EU pork market: Will current market steadiness last the year?

Tuesday, 14 May 2024

Key points:

- Pork production grew in the first two months of the year compared to 2023

- EU E-grade pig prices have stabilised in recent weeks

- EU pig meat consumption expected to stay stable

- The European Commission predict a marginal decline in production in 2024

Production

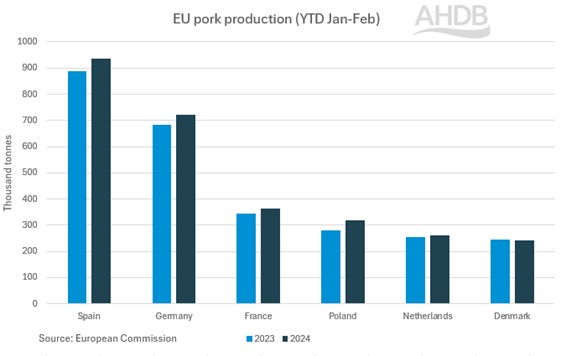

EU pork production in the first two months of 2024 has totalled just over 3.7m tonnes. This is an overall growth of 5% compared to the same period in 2023. This was primarily driven by growth in Spain, Germany and Poland.

Production gains have reflected increased slaughter numbers. Spain grew by 3% from 2023 to 9.7m head in 2024. Germany and Poland recorded year-on-year growth of 5% and 11%, respectively, to reach 7.5m head and 3.3m head.

Of the top six producers in the EU, Denmark was the only country to report a decline in production during this time – a fall of 2,610 tonnes from 2023. Similarly, slaughter in Denmark has fallen by 190,000 head (-7%) from the year to 2.6m head. Danish statistics for populations on 1 April 2024 show a near 7% increase in the total pig population from last year. However, this growth in population should be seen against a low base in 2023. Comparing the data to 1 January, there has been a more modest 0.7% increase in the population, indicating relative stability.

EU pork production (YTD Jan-Feb)

Source: European Commission

Prices

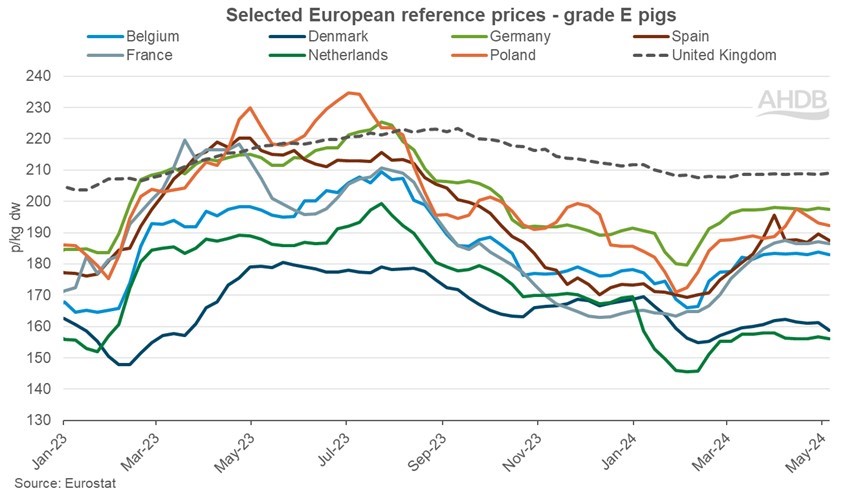

Looking into EU Grade E pig prices, we can see that the overall EU price has seen relative stability over recent weeks. Average pig prices have risen from the lower levels seen in the beginning of 2024 when weakening demand was reported to be driving prices down. For the week ending 5 May, the EU average sits at 187.11p/kg with the market reported to be in balance. Although there have been some weekly fluctuations, the value has remained between 187 and 188p/kg for the last six weeks, up almost 4p since the start of the year. The difference between UK and EU prices now sits at 21.8p/kg, returning to more usual trends following a larger difference seen at the beginning of the year and a narrow 2023.

Looking at the key producing nations, France has recorded the largest growth since the year began, up 21.5p. Spain has seen the second-largest change, up 14.1p, while smaller gains were made in Poland, Germany and Belgium between 5 and 7p. Denmark and the Netherlands, however, have lost 9.9p and 13.4p, respectively.

If demand within the EU remains stable, as predicted by the European Commission latest outlook, we expect this to support current pricing, given current market conditions. However, if consumption sees a shift either positively or negatively, this may add pressure to the market.

Selected European reference prices - grade E pigs

Source: Eurostat

Short-term outlook

The December 2023 survey showed a 170k-head increase in breeding sow numbers, indicating small shoots of recovery following three years of declining sow numbers. However, the number of fattening pigs is down year on year, which is expected to last through the first half of 2024. Feed prices softened in 2023, giving some optimism to the market. Poor predicted yields stemming from unfavourable weather in Europe may place unwanted pressure on feed prices into the second half of the year. The ASF picture is not expected to dramatically change throughout 2024, giving a marginal overall decline in expected pig production of -0.4% for 2024.

Exports of pig meat have been hampered by higher prices relative to the EU’s key competitors, the USA and Brazil, with a near 25% fall in 2023. If domestic high prices continue, the European Commission is predicting a further 4% decline in export volumes in 2024.

Given the UK’s fall in production, it is no surprise that EU imports from the UK fell by 25%. In 2024, EU imports are expected to stay low and decline further by 2%, given there are no short-term replacement imports from other origins. These plus steady consumption, and lower exports, could lead to potentially higher available supplies within the EU.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.