.

A slightly higher rate of barley was also included in rations last season due to its availability and price relative to wheat; however, with an anticipated rise in wheat production and decline in barley, we could see a change in this discount.

The discount of the spot UK average ex-farm feed barley price to feed wheat sat at £23.00/t in July 2025, compared to £29.60/t in July 2024.

Milling

Initial harvest results suggest wheat quality this season is largely positive, with high protein levels and specific weights in UK Flour Miller Group 1 samples. However, Hagberg Falling Number levels did decline slightly after heavy rain in early August.

In terms of demand, full season flour production (excluding ‘other’ flour which is made up of flour for starch and bioethanol production) was back slightly (2%) in 2024/25 on year-earlier levels and down 4% on the five-year average.

The proportion of imported wheat in the grist remained high throughout the season; with heavy stocks of imported wheat, it will likely remain high in the near term.

The high cost of living will likely continue to impact the consumption of more premium products, but as they have become a staple in most people’s diets, it is unlikely that we will see great fluctuation in demand.

Human and industrial usage for oats fell 1.9% in 2024/25 versus year-earlier levels. Despite extra capacity coming online, the impact on demand was negligible.

Anecdotal reports suggested global demand for oat products was poor and, as such, demand for oats stayed sluggish throughout most of the season. However, demand firmed for the last quarter.

Looking ahead, global demand for oat products will be key.

Biofuels

The ‘other flour’ category of AHDB’s flour millers’ usage data set gives a good indication of trends in the bioethanol and starch sector.

In 2024/25, wheat usage by the sector fell 26.4% year-on-year. Neither UK bioethanol plant ran at full capacity last season, largely due to competitively priced ethanol imports. Another factor driving the decline was the question mark over the resolution of the status of domestic feed wheat under the renewable energy directive (RED II).

The decision made by the Government in May to remove tariffs on imported US bioethanol also raised concern over profitability for the UK plants.

In mid-August, Associated British Foods plc (ABF) announced the closure of Vivergo, with all production ceased by the end of the month. As such, with just the one plant now running, we can expect a drop-off in wheat demand for the sector. Focus in 2025/26 will now be on Ensus. Providing it prices competitively, maize usage is likely to remain firm, if the plant continues to be operational.

Brewers, maltsters and distillers (BMD)

Total barley usage by the BMD sector dropped 5.9% in 2024/25 compared to a year earlier.

This was due to a downturn in demand, particularly on the brewing side, partly driven by the increase in the cost of living, as well as the longer-term trend of fewer younger people choosing to consume alcohol. Maintenance was also being carried out across key sites within the industry last season, contributing to steady production.

Demand did pick up towards the end of the season, however, and warmer weather over the summer could have contributed to increased alcohol sales.

With less-sluggish distilling demand, and further growth in the starch industry, wheat usage by this sector climbed 5.2% last season.

What could this outlook mean for UK prices?

Overall, steadier demand for cereals in the UK last season led to a historically heavy exportable surplus of domestic grain. Alongside a heavier dependence on imports, this meant UK prices continued to track global markets.

In global markets looking forward, the grain supply and demand balance is expected to remain tight, but for major exporters it is heavier than the five-year average. A tighter wheat outlook is offset by more stability for maize, which is currently weighing on prices.

New season plantings will be a key watchpoint over the next couple of months in the Northern Hemisphere. In the UK, soil moisture will be key to crop establishment and initial development.

Consumption trends

The level of meals eaten in the home during 2024 was 3% higher compared to 2019 but 2% behind when compared to the previous year. There were slightly higher levels of eating out during 2024. However, these levels remain behind that compared to pre-Covid years (Kantar Usage, 52 w/e 4 August 2024).

For 2025 we expect a level of economic uncertainty, as detailed in our economic outlook. We expect business confidence will remain low, and this will likely feed down to shoppers. After multiple years of overcoming challenges and reconsidering how to spend their money, we expect any changes in shopping behaviour to be gradual.

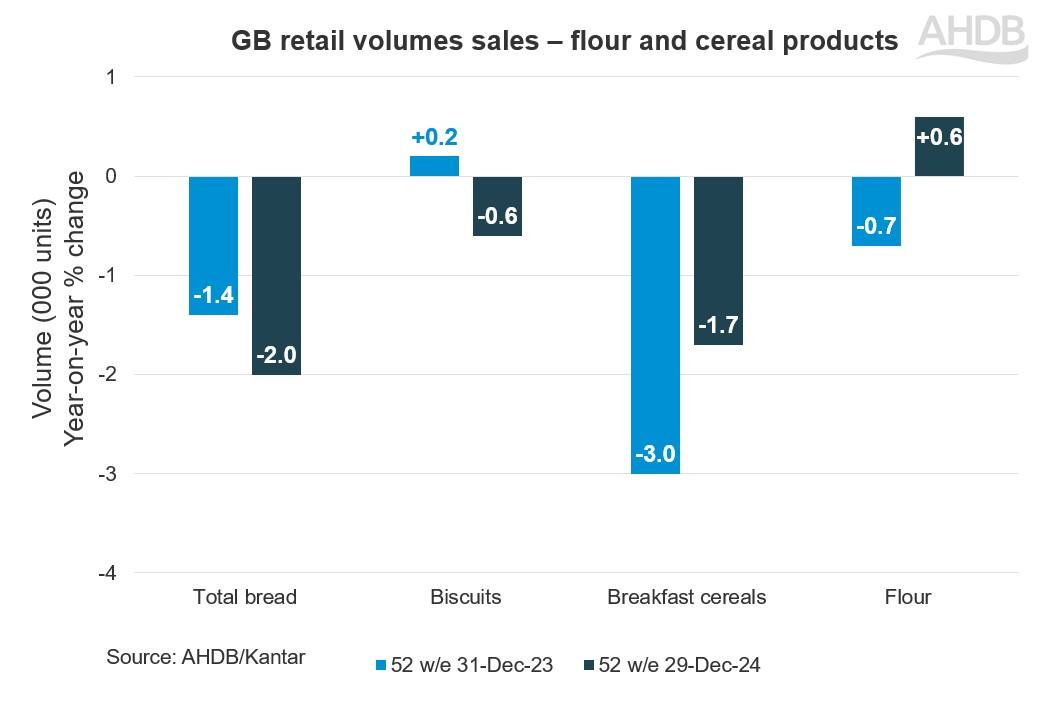

In-home breakfast occasions are likely to face increased challenges from the on-the-go format, which is attracting interest from supermarkets and foodservice. While half of all breakfast occasions still feature cereals, it still faces volumes challenges: currently down 1.7% vs the previous year (Kantar Usage 52 w/e 29 December 2024).

The slight rise during 2023 for in-home baking did not continue into 2024, and the category has experienced a long-term decline. The current levels are 10% lower than the previous year. These dips have occurred in both savoury and sweet baking occasions (Kantar Usage 52 w/e 1 September 2024).

Baking is still very much on consumers’ radar, with 58% of consumers claiming to have baked in the last six months. Of those, 20% say they plan to bake more often in the next six months. Further encouragement for the longer term is that interest in baking more often peaks at 36% for the 18–24 age group (YouGov/AHDB Pulse, January 2025). Tapping into the needs of this younger Gen Z group and considering how they source their information on food could benefit the category.

Volume sales of flour rose by 0.6% during 2024 compared to the previous year (Kantar 52 w/e 29 December 2024). There are signs that consumers are using these purchases across fewer meal occasions, as flour occasions are down by 11%. Evening meals and lunch remain the heartland of flour consumption, but breakfast has gained share in the last five years (Kantar Usage, 52 w/e 1 September 2024).

Biscuit volumes were slightly behind for 2024 year-on-year (Kantar, 52 w/e 29 December 2024), with Kantar reporting that consumer desire to treat themselves has benefited branded biscuits where volume growth has outstripped that of own-label, helped in part by some consumers switching into the category from chocolate confectionery (The Grocer Focus on Biscuits September 2024 – Kantar 52 w/e 7 July 2024).

Bread volumes in 2024 were -2% down year-on-year, with the traditional ambient loaf coming under increased pressure from sandwich alternatives like pittas/wraps. There has been strong volume growth in meal accompaniments like naans and flatbreads, where consumers are exploring a range of cuisines (The Grocer Focus on Bread & Baked Goods May 2024 – Kantar 52 w/e 17 March 2024).

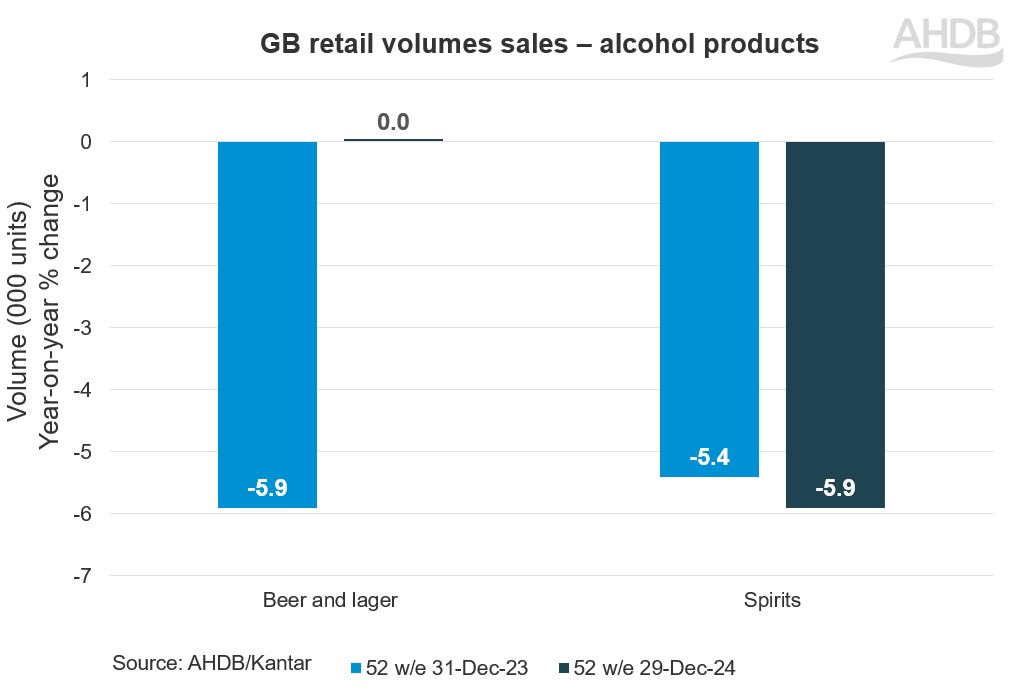

Retail volume sales of beer and lager remained flat during 2024 following challenging declines during 2023 (Kantar 52 w/e 29 December 2024). Higher prices have meant volume growth has been hard in the backdrop of consumers watching their finances.

There has been 4.6% volume growth for non-alcoholic beer during 2024 on the back of rises in 2023. Mintel reported that moderation of alcohol consumption has grown since 2022 and is set to further increase in the near future. Low-/no-alcohol beers have enjoyed strong sales growth in recent years, but their share of overall beer sales remains small. The category will need to address various barriers to uptake, such as views of low-/no-alcohol beers as overpriced, held by 74% of beer drinkers (Mintel Beer Report January 2025).

Fewer sporting events during 2025 are likely to impact both on- and off-trade alcohol sales.

Spirits volumes sales continue to dip, with affordability being a key consideration for consumers for which finances may remain tight. The spirits category has seen continued price rises, with the average price for consumers of £20.07 per litre (Kantar 52 w/e 29 December 2024). Premium ready-to-drink launches over the last few years have also impacted the spirits category. Canned cocktails may well sell at a higher price per litre, but their lower unit price could be a cost-effective way for consumers to try out and enjoy a range of tastes/flavours.

Sign up to receive Grain Market Daily from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.