Chinese purchases provide support to the global barley market: Grain Market Daily

Wednesday, 3 February 2021

Market Commentary

- May-21 UK wheat futures closed at £204.10/t yesterday, down £1.35/t from the previous close. Whilst new-crop UK wheat futures (Nov-21) remained at £166.50/t, the same close as from the day before.

- Last week the USDA recorded a private sale of 2.108Mt of maize, for marketing year 2020/21 to China: the second largest US sale after a USSR purchase of 3.72Mt in 1991. Amid concerns surrounding tight domestic supply, Chinese processors' maize stocks are reportedly reaching multi-year highs to secure supply (Refinitiv).

- Though, disease outbreaks amongst China’s pig herd are reportedly hampering herd growth (Refinitiv). Porcine epidemic diarrhoea (PED) as well as more frequent outbreaks of swine flu in the northern and northeast provinces are being reported (Refinitiv).

- Argentina’s truckers cause export disruption this week through protests and roadblocks around the Buenos Aires region. The truckers are set to move to Rosario, where around 80% of farm exports (mostly maize and soyameal) are shipped (Refinitiv).

Chinese purchases provide support to the global barley market

Yesterday’s feed barley export price (4Kt) was quoted as £176.50/t for March loading, up £2.00/t on the week. In the latest corn returns data week ending 28 Jan, GB feed barley April ex-farm was quoted as £170.40/t, up £2.10/t on the week. On this date, April movement held a premium over February movement by £7.10/t.

So what is contributing to the firming of UK exports and delivered prices?

Chinese demand is continuing to support feed grain prices. As China rebuilds their pig herd, feed demand for 2020/21 is seen to increase by 15.6Mt from 2019/20.

Chinese maize production is expected to total 260.7Mt for 2020/21, though analysts forecast a 23Mt maize deficit (FAS-China). Imports and substitutions are two main ways of narrowing this gap, and this is assisting feed grain price gains across the board.

Maize

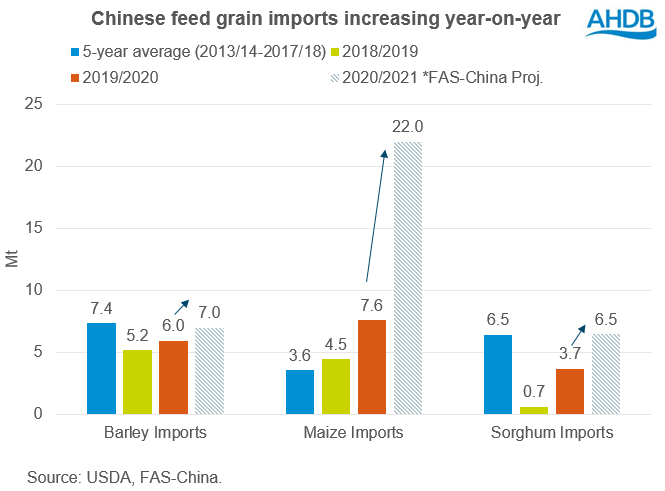

Despite rallying prices, Chinese imports are forecast to total 22Mt. This is 4.5Mt higher than the official USDA forecast and 190% higher year-on-year.

Sorghum

Imports are projected up 75% year-on-year at 6.5Mt; this is 900Kt lower than official USDA forecasts. New-crop sorghum priced at $621/t in mid-December, almost double prices in the same period last year due to tight supplies.

Barley

Barley imports into China are expected to total 7Mt in 2020/21, this is up 17% on 2019/20 and up 34% on 2018/19. However, as shown in the graph, this is just below the 5-year average of 2013/14-2017/18.

With trade disputes ongoing with Australia, this has shaken up suppliers. Marketing year to date, Ukraine and France are the most prominent import origin for China, totalling imports of 2.3Mt and 1.5Mt respectively (IHS Maritime & Trade—Global Trade Atlas ® - China Customs).

What do we expect in the coming months for barley?

Against current USDA projections, at the end of December 1.4Mt of barley was still to be imported by China this marketing season (IHS Maritime & Trade—Global Trade Atlas ® - China Customs). Chinese barley imports remain strong, with large forward purchases of French and Canadian extending into the 2021/22 crop.

Should new-crop sorghum price remain high, and maize prices continue to rally, we could see barley imports rise, potentially eroding global stocks. The USDA forecasts world barley production for 2020/21 at 157.19Mt, leaving an ending stock of 20.4Mt, the largest since 2016/17.

Currently, Black Sea barley prices remain competitive to US maize. With February’s WASDE out next week, reductions to ending stocks of coarse grains could support prices of other feed grains further.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.