- Home

- Consumer Insights: The importance of events for pork

Consumer Insights: The importance of events for pork

Return to importance of events for red meat and dairy homepage

In 2023, there were several events which boosted the sales of pork. However, retail sales fell by 2.2% (Kantar), and growth of 9.3% in foodservice was not enough to balance the losses, causing overall demand to fall by 0.8%.

Pork sees an uplift across a lot of the seasonal events despite not having its own traditional meal event like lamb or turkey. Pork’s versatility and good value mean it can cater to the variety of needs which consumers look for at events.

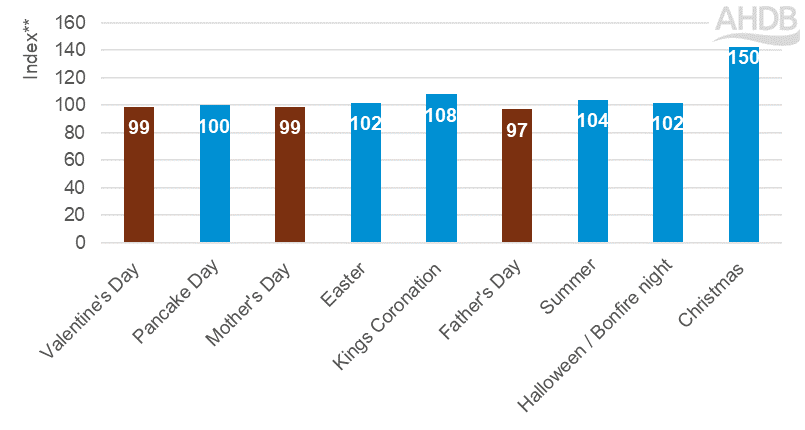

Pork retail performance at key seasonal events compared with average two-week period in 2023

Source: AHDB analysis of Kantar data, Volume, Total pork, index versus average 2 w/e 2023*

Easter

There is an uplift in pork sales at Easter and is an event not to be overlooked for pork.

For primary pork, there is an overall uplift of 2% compared to the average week but the types of products people are purchasing changes significantly (Kantar).

Everyday cuts like pork chops and steaks are less likely to be purchased, as well as some roasting joints, such as shoulder and loin roasting joints, which also under-index.

The majority of the uplift at Easter came through from leg roasting joints, which saw an uplift of 45% versus the average two weeks (Kantar).

Within the processed category, gammon demand dramatically increases at Easter, with an uplift of 40% in 2023 (Kantar). Most other processed areas also saw uplifts but just not as significant.

Easter is the second-biggest occasion for bacon, behind Christmas, with the potential for more fry-ups with extra days off work or school. The only area in processed pork not to see an uplift at Easter was sliced cooked meats (Kantar).

School holidays around Easter meaning less lunchboxes could explain the drop in ham sales at this time of year. However, children still need lunch in the holidays, and opportunities for picnics and days out could motivate parents to buy ham as a quick and easy sandwich option.

There are uplifts in family meals and meals with three or four people present, such as small family gatherings, on an average four-week period around Easter (4 w/e 16 April 2023, Kantar Usage).

Meals including pork around the Easter period are more likely to be thought of as relaxing than any other time of year, so including the inspiration of fuss-free pork recipes, meaning that more quality time can be spent with friends and family over the long Easter weekend, could help boost sales.

While overall pork meals in foodservice under indexed in the four weeks to 16 April, there was an uplift in pork-meat-centred meals, such as roast dinners or sausage and mash. There were also significant uplifts in pork burgers and Asian dishes with pork.

What does this mean for farmers?

To meet increased demand from consumers in the run-up to Easter, March sees increases in imports of pig meat. On average, over the last few years, it is the second-biggest month for pork imports (TDM average 2021–2023).

Significant structural change has occurred in the UK pork supply chain since 2021 and has resulted in the UK becoming more reliant on imports, the EU being the main supplier.

Alongside improved demand, imports are often driven by an increase in the price differential between UK and EU product, making EU more product more attractive due to a lower price point.

Foodservice typically holds a greater weighting of non-British product and is more susceptible to these price changes, with most large retailers holding a commitment to British pork.

King’s Coronation

More bank holidays were certainly a boost to pork sales in 2023. This is typically seen when there are extra events and bank holidays, as similar trends were seen at the Queen’s jubilees in 2012 and 2022. Street parties and local celebrations call for picnics and buffet foods, which boost sales of processed pork products. Despite the official royal quiche recipe not containing any pork, pies and pastries containing pork saw uplifts of 19% versus the average week (Kantar).

Added value pork products were also a hit, with uplifts of 20% for ready-to-cook pork and 48% for marinaded pork products (Kantar), indicating that some consumers were inclined to get their BBQs out over the bank holiday weekend.

The story was fairly different in the out-of-home market, where savoury pastries under indexed in May compared to the average month while burgers and sandwiches saw uplifts in volumes (Kantar Out-of-home).

Summer

The summer is often a highlight season for pork, especially when the sun is shining. The two weeks to 4 June 2023 were the biggest in the summer for pork last year, seeing an uplift of 4% versus the average (Kantar).

These dates often flex in different years depending on the weather and consumers make the most of the summer sun with last minute trips to stock up on BBQ foods.

Classic BBQ products which saw uplifts in the two weeks included sausages, marinades, and pork ribs. Pies and pastries also saw uplifts in the summer potentially driven by more pork snack foods like Scotch eggs, pork pies and quiches (Kantar).

Pork is more likely to be used in social meal occasions over the summer than any other time of year (16 w/e 3 September 2023, Kantar Usage).

This means more BBQs but also more people experimenting with cuisine cooking, with Italian, Oriental and Mexican cuisines all seeing uplifts on an average period for evening meals (4 w/e 11 June 2023, Kantar Usage).

Pork burgers under index at this time, showing there is opportunity to remind shoppers about pork options beyond sausages which they could include at their summer events.

There was a 6% uplift in June for the foodservice market, with Mexican cuisine seeing the biggest uplift, and salads and burgers also over indexing at this time of year.

What does this mean for farmers?

Generally, there is little seasonality to pig production. Pig meat volumes may ease slightly over the summer as carcase weight reduces. During this time, sausage imports pick up (TDM average 2021–2023), likely contributing to BBQ demand.

Halloween and Bonfire Night

Our previous events report highlighted the opportunities at Halloween and Bonfire Night. However, there was only a small uplift for these events in 2023.

Halloween and Bonfire Night is the biggest occasion of the year for pork burgers and grills, which saw an uplift of 13%. Bacon and sausages also see uplifts in these two weeks (Kantar).

Roasting joints saw uplift in primary pork, with leg joints in particular seeing increases versus the average week. Shoulder roasting also saw increases but to a lesser extent showing it is likely for more winter warmer roasts rather than for occasions, like pulled pork.

This also plays out in the added value category where sous vide pork and, in particular, sous vide pulled pork under indexes. However, there is an opportunity here to promote pulled pork or hog roasts.

There is an increase in demands for ‘instagramable’ foods, and pork could play a great role in this for all of these events. Social media platforms such as Instagram, YouTube and Pinterest promote these types of mouth-watering dishes and are reaching a wider audience.

While Google searches for new recipes (and Halloween recipes) peaked in 2020, these still engage large audiences.

October saw an uplift in out-of-home sales for pork with savoury pastries and breakfasts driving the overall increase (Kantar Out-of-home). There could be opportunities to push pork-based meals for more out-of-home events, with hotdogs or hog roasts at Bonfire Night.

Christmas

Christmas is by far the biggest event for pig meat sales with an uplift of 50% versus the average two weeks in 2023 (Kantar).

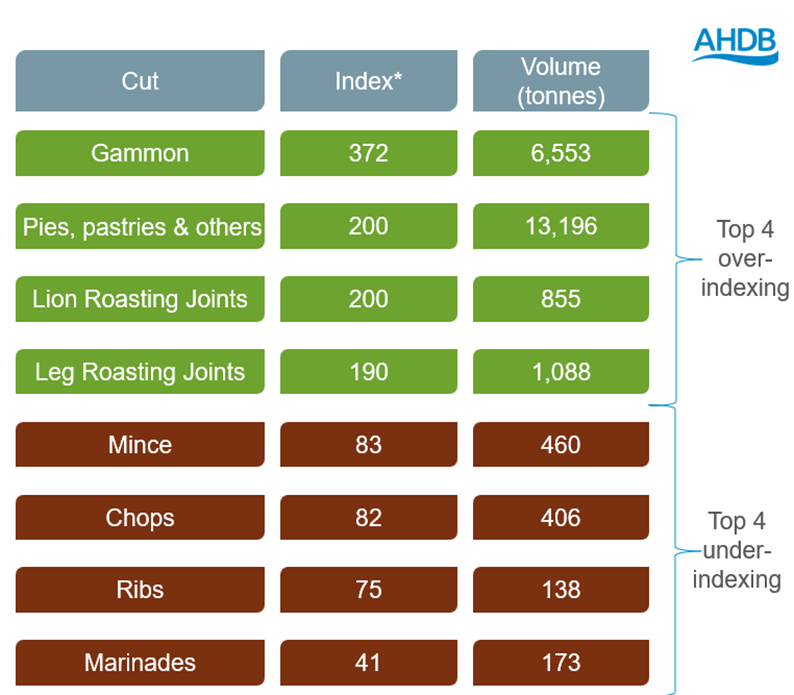

It is also the biggest event for processed pigmeat sales. Most of the uplift is driven by gammon, with 13% of all gammon sales taking place in the two weeks leading to Christmas last year.

Consumers purchased nearly four times as much gammon in these two weeks than the average two weeks, and over a third of gammon sales came through retailer promotions, with temporary price reductions on gammon proving particularly popular in 2023 (Kantar).

Although not in the top four, bacon and sausages also see significant uplifts at Christmas for use in the traditional pigs in blankets.

Top over- and under-indexing pig meat products at Christmas

Source: Kantar, 2 w/e 24 December 2023 versus average 2 weeks in 2023*

Christmas is important for primary pork, with roasting joints seeing strong uplifts. Although there was growth in joints, there is a switch in the types of cuts shoppers are buying, with less demand for everyday cuts such as mince, chops and steaks (Kantar).

There were significantly more promotions this Christmas for pork roasting joints than in previous years, but pork is promoted much less than other red meat joints.

Despite the increase in promotions, shoppers are willing to spend more at Christmas, with average prices paid per kilo for roasting joints up 12% in the two weeks to Christmas versus the rest of the year (Kantar).

We see shoppers buying slightly bigger joints (1.5 kg on average), but only an extra 100 g – perhaps as shoppers look to have multiple meats at Christmas rather than one larger offering.

There are opportunities for pork at Christmas to highlight its affordability. As consumers look to return to pre-Covid traditions, there are opportunities for growth as consumers go back to having multiple meats as part of the Christmas dinner.

According to IGD, only 15% of consumers had gammon at their Christmas celebrations, but there is potential to encourage pork, and particularly gammon, to be the go-to second meat option at Christmas.

Pigs in blankets are a classic food item we see at Christmas, but there could be opportunities to preimmunise these with NPD. Having different flavours or formats of the pigs in blankets could lead to further growth.

Convenience cooking also plays a role in celebrations, with party food and meal deal promotions on prominent display. It is therefore unsurprising that convenience cooking methods also see uplifts around Christmas for pork products in 2023 (Kantar Usage), as shoppers looked for ways to spend more time celebrating with friends and family and less time in the kitchen.

A surprising area to over-index at Christmas is pork frozen ready meals (17% uplift versus average two weeks) (Kantar).

With the shops being shut over the Christmas period and with a fridge full of Christmas foods, some consumers may look to stock up the freezer with easy meal options for the days before and after the main event. Frozen toad in the hole is a particular favourite at this time of year.

December not only sees the biggest uplift in retail but also in foodservice for pork. Pork volumes out-of-home saw an 8% uplift – the highest seen across the year as consumers go out to celebrate the festive season (Kantar Out-of-home).

This doesn’t seem to be driven by Christmas parties however, as savoury pastries, breakfasts and sandwiches were the most popular meals in the final month of 2023. Pork-centred meals such as roasts or gammon actually under index in December.

There is an opportunity for restaurants to promote pork roasts as an option with better margins for restaurants than many other meats.

What does this mean for farmers?

Looking at the supply chain, imports of total pig meat peak in November (TDM average 2021–2023), making contributions to the increased volumes of key products seen over the festive period, such as sausages.

Popular cuts at Christmas, such as gammon and bacon, require curing and processing. Pork supply chains have been set up for these elongated processes, designed to remove production peaks. However, at times of peak demand, we do see movement in the market.

Many processors pulled pigs forward for kill at the back end of last year to meet Christmas demand and enable sufficient supplies into the new year.

Though UK pig meat production was at its lowest volume for 5 years in 2023, November saw some uplift month on month, which could be linked to the popularity for gammon seen over Christmas.

Other event opportunities

While pork currently under indexes, there are still opportunities at smaller events and we can apply learnings from events where pork is more successful.

For Valentine’s Day, pork can provide a cheaper option for meal deals at retailers. Although shoppers are looking to indulge in a romantic meal, many are still looking for good value options.

Pork fillet, steaks, bacon and the famous love sausage could all have a role to play at Valentine’s Day.

Many retailers may be missing a trick to use this good-value option, but making it easy and fool proof for shoppers when cooking is essential – as knowing how to cook pork well is a barrier felt by many shoppers.

Pancake Day also has an easy link for pork, with bacon and maple syrup pancakes being a popular dish in the USA. Making this connection in the UK could be a way to see growth for pork at this event.

For Mother’s Day and Father’s Day, pork could really harness a breakfast-in-bed occasion. Going out for breakfast or even cooking up a classic full English at home is a great way to treat parents, so remind shoppers of this in the run up to these events.

Ensuring sausages and bacon are included in these meals is an easy win for pork in the classics or trendier breakfast options like eggs benedict or smashed avocado with bacon.

Another potential option would be around pork snacking foods and taking the learnings from the coronation celebrations. Highlighting classic pork snacking options as potential for Father’s Day treat as it falls in the summer, or at Mother’s Day when weather permits.

Pork pies, Scotch eggs and sausage rolls could all do well if the link is made to a Mother’s Day or Father’s Day buffet.

Opportunities for pork

- Pork doesn’t have an event which it is highly associated with, but due to the versatility of pork products, it has the potential to be a star at all events. From breakfast to party food and snacks to roast dinners, pork has cuts which can cater to all meal occasions. There is an opportunity to remind shoppers of the good value and versatility of pork during events

- Lean into messaging around taste and enjoyment, as these are key drivers for shoppers purchasing and using pork for events

- In the out-of-home market, pork is more reliant on food-to-go, so capture when this could cater to events, such as picnics in the summer. In the winter, pork is a great option for restaurants due to its lower price point, and there should be a focus on including pork within Christmas menus

*Average two-week sales excluding the 2 weeks to Christmas

**Index versus the average two weeks excluding Christmas (over 100 means more likely to be purchased and under 100 means less likely to be purchased)

***Average two-week summer period is defined as the best performing two-week period within the 16 w/e 3 September 2023

The importance of events for beef

How important are seasonal events for beef demand? Is beef just for Valentine's Day or Christmas? We explore the impact seasonal events have on seasonal demand

The importance of events for lamb

How important are seasonal events for lamb demand? Are there opportunities outside of Easter? We explore the impact seasonal demands have on lamb performance

The importance of events for dairy

How important are seasonal events for dairy demand? Which events see greatest performance for dairy products? We explore the impact seasonal demands have on dairy performance

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.