- Home

- Consumer Insights: The importance of events for dairy

Consumer Insights: The importance of events for dairy

Back to the importance of events for red meat and dairy homepage

Dairy is a staple product for many consumers, and total volumes are largely driven by demand for cow’s milk, which accounted for 75% of all cow’s dairy volumes sold in 2023 (NIQ Homescan, 52 w/e 30 December 2023). However, special occasions do not just impact milk demand, but also volumes of other dairy categories, as consumers look to indulge through retail purchases and home-cooking.

While retailers seek to make the most of these special events, dairy volumes on promotion were marginally down for many occasions compared to an average two-week period* in 2023.

Therefore, increased demand for dairy often comes from consumer desire to celebrate rather than supermarket deals.

Home baking and scratch cooking are key to this, with consumers often looking to add more of a personal touch and share food with family members and loved ones.

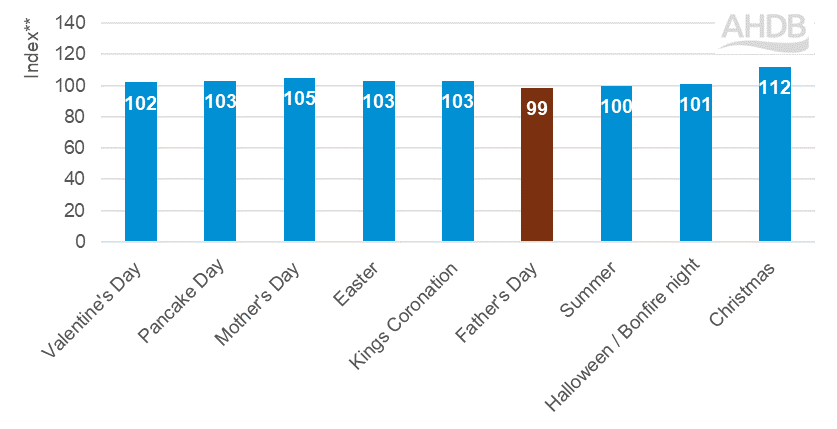

Cow’s dairy retail performance at key seasonal events compared with average two-week period in 2023

Source: AHDB analysis of NIQ Homescan retail data – 2023 events

Valentine’s Day

In 2023, Valentine’s Day saw a 2% seasonal uplift in volumes according to Nielsen (NIQ Homescan). While cream and yogurt under indexed by -2% and -4% respectively compared to an average two weeks in 2023, this was offset by uplifts to milk (+2%).

Butter saw the biggest uplift in these two weeks (+6%), driven by butter spreads. There was also increased demand for butter for cooking with steaks, as well as cream for desserts, which also will have boosted retail volumes.

Butter had one of its greatest uplifts for being chosen for romantic meal occasions in the four w/e 19 February 2023, more than twice as likely than an average four-week period (Kantar Usage), and special meals had the greatest uplift in meal occasions for total dairy in this same period.

Pancake Day

Cow’s milk volumes over-indexed by 3% from increased demand for skimmed, semi-skimmed milk and whole milk.

These products are all key ingredients for pancakes, and as a result we saw more in-home meal occasions containing these products.

However, there was also a seasonal uplift for plant-based milk, which gives an opportunity to remind shoppers of the positives of using cow’s dairy within cooking and baking.

Mother’s Day

Consumers look to treat their mothers on this special day, and Mother’s Day 2023 was no different, as dairy volumes saw a seasonal uplift of 5% around Mother’s Day (NIQ Homescan, 2 w/e 18 March 2023).

All categories saw uplifts; however, milk (+5%) and butter (+9%) saw the largest, perhaps with shoppers preparing for those breakfast-in-bed occasions to spoil their mothers.

Contrastingly, total cow’s dairy volumes did not increase for Father’s Day, despite cheese (+3%), cream (+2%) and yogurt (+6%) all seeing uplifts.

Easter

Overall, cow’s dairy volumes saw an uplift in the run up to Easter 2023, with volumes for the two w/e 8 April 2023 3% greater than an average two-week period* in 2023 according to Nielsen (NIQ Homescan).

The majority of categories saw a seasonal uplift, with notable growth seen for butter (+8%) and cream (15%). Both cow’s block butter and spreads and plant-based spreads saw a seasonal uplift.

Cow’s butter spreads make up the majority of butter volumes, driving the uplift, as consumers got provisions to toast hot-cross buns and slather butter on top.

The uplift in both butter and plant-based spreads gives an opportunity for dairy to gain share of the market by highlighting its positives at this key event period.

For cream, the uplift was largely driven by double and single cream, driven by a double-digit increase to household penetration, likely from consumers purchasing products for more sweet treats for this indulgent event, as whipping cream also saw a seasonal uplift.

Yet as consumers indulge rather than focusing on health, this spike in volumes at Easter was tempered, as cow’s yogurt is the second-largest dairy category in volume terms, and this saw volumes underperform by 2% compared to the two average weeks.

Easter is an event which leans towards home-cooked meals. An uplift in scratch cooking is seen for most dairy products during family centric events (including the periods where Mother’s Day and Easter fall), where the focus is around spending quality time together and eating home cooked foods (Kantar Usage).

King’s Coronation

There was also a spike in cow’s dairy volumes in the lead up to the King’s Coronation bank holiday on 7 May (two w/e 6 May 2023). This came from a 7% uplift in butter spreads, and a 19% uplift in processed cheeses.

There was also a huge uplift in clotted cream, which is perfect for a classic British scone (NIQ Homescan). Bank holiday’s, particularly those falling in May and August, also often have a similar celebratory feel to royal occasions, so remembering to promote these more indulgent dairy treats could help boost their sales at other points throughout the year.

Summer

Summer 2023 was a washout, which limited demand for products such as cheese due to fewer barbecues and, therefore, fewer burgers. However, demand for cow’s cream (+4%), yogurt (+5%) and butter was elevated compared to an average two-week period.

Should we see warm, sunny weather this year, we can expect to see more of a spike in dairy volumes compared to 2023, when volumes saw very little change.

Sales of ice creams through supermarkets peak in the summer months as good weather coincides with school holidays, with family tubs and handheld ice creams proving popular.

A third of shoppers would be interested in DIY sundae kits (Mintel). Retailers could tap into this need by displaying syrups, cones, baked goods and other toppings together or in a bundle.

Linked to this, retailers can tie in dairy promotions and inspiration to major sporting events this summer, as over 40% of consumers say they will watch these events at home (Mintel).

Euro 2024 provides the opportunity to boost dairy sales, perhaps by providing barbecue and burger meal kit bundles including cheese to provide inspiration for pre-match parties.

Consumers may also be inspired by the Paris 2024 Olympics to be healthier, so retail campaigns should tie in with this by highlighting the great health benefits of milk and yogurt.

While evening meals tend to be seen by shoppers as more celebratory from a total food perspective, cream bucks this trend as it is more likely to be used for celebratory, social, and special occasions at lunch than in an evening meal (Kantar Usage). This shows opportunities for cream as part of summer lunches, picnics and snacks.

The importance of events for beef

How important are seasonal events for beef demand? Is beef just for Valentine's Day or Christmas? We explore the impact seasonal events have on seasonal demand

The importance of events for lamb

How important are seasonal events for lamb demand? Are there opportunities outside of Easter? We explore the impact seasonal demands have on lamb performance

The importance of events for pork

How important are seasonal events for pork demand? When do consumers like to celebrate with pork? We explore the impact seasonal demands have on pork performance

What does this mean for farmers?

While summer demand for cream and ice creams feeds into general demand, at farm-gate level, prices are more respondent to supply.

The spring flush, where production reaches its peak, is a key time in the dairy calendar. This offers an opportunity for processors to use this extra milk for longer shelf-life products such as cheese and ice cream in time for the summer season.

Halloween and Bonfire Night

For Halloween, we saw little seasonal uplift (+1%) in cow’s dairy volumes (NIQ Homescan, 2 w/e 4 November 2023). Yet an uplift in butter was seen due promotions increasing demand for block butter (18%), with this trend also reflected in plant-based spreads.

As Halloween is a time for sharing sweet treats, consumers require more butter for baking. It is also likely that consumers shopped for provisions for Bonfire Night.

Christmas

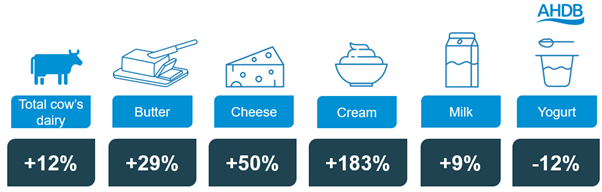

Total cow’s dairy volumes increased in the lead-up to Christmas (+12%) as people looked to stock up their fridges and treat themselves to special goodies (NIQ Homescan, 2 w/e 23 December 2023).

Demand for all dairy categories, apart from yogurt, increased by more than at other events as shoppers looked to indulge over the festive period. The most notable seasonal uplift was for cream volumes, which grew by 183%, mainly due to double cream, which lends itself well to dessert occasions.

This was followed by cheese (+50%), butter (+29%) and milk (+9%), as these are staple ingredients during the festive period, and it is a key occasion to share home cooking with family.

Percentage volume changes for cow's dairy products seen at Christmas 2023 vs an average two-week period

Source: NIQ Homescan, Total dairy and dairy products, Volume % change versus average 2-week period. 2 w/e 23 December 2023

Overall, demand for luxurious dairy increased, as consumers may also be more open to browsing for more indulgent products in the spur of the moment, such as cheeses perfect for snacking (+108%) or when socialising, as well as classic British regional (+102%) and specialist/continental varieties (+77%).

Alongside the strong performance for these cheeses, Stilton and British Blue over indexed by 416% as demand greatly increased compared to an average week in 2023, albeit from a low base.

In comparison, Cheddar volumes saw a 31% uplift. Yogurt volumes declined compared to an average week in 2023, which counteracted some of the growth since it is not a Christmas staple.

What does this mean for farmers?

Within the supply chain, the uptake of dairy products consumed over Christmas can be seen in wholesale prices. Both November and December 2023 wholesale prices saw upward movements for cream and butter month-on-month.

The seasonal uptick in demand was seen at wholesale level, but peaks are evened out by the time this value reaches farmgate.

Other Christmas favourites, such as cheeses, require extra storage and maturation times and hold a long shelf life, thus enabling excess supply to be evenly distributed throughout a longer period.

The three-year commodity cycle, boosted but not directly influenced by events, has a larger influence on farmgate prices. However, increased popularity for cheese, especially at Christmas, has led to an increase in production.

There has been significant growth in milk which is going into the cheese category, which accounted for 34% of the milk utilisation in 2023 compared to 28% in 2015.

Future opportunities for dairy

- There is little change in retailer volumes on promotions during many of these key events. Retailers should therefore look to change tactic and make the most of consumer demand and even boost retail volumes further with greater dairy volumes on promotion for events such as Pancake Day, perhaps with recipe kits to make home cooking easier. Retailers can take inspiration from events such as Valentine’s Day and Easter, when meat is often purchased to indulge and share with loved ones, to ensure dairy is also seen as being an important product used to treat people. Desserts should be a key focus for retailers to try and engage consumers

- Yogurt is also the second-largest dairy category in volumes, yet very few seasonal uplifts were seen for larger occasions like Christmas and Easter. Retailers should therefore try and promote yogurt as a sweet treat to be enjoyed as part of a wider food offering for these occasions

*Average two-week period excludes two weeks to Christmas (23 December 2023)

**Index versus the average two weeks excluding Christmas (over 100 means more likely to be purchased and under 100 means less likely to be purchased)

***Average two-week summer period is defined as the best-performing two-week period within the 16 w/e 2 September 2023

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.