Future trade deals: New Zealand production and trade

Wednesday, 17 March 2021

Continuing our series looking into how the UK stacks up against potential future trading partners, in this article we take a look at New Zealand. Historically a crucial trading partner with the UK, before ascension to the European Economic Community, trade with New Zealand remains important across certain agricultural sectors, notably lamb. As a key member of CPTPP (The Comprehensive and Progressive Trans-Pacific Partnership) securing a deal with New Zealand will be vital to ensure the UK reaches its aim of CPTPP ascension – another key negotiating objective we will be looking into in more detail in the coming months. See below the relative sector headlines for NZ and UK, click the expand button for more in-depth analysis of a particular sector.

Beef and veal

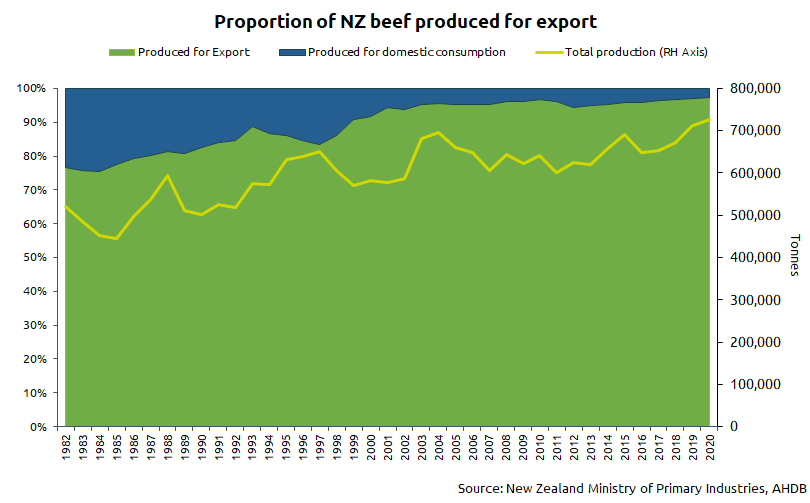

New Zealand beef production is heavily focussed on the export market. Against a backdrop of declining consumption per capita, and a steady increase in beef production due to an expanding dairy herd, the proportion of beef produced that is exported has increased over the past few decades and is now above 90%. This results in New Zealand being in the top 5 beef exporters in the world, despite falling outside the top 10 in terms of cattle numbers. Since the mid 90’s, an increasing trend to convert from beef and sheep into dairy has meant a greater source of beef from the dairy herd, with around 70% of New Zealand beef production now deriving from the dairy herd in one form or another.

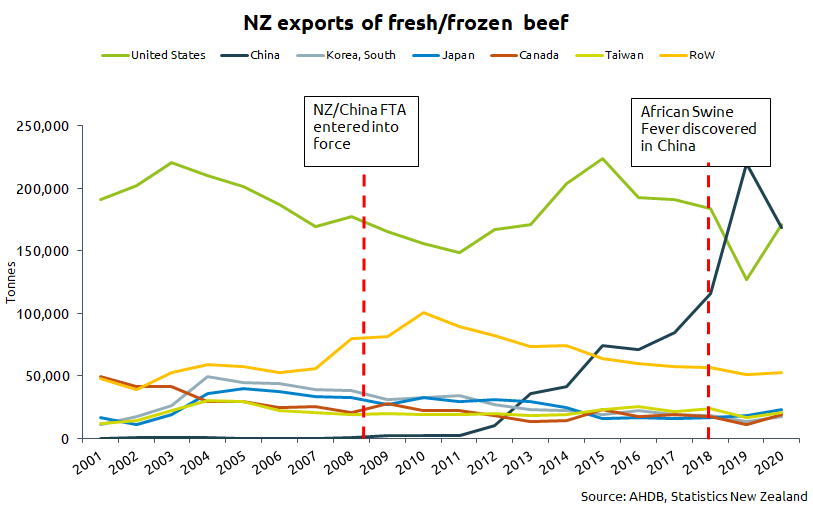

Historically, the United States has been the primary destination for New Zealand beef, however in recent years, there has been a marked shift towards China. This has primarily been driven by an increased demand from China due to the African Swine Fever epidemic which began in August 2018. Exports to China had already been increasing in the run up to that due to the signing of an FTA between New Zealand and China in 2008, which has been bolstered by continuing economic growth and an increase in middle class consumers with more disposable income New Zealand fresh/frozen beef exports to China in 2019 surpassed those to the US for the first time, however dropped back again in 2020. New Zealand is heavily reliant on these two markets, accounting for around 72% of total exports in 2020.

New Zealand annual exports of beef incl. offal to key markets, 2017–2019 average

|

Country |

Volume shipped (t) |

Value (£ million) |

Unit price (£/t) |

|

United States |

172,800 |

649 |

3,800 |

|

China |

145,300 |

537 |

3,700 |

|

Japan |

23,000 |

112 |

4,900 |

|

Taiwan |

22,300 |

94 |

4,200 |

|

South Korea |

24,200 |

77 |

3,200 |

|

Source: IHS Maritime & Trade - Global Trade Atlas®, Statistics New Zealand |

|||

New Zealand predominately exports frozen boneless cuts of beef, at varying prices around the world. Export unit prices for boneless New Zealand beef vary, with exports to the US and Canada at the lower end of the scale (£3,300-£3,500/t). Meanwhile, exports to European countries, such as the Netherlands and Germany are at the higher end of the scale (£8,000-£9,000/t).

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

680,000 tonnes (cwt) |

906,000 tonnes (cwt) |

|

TOTAL EXPORTS (3-yr avg) |

492,000 tonnes |

171,000 tonnes |

|

TOTAL IMPORTS (3-yr avg) |

<10,000 tonnes |

361,000 tonnes |

|

Source: Defra, HMRC, Statistics New Zealand, IHS Maritime & Trade - Global Trade Atlas® |

||

Sheep meat

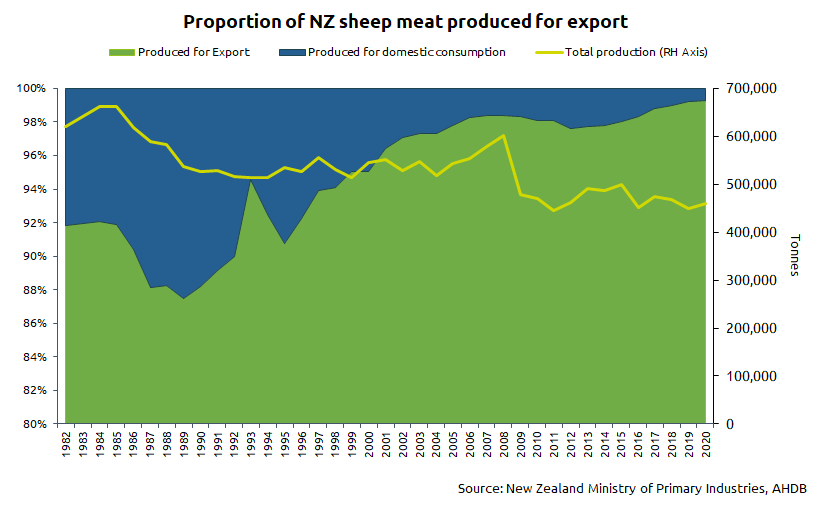

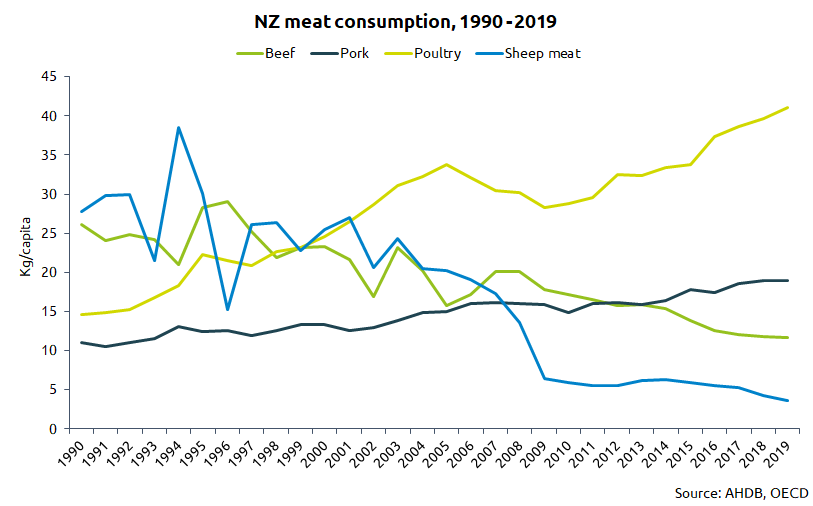

In contrast to beef production, sheep meat production in NZ has been slowly declining over the past few decades. Production is currently around 464,000 tonnes (2017-19 avg.), down from over 600,000 in the 1980s. Consumption in NZ has also fallen dramatically during that period. . According to data by OECD, NZ sheep meat consumption has gone from around 30kg per capita in 1990 to just over 3kg per capita in 2020. This is likely due to a number of factors. Consumption of other proteins such as pork and poultry have increased significantly over this time period. At the same time, subsidies were abolished in New Zealand which meant that production reduced as sheep made way for dairy in the more productive areas. A major drive towards the export markets for lamb also likely contributed to a higher price as lamb became more exposed to the global marketplace. Around 98% of lamb production in New Zealand is now exported.

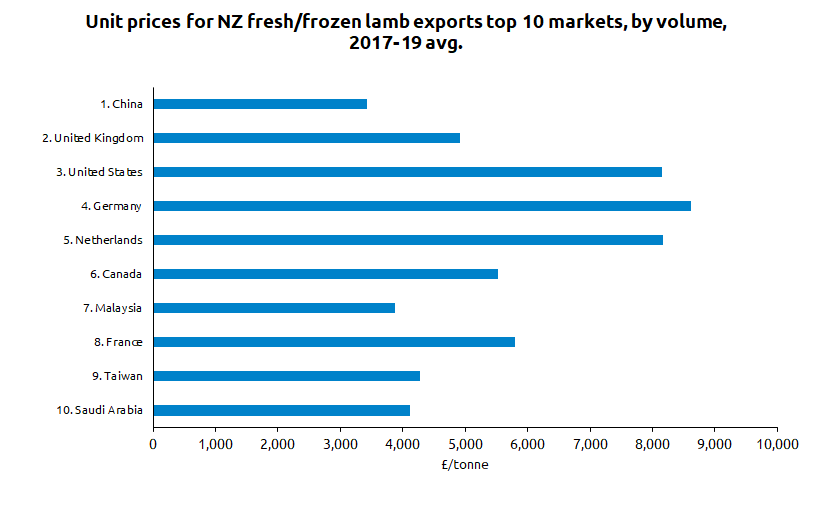

China is the leading market for New Zealand lamb, with shipments averaging 184,000t between 2017-19. The UK is also an important market, along with the United States. Prices across New Zealand’s major markets vary significantly. Like with beef, exports of lamb have been pivoting towards China for a number of years, again facilitating by the 2008 FTA. Markets in Europe, particularly the UK, have recorded lower imports from New Zealand for some time, and New Zealand have not filled the EU quota on sheep meat since 2008, and is currently around 60% utilisation. This dynamic could change in the future, as demand from China could soften going forward as they recover from African Swine Fever. Demand for cereals in China were significantly up in 2020 and the highest on record, which suggests that a recovery in the pork sector, and potential expansion in other proteins is on-going. This may see some New Zealand lamb pivot back to more traditional markets in Europe.

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

464,000 tonnes (cwt) |

299,000 tonnes (cwt) |

|

TOTAL EXPORTS (3-yr avg) |

397,000 |

95,000 tonnes |

|

TOTAL IMPORTS (3-yr avg) |

N/A |

83,000 tonnes |

|

Source: Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Pork

Like in Australia, pork imported to New Zealand is subject to a rigorous set of Sanitary and Phytosanitary (SPS) measures. Only a select few countries have the ability to export to New Zealand: Australia, Canada, European Union, Sonora State of Mexico and the United States of America (USA)[1]. Pork production in New Zealand is small, and therefore imports are required in order to match consumption. Currently around 60% of New Zealand pork is imported with many products made in New Zealand using imported product[2].

Pork imports total around 52,000 tonnes (2017-19 avg.), with the vast majority of imports (85% by value) consisting of frozen pork cuts with an average price for frozen pork standing around £2,100/tonne. In value terms, the total market is worth around £122m. Spain is currently the leading supplier of pork to the New Zealand, and imports have been steadily increasing year on year as consumption of pork in New Zealand rises. Other major suppliers are also Canada and the US.

[1] https://www.mpi.govt.nz/import/food/pork/steps-to-importing/

[2] NZ Pork - https://www.nzpork.co.nz/pigcare/pigcare-accredited-pork/#:~:text=Currently%2C%20over%2060%25%20of%20pork,likely%20made%20from%20imported%20pork.

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

45,000 tonnes |

930,000 tonnes |

|

TOTAL EXPORTS (3-yr avg) |

N/A |

353,000 tonnes |

|

TOTAL IMPORTS (3 yr-avg) |

52,000 tonnes |

966,000 tonnes |

|

Source: USDA FAS PSD database, Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Dairy products

New Zealand dairy production is considerable. Much of the milk production in New Zealand is made into milk powders, with butter and cheese also being cornerstone products of the New Zealand dairy market. Again, production far outweighs domestic consumption and around 95%[1] of production is exported to a wide variety of trading partners across the globe. New Zealand farmers continue to improve productivity on farms, however a steady reduction in cow numbers has meant that production has remained fairly stable recently.

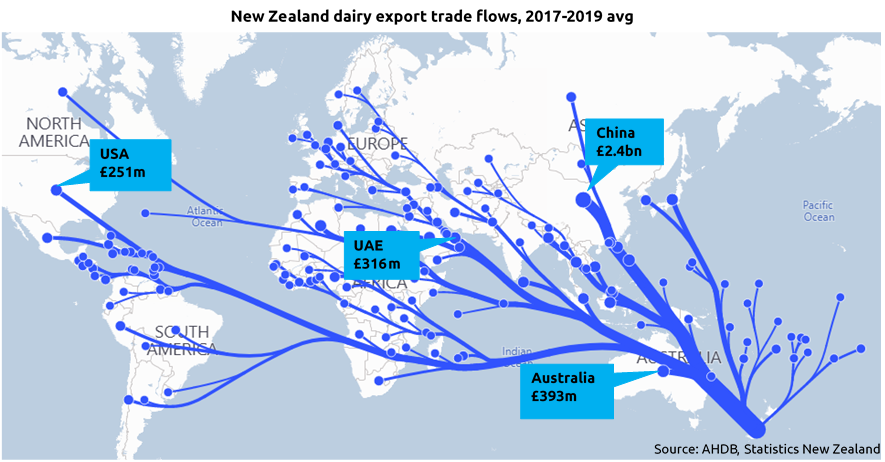

China is a key trading partner, with over 30% of all exports by value heading to the country. Fonterra, a major dairy exporter in New Zealand has made significant investment within China, in both farms and processing capacity in order to extract the most value from the growing dairy market in China. Other key trading partners include Australia, as well as a variety of Asian markets.

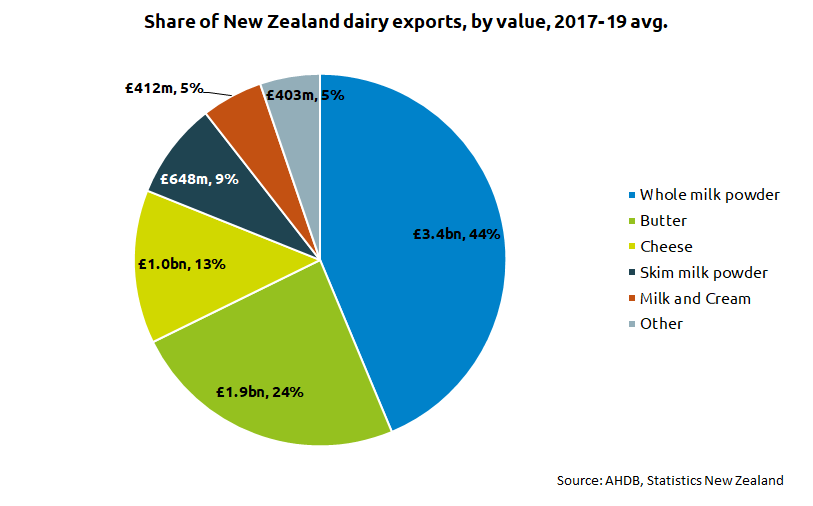

Whole milk powders are the largest dairy export for New Zealand by value, making up around 44% of the total value of exports. The vast majority of these go to China, UAE and other Asian markets for infant milk formula. Butter and cheese exports are also substantial, totalling £1.9bn and £1.0bn respectively per annum (2017-19 avg.). New Zealand exporters are constantly working with food service companies and chefs in China to develop new products which use cheese. For example, hotpot dishes are very popular in parts of China and recognizing this, New Zealand food technologists are working on hotpot recipes and products which incorporate cheese[2].

In terms of imports, New Zealand imports relatively little, with a total market size of around £139m per annum (2017-19 avg.). The vast majority of import by value come from cheese and whey. Cheese imports have been growing steadily in recent years, with imports totalling £55m in 2019, up from £28m in 2015. The market is predominately supplied by Australia and the United States. Very little trade for any dairy products currently occurs between the United Kingdom and New Zealand.

[1] https://www.dcanz.com/about-the-nz-dairy-industry/

[2] USDA FAS: NZ Dairy and products annual.

|

Annual production and trade, 2017–2019 average |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

Liquid Milk: 22m tonnes Butter: 533,000 tonnes Cheese: 374,000 tonnes |

Liquid milk: 6.7m tonnes Butter: 167,000 tonnes Cheese: 461,000 tonnes |

|

TOTAL EXPORTS (3-yr avg)

|

£7.7bn Top exports: 1. Whole Milk Powder (WMP)- £3.4bn 2. Butter - £1.9bn 3. Cheese - £1.0bn

|

£1.66bn Top exports: 1. Cheese - £666m 2. Milk – 266m 3. Butter - £252m |

|

TOTAL IMPORTS (3-yr avg) |

£139m Top imports: 1. Cheese - £51m 2. Whey - £45m 3. WMP - £13m |

£2.86bn Top imports: 1. Cheese - £1.7bn 2. Butter - £338m 3. Yoghurt - £222m |

|

Source: Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas®, USDA Foreign Agricultural Service |

||

Cereals and oilseeds

Arable production in New Zealand is on a fairly small scale, with most grains produced for the domestic feed sector to complement imported grain, primarily from Australia. Small-scale farming, and prohibitive transport costs to the major mills from the areas suitable for growing crops mean that widespread adoption of arable farming has been limited. The cost of transporting grain from Canterbury to mills in Auckland is more than the price of shipping grain from Sydney, and similar to the cost of transporting grain from the east coast of the United States to Auckland's mills[1]. The country is primarily a net importer of a number of crops with Australia the main import origin. We have detailed below some statistics for wheat and barley production to give some context.

Wheat

|

Annual production and trade, 2017–2019 average (crop years) |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

395 Kt |

14.9m tonnes |

|

TOTAL EXPORTS (3-yr avg) |

185 tonnes |

747,000 tonnes |

|

TOTAL IMPORTS (3-yr avg) |

534 Kt |

1.8m tonnes |

|

Source: USDA, Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

Barley

|

Annual production and trade, 2017–2019 average (crop years) |

||

|

|

|

|

|

PRODUCTION (3-yr avg) |

353 Kt |

7.3m tonnes |

|

TOTAL EXPORTS (3-yr avg) |

175 tonnes |

997 Kt |

|

K |

19.2 Kt |

94 Kt |

|

Source: ABARES, Defra, HMRC, IHS Maritime & Trade - Global Trade Atlas® |

||

[1] https://www.stuff.co.nz/business/farming/109065071/arable-farming-the-silent-partner-to-sheep-beef-and-dairy

Topics:

Sectors:

Tags: