GB pork market: mixed movements in June, but stable longer term

Wednesday, 10 July 2024

Key points:

- GB pig prices eased month on month in June, however looking at long term trends there has been little movement in prices through the first half of 2024

- Available pig supplies are still noted as being tight although provisional data indicates that throughputs have seen a marginal uplift in June

- Higher carcase weights year on year support pig meat production volumes

- Summer is often a highlight for the pork category, but consumer purchase volumes in retail paint a mixed picture for demand

Prices:

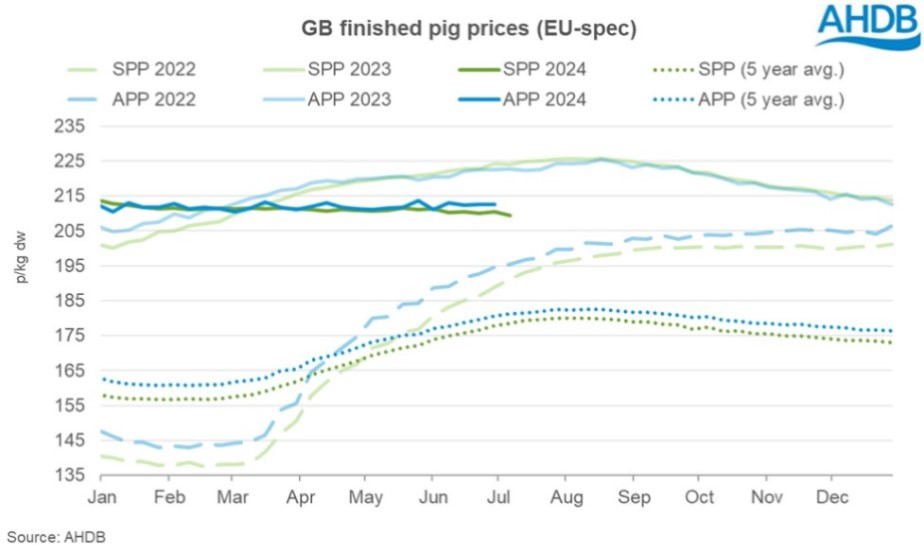

The latest pig prices show that the EU-spec SPP currently (w/e 6 July) sits at 209.50p/kg a weekly loss of 0.91p.

In June the EU-spec SPP averaged 210.26p/kg, a decline of just under a penny compared to the monthly average for May. During the month we recorded two large falls in weeks ending 08 June and 22 June, however these were partially offset by smaller increases in the remaining weeks.

The EU-spec APP however has seen modest growth month on month, averaging 212.63p/kg in June. Larger weekly declines were seen in the APP prior to the SPP, with only one week falling into the June average (w/e 15 June), this meant the smaller uplifts in the remaining weeks outweighed the decline.

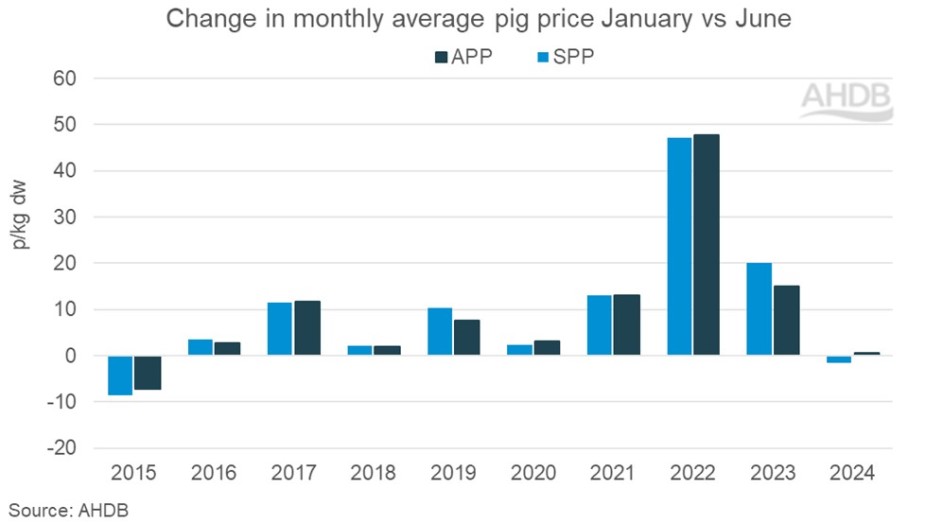

Although weekly price changes were more pronounced than in previous months, the monthly average EU-spec SPP has moved by just 1.65p in the first 6 months of the year. Looking at previous years, this is a relatively small movement and indicates that market stability continues in the domestic market. Since the SPP price series was introduced in 2014, this year is the only year to record a price change of less than 2p in monthly averages between January and June, with the last three years having all seen significant movement in price during this period (20p 2023, 47p 2022, 13p 2021). However, it is noted that despite the size of change, 2024 is the first year since 2015 to record a downward movement.

The trend is generally repeated for the APP, except in 2024 where the direction of change differs to the SPP.

The average EU reference price currently sits around 22p below the UK and tells a similar tale over the month of June. EU average prices fell 1.19p/kg in the four weeks ending 30 June, weighted on a large decline in the week ending 16 June which coincided with the news of new ASF outbreaks in Germany. Small increases were recorded in the following weeks but were not enough to outweigh this decline. Click here to read out latest EU market update.

Supplies:

Provisional estimates indicate that slaughter throughputs have picked up marginally in June, compared to May, most likely due to the impact of two bank holidays during May. The availability of pigs is still reported as running tight, however kill numbers have begun to show some small year on year gains, again likely due to comparing to a lower kill period, with hot weather impacting the market in 2023.

Pig meat production is supported by higher carcase weights. Average weights for the SPP sample in June stood at 90.6kg, a marginal decline from May but an uplift of over 2kg compared to last year. There have been some comments that growth rates have slowed on some farms following the removal of zinc oxide from pig diets. We will keep a close eye on this trend in the coming months.

Domestic Demand:

Summer is often a highlight season for pork, but consumer purchases continue to paint a mixed picture in 2024. Overall pork volumes are down year on year, according to retail data from Kantar (12 weeks ending 9 June), however some categories and products are seeing volume growth.

Primary pork has been performing well. Roasting joints made the largest volume gain of all products for the period, with promotional activity increasing shopper numbers. Pork belly has also seen good growth year on year. Easter was a key driver during the period.

Processed pork, the largest category by volume has seen overall volumes fall, driven by a substantial drop off in gammon, sliced cooked meats and bacon. All three products have seen shopper numbers and volumes purchased per trip decline. However, it is not all doom and gloom for the category as Sausages and Burger/grills have both recorded strong volume growth. Burgers/grills have seen an increases in shopper numbers, while promotional activity has supported the frequency of sausage purchases. It is likely these products are also being supported by seasonal demand with BBQ and current sporting events. Our recent analysis showed that pork is more likely to be used in social meal occasions over the summer than any other time of year.

Looking ahead:

Despite both price series sitting below year ago levels (-13p SPP, -10p APP), pig prices remain historically high. Although the estimated cost of production continues to be historically elevated, net margins are in a positive position and industry sentiment is said to have improved. However, most will still agree that 2024 is a year of reset and recovery, both mentally and financially.

There are plenty of risks still present in the pork sector with inflation and interest rates still above target levels. This will continue to play on consumer and producer minds when making purchasing or investment decisions.

Everyone is waiting to see if the weather becomes more settled and how crop and straw harvest performs, with planting areas recorded at their lowest in 20 years. The impact on industry of future regulations such as the UK soy manifesto is yet to be clarified.

Added to these is the ever-present disease risk with the most recent outbreaks of ASF in Europe getting closer to our borders. A stark reminder to keep biosecurity a top priority.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.