EU pork market: production steady as prices see stability

Tuesday, 25 June 2024

Key points:

- Total EU production saw marginal gains of 0.3% in the first quarter compared to 2023

- Large production declines in Spain and Denmark as slaughter levels fall

- The EU Grade E pig price was sitting stable before dipping in the week ending 16 June

- ASF remains a huge challenge, with a recent outbreak confirmed on a German pig fattening farm

Production

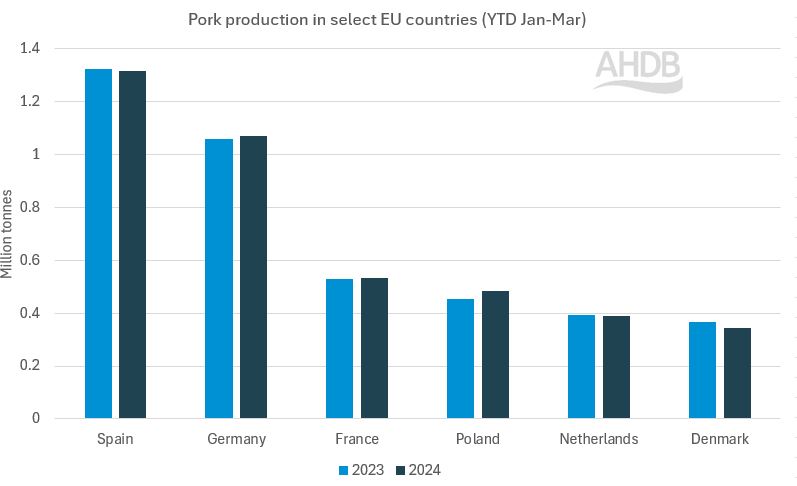

Pork production in the EU has seen marginal gains in the first three months of the year compared to 2023. Total production from January to March 2024 sat at 5.42m tonnes, a minimal increase of 0.3% (18,200 tonnes) from the same time in 2023. The majority of the gains in production came from Poland which saw growth of 31,000 tonnes to 485,000 tonnes and Germany at 10,400 tonnes to 1.07m tonnes. This was offset by large declines in key producing countries, such as Spain and Denmark who saw falls of 7,000 and 21,500 tonnes to 1.32m and 344,000 tonnes respectively.

Falls in production have been reflected in slaughter numbers, with the EU total of 56.2m head sitting 1% lower compared to the year-to-date 2023. Much like production, gains in slaughter numbers made by countries such as Poland (214,000 head) and Hungary (67,000 head) were offset by declines in Denmark and Spain. Danish slaughter fell most severely, down by 471,000 head (11%) from the Jan-Mar period in 2023, as Spanish slaughter decreased by 238,000 head (2%) in the same period.

Pork production in select EU countries (YTD Jan-Mar)

Source: European Commission

Trade

Falls in EU production have limited export opportunities, as total pig meat (inc offal) exports have fallen by 6% from 2023 in the year to date (Jan-Apr), to sit at just over 1.3m tonnes. The majority of this decline has come from falling exports to China, which sat 83,000 tonnes lower in the first four months of 2024, to 363,000 tonnes. Other notable falls in volume have come from Japan, sitting 13,200 tonnes lower in 2024 than 2023. There has been some growth to other Asian countries such as South Korea, the Philippines, and Vietnam to counteract declines.

EU imports of total pig meat (inc offal) have fallen by 1,800 tonnes from the year-to-date total of 2023 to 2024. EU imports totalled 46,000 tonnes over this period in 2024, with declines in volumes from the UK and Switzerland. Notable gains have been made by Chile, increasing their volumes shipped by 4,800 tonnes into the EU from 2023 to 2024 year-to-date.

Prices

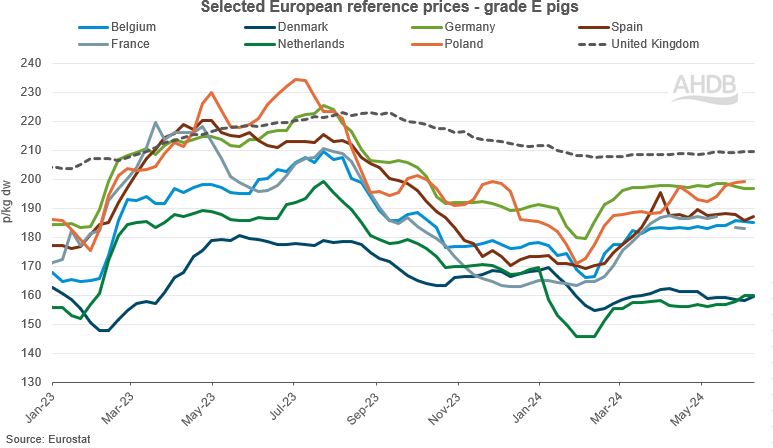

EU Grade E pig prices saw stability in previous weeks but have since fallen. For the week ending 16 June, the EU average price was 185.8p/kg, a decrease of 2.5p/kg from the previous week. The EU-UK price difference now sits at 23.6p/kg for the week ending 16 June, sitting stable compared to large differences seen at the beginning of the year.

Looking into key producing nations, all recorded countries reported losses of between 1.4-3.1p/kg from the week ending 09 June to the 16 June. There have also been large declines in prices from the beginning of the year in both the Netherlands and Denmark losing 11-12p to sit at 156.5p and 158.4p for the week ending 16 June respectively. This is compared to Spain which has recorded growth of nearly 12p from the beginning of the year to 184.8p/kg for the reporting week ending 16 June. German prices have seen a decline of just over 2p/kg from the previous week to 16 June, with a minimal increase of 3.4p/kg from the beginning of the year.

Recently outbreaks of ASF in Germany continue to cause huge disruption, seeing restrictions placed on farm, abattoirs, and butchers’ shops. Similarly, there have been further cases of ASF found in the west of the country close to borders with Belgium and France.

Selected European reference prices - grade E pigs

Source: Eurostat

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.