- Home

- Consumer Insights: The importance of events for beef

Consumer Insights: The importance of events for beef

Return to importance of events for red meat and dairy homepage

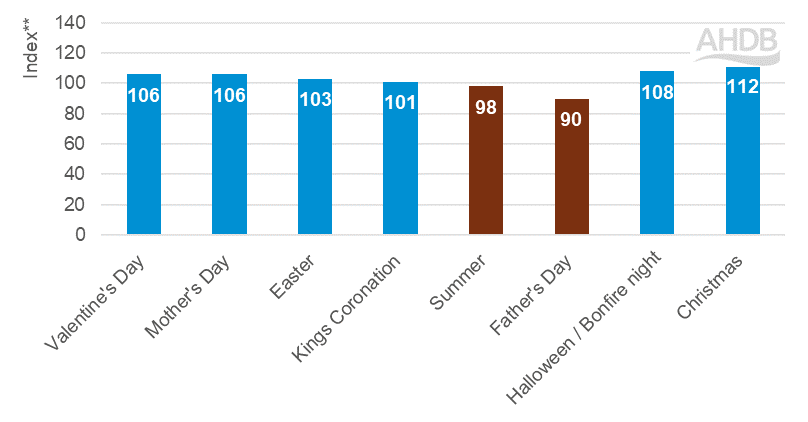

Beef is an everyday favourite protein for many Brits, and despite its popularity at ordinary mealtimes, beef was seen to perform well at almost all the major celebratory events in 2023 with retail purchases seeing volume uplifts compared with an average two-week period*, but to a lesser extent than we see in other proteins.

Beef retail performance at key seasonal events compared with average two-week period in 2023

Source: AHDB analysis of Kantar data, Volume, Total beef, index versus average 2 w/e 2023

Despite beef being a staple in shoppers’ weekly repertoire, more than a third of all beef sold in 2023 was associated with the key seasonal events (Kantar), suggesting that there are still opportunities for boosting demand at peak occasions through the year.

Valentine’s Day

Beef dishes, such as steak, are often the first choice for many shoppers on Valentine’s Day and typically performs well. This was seen in 2023, where overall volumes of beef purchased saw a 6% uplift compared with an average two-week period (Kantar, 2 w/e 19 February 2023).

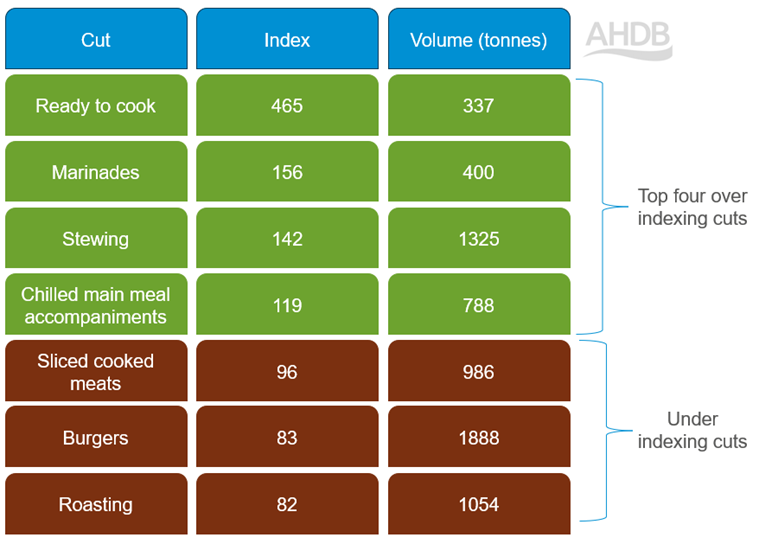

Top over- and under-indexing beef products at Valentine’s Day 2023

Source: Kantar, total beef, volumes, 2 w/e 19 February 2023

Steaks have strong ties with romantic meals, and in 2023 saw an uplift of 7% compared with an average two-week period (Kantar).

However, the real key drivers of overall beef performance were added value products, stewing, mince and ready meals, which all over indexed at Valentine’s Day and saw greater actual volume uplifts than steak.

The trend of replacing out-of-home dining occasions for in-home ones at Valentine’s Day will have helped retail performance, particularly benefitting beef cuts included in meal deal promotions, such as added value products, which saw uplifts over an average two-week period (Kantar).

Meal deals are a popular marketing tool retailers use at Valentine’s Day, as they offer opportunities for shoppers to indulge and create a restaurant style meal in home, but on a budget.

This may have impacted the out-of-home market for beef, which underperformed in the four w/e 19 February, down by almost 6% on an average period (Kantar Out-of-home) as shoppers seemingly rationalised their spend.

We also see that in home meals for single diners have their biggest uplift in the four w/e 19 February (Kantar Usage), particularly for beef, perhaps due to the focus that the out-of-home market puts onto Valentine’s Day and couples dining out together, pushing single diners to spend more mealtimes at home.

The performance of more everyday cuts such as stewing and ready meals was likely due to just over a third of consumers (36%) claiming to celebrate Valentine’s Day this year (YouGov, 2024), making it one of the smaller events in the year.

It is therefore important to remember the meals in the build-up, or to expand our perceptions of romantic meals to include ‘Galentines’ or ‘Palentines’ day celebrations to boost participation in meals containing beef.

Mother’s Day

Mother's Day (two w/e 19 March 2023) saw an almost 6% uplift of beef volumes purchased compared to an average two weeks in 2023.

Primary beef drove the majority of sales, with uplifts in volumes purchased of roasting joints, mince, and stewing (Kantar).

Stewing performed the best of the primary cuts at Mother’s Day, with just over a third more volumes being purchased compared to an average two-week period.

Weather is likely to have played a factor in this, as March was a cold, wet and windy month highlighting the connection shoppers feel for certain cuts for warming dinners.

Beef chosen for treat reasons saw its greatest uplift for the year in the four w/e 19 March 2023 (Kantar Usage), therefore future opportunities for beef at Mother’s Day should focus on these treating needs.

This is when more indulgent cuts such as steak, marinades and ready-to-cook beef, could be used to celebrate the occasion, all of which can be relatively easy or quick to cook, meaning more time can be spent with family and less time in the kitchen.

Easter

As one of the first bank holidays of the year, Easter is seen by many to be a chance for families and friends to get together and celebrate.

At Easter there was a 3% uplift for beef, driven by roasting joints, where volumes purchased more than doubled compared with an average two-week period (Kantar).

Retailers supported this with strong promotional activity in the form of temporary price reductions, including loyalty pricing.

8 out of 10 households spend most of the long weekend at their home, or someone else’s (NIQ Homescan Survey, March 2024), with Easter being a strong family centric event, where the focus is around spending quality time together and eating traditional home cooked foods.

Continuing to remind shoppers of the traditional beef roast with all the trimmings as a great way to celebrate with friends and family at Easter could help grow sales.

The ever-shifting date for Easter means the Easter weather one year can be very different to the next. When Easter coincides with warmer weather, we naturally see some shoppers go for BBQ options than roasting joints as they celebrate outside in the sun.

Easter also has school holidays, which offers an opportunity to have beef in more in-home family friendly meals. Versatile cuts which can be easily incorporated into mealtimes whatever the weather can have potential.

Inspiration in aisle can help shoppers to realise all the tasty meals that they can make with beef, and ‘weatherproof’ against the predictably unpredictable UK weather – from BBQing a beef roasting joint to gastropub style burgers.

King's Coronation

Royal celebrations are something that most of the British public like to get behind. The coronation of King Charles III was a historic occasion and was hoped to bring increased volume sales of red meat, as has been seen at other Royal occasions.

Overall, beef saw a slight uplift (+1%) in volumes purchased leading up to the coronation (Kantar, 2 w/e 7 May 2023), but in contrast to the other seasonal celebrations, where primary beef drove uplifts, it was processed beef which boosted performance.

With the additional bank holiday, consumers had anticipated good weather for BBQs which helped boost burger sales. While the sun didn’t materialise, the ease of cooking burgers inside meant that there was still demand for them.

Beef in the out-of-home market was also seen to be boosted in the four weeks ending 14 May. While burgers accounted for the greatest volumes purchased and saw the greatest actual uplift compared with an average period in 2023, meat-centred meals (in particular steaks) also performed well (Kantar Out-of-home).

Summer

The summertime in 2023 was a washout and under-indexed compared to the average two weeks. However, 2023 was not a typical summer*** and we would expect beef to see uplifts around BBQ season.

Beef’s best performance coincided with the best of the weather and fell early within the summer season (Kantar, 2 w/e 4 June 2023).

Shoppers made the most of this limited good weather, with burgers seeing their greatest volumes sold for the year and more steaks being eaten than any other two-week period in 2023.

We saw gathering sizes of 5+ people peak during the summer season for beef (4 w/e 6 August 2023, Kantar Usage), as well as a decrease in meals being classed as planned compared to an average period (4 w/e 11 June 2023, Kantar Usage).

This indicates that consumers are quick to organise spontaneous, social summer occasions which make the most of the weather, and it is important for retailers to ensure that there is sufficient stock to cater for these spur-of-the moment meal occasions.

Summer is also usually a good time for the eating-out market, and while peak beef performance out-of-home did not coincide with that seen in retail, it did occur during the warmer months (four w/e 3 September 2023).

Burgers are a hugely popular dish for beef in foodservice, and the periods in which they saw uplifts versus an average four-week period coincided with the overall beef performance for the out of home market (Kantar Out-of-home).

This highlights how key burgers are for beef in the out-of-home market. Burgers can cater to both cost-conscious consumers and are gaining share of menus (Lumina Intelligence).

The trend for meal customisation fits well with burgers, allowing consumers to cater to dietary requirements or upgrade their meal option, by adding cheese or other toppings.

What does this mean for farmers?

All prime deadweight average prices are typically supported in spring through to the summer months, with the 2023 price reaching 492p/kg for the w/e 28 April to the w/e 19 May 2023.

Although peaks sit inverse to production troughs, this coincides with the beginning of the (typical) BBQ season. Cull cow prices tend to see support for a longer time period through the spring, as both seasonal reduction in supply and improved demand are experienced.

Of the beef we export, a large proportion is likely to be cow beef (TDM average 2021–2023). However, much of this meat lends itself for burgers and mince, with the potential to support the increased domestic demand for these products in the summer months.

Halloween and Bonfire Night

Both Halloween and Bonfire Night (two w/e 5 November 2023) are often associated with large social gatherings, and while for many these occasions might make us think of sweet treats and fireworks, primary beef, in particularly beef mince, is also a standout performer.

In 2023, overall beef saw its second largest seasonal uplift of the year (Kantar), highlighting that we shouldn’t dismiss these smaller seasonal events.

Mince saw the greatest volumes purchased in the two weeks to 5 November, an uplift of almost 13% over an average two-week period (Kantar).

Consumer perceptions around mince’s versatility and ease of cooking may contribute to this, and as many school half terms coincide with these events, a quick and family-friendly meal is desirable.

Most consumers feel confident in how to cook mince and incorporate it into a number of dishes. Hence, when on the go with activities and events while schools are off, or even planning spooky gatherings with friends and families at Halloween, consumers rely on mince for making a number of tasty seasonal dishes.

Christmas

Christmas is the most anticipated seasonal event for many consumers and is the time of year when beef sees the greatest uplift in volumes purchased of any of the seasonal events.

In 2023 this was no different, and volumes purchased were up by over 12% on an average two-week period (Kantar, 2 w/e 24 December 2023).

This was driven by roasting joints, which saw volumes purchased increase to more than four times the standard two-week period, and had more than three times as many shoppers.

We also saw the way shoppers were purchasing beef change, as Christmas is often thought of as a time for family and friends to gather and celebrate together. As a result, larger gathering sizes were seen for meals which contain beef, bigger than almost any other time of year (Kantar Usage). On average, shoppers purchased larger quantities of roasting joints, from 2.2 kg to 2.4 kg (Kantar).

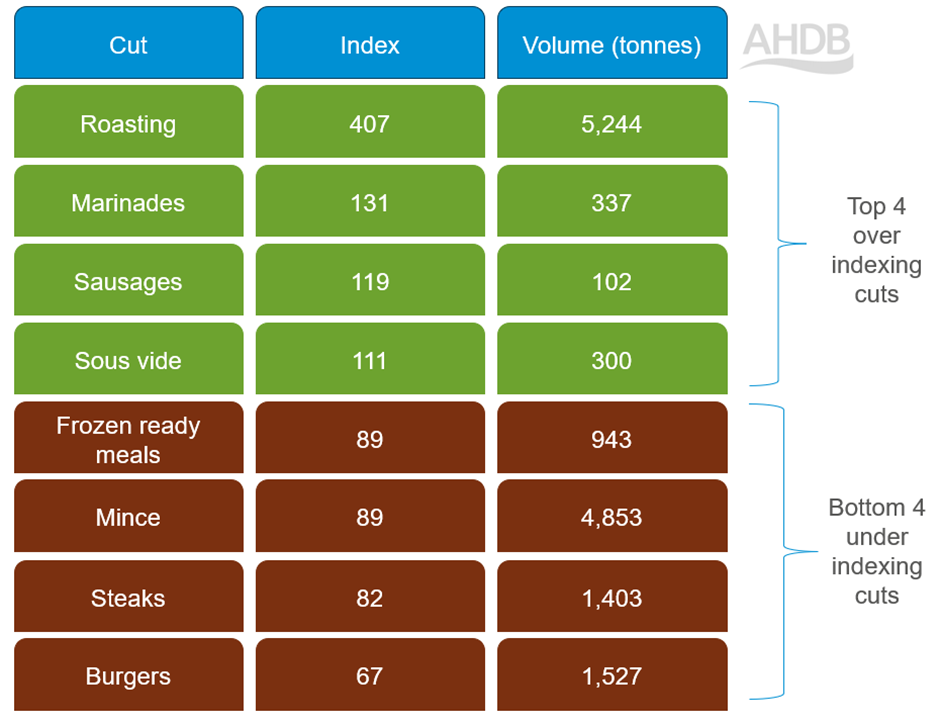

Top over- and under-indexing beef products at Christmas 2023

Source: Kantar, total beef, volumes, 2 w/e 24 December 2023

Roasting performance could be further boosted as we return to pre-Covid traditions. Larger gatherings and multiple meats at the Christmas meal offers potential for beef, by reminding shoppers to purchase beef as either their primary or secondary roasting meat, particularly as almost a third of shoppers spread the cost of the Christmas lunch by sharing dishes (IGD, 2024).

Although not the biggest category with regard to over-indexing, party food could also offer an opportunity for beef. The return of more informal Christmas gatherings could benefit party foods which include beef.

December is a time for family and friends to gather at Christmas parties and work dos out-of-home in the build up to the big day, and can provide opportunities for beef in the out-of-home foodservice market.

Ensuring that beef is included on menus in more indulgent meals, such as Italian dishes, which were seen to have uplifts in the out-of-home market in the four w/e 24 December 2023 (Kantar Out-of-home), can help drive beef sales as people are looking for more special meals.

What does this mean for farmers?

Within the supply chain, the average volume of beef imports from 2021 to 2023 was elevated throughout Q4 (source: TDM), allowing sufficient time for maturation and building of stocks before Christmas celebrations.

As consumers trade up, demand needs to be met in the form of more premium lines and cuts. Increases in both import and export volumes help to manage increased seasonal production while balancing carcases during this period. Improving purchase intent for less-favoured cuts, particularly around events, could benefit overall carcase value.

Domestic throughputs are also consistent across the year, with a seasonal uplift towards the Christmas period. Generally, Christmas kill begins in October while November kill numbers remain elevated.

These kills are supported with a regular supply from dairy beef. In 2023, just over half of cattle slaughtered for beef in GB came from the dairy herd.

Meeting market specifications is a key consideration at Christmas. However, for meeting –for example – ‘mini-roasting joints’ weights, butchery input tends to be more relevant for reducing size rather than procuring smaller animals.

Other event opportunities

Falling in mid-June, Father's Day is thought to have a greater potential for red meat sales than Mother’s Day, due to the potential for warm-weather BBQs and meat centric meals that dads will enjoy.

Steaks and burgers saw their second-best performance for the year, leaning into this association of treating Dad with protein.

Future opportunities for beef

- Cater to traditional and non-traditional choices for each seasonal event. Remind shoppers of traditional cuts to ensure they continue to perform well, and entice everyone with promotions and new products, as there is evidence to suggest that shoppers who are perhaps not taking part in celebratory events are still keen to make use of offers

- Use activations and inspiration in store to promote the use of cuts in different ways, highlighting the versatility of tasty beef products – particularly for those cuts more closely associated with a time of year or cooking method, such as BBQ burgers

- For more premium products, capturing meal occasions lost from more expensive proteins and the out-of-home market by inspiring treat dinners such as fake aways or restaurant quality dine-in recipes

*Average two-week period excludes two weeks to Christmas (24 December 2023)

**Index versus the average two weeks excluding Christmas (over 100 means more likely to be purchased, under 100 means less likely to be purchased)

***Average two-week summer period is defined as the best performing 2-week period within the 16 w/e 3 September 2023

The importance of events for lamb

How important are seasonal events for lamb demand? Are there opportunities outside of Easter? We explore the impact seasonal demands have on lamb performance

The importance of events for pork

How important are seasonal events for pork demand? When do consumers like to celebrate with pork? We explore the impact seasonal demands have on pork performance

The importance of events for dairy

How important are seasonal events for dairy demand? Which events see greatest performance for dairy products? We explore the impact seasonal demands have on dairy performance

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.