Feed report: 26 January 2022

Wednesday, 26 January 2022

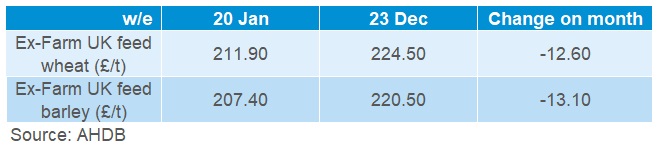

Grains

It’s been a volatile month for wheat prices. UK nearby wheat futures closed 20 December at £219.50/t, then dropped as low as £206.35/t on 14 Jan. However, they have since risen, closing at £226.05/t on Tuesday (25 Jan).

In the middle of December, grain prices were pressured from the unknown implications of the Omicron Coronavirus variant. We even saw old crop delivered bread wheat prices drop as potential lockdowns could have ensued.

However, over the Christmas break there was a lack of ‘new’ news for global wheat markets, though there were concerns over South American weather. This dominated the headlines as hot and dry areas were potentially impacting the record maize production out of South America.

Going into January, two key grain markets (wheat & maize) moved in opposite directions. Wheat markets were pressured as Argentina & Australia’s bumper harvest came to a close and lack of US exports sales added to this pressure.

By the middle of January, the release of latest the USDA Supply and Demand report caused on-going pressure, as there were increases to US and Ukrainian maize output. Further to that, wheat prices dipped as global ending wheat stocks for 2021/22 were revised up 1.8Mt, to 279.9Mt. This is down to a marginal global production increase coupled with a greater cut to global consumption.

The markets soon brushed off this bearish news as dry weather in South America came to the limelight again and supported grain markets, with rains arriving in Argentina, although speculated to be too late according to both the Buenos Aries and Rosario Grain Exchanges.

Further to that, political tensions in the Black Sea are causing concerns due to the threat of disruption to exports. The main threat is arguably to the wheat market, from a volume perspective.

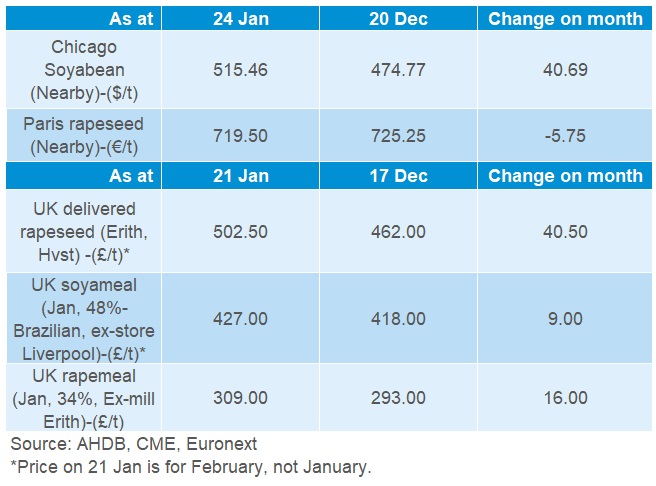

Proteins

For proteins, like grains, the impact of Omicron was apparent. Markets were pressured, led by the drop in Brent crude oil, as social restrictions could reduce demand for oils, including vegetable oils.

However, attention then turned to South American weather as the Bolsa de Cereales agency said that dry weather in the coming months presented a ‘big challenge’ for soyabean production in Argentina.

Chicago soyabean futures gained off the back of this over the Christmas period and beyond. From this, several agricultural consultancies cut Brazilian soyabean production. AgRural pegs the crop at 133.4Mt, down from 144.7Mt. StoneX estimates the production at 134Mt, down around 11.0Mt from its December 2021 estimate.

By the middle of January, the USDA WASDE report cut Brazilian and Argentinian production by 5.0Mt and 3.0Mt, respectively.

Towards the end of January rains did eventually arrive in Argentina. However, the question remains, is it too late? On Thursday, updated crop conditions from the Bolsa de Cereales to the 19 January, show 27% of Argentinian soyabean crops were rated ‘poor/very poor’, down 2 percentage points (pp) from the previous week. Meanwhile, 30% were rated ‘excellent/good’, down 1pp from the previous week. The market still awaits yields data from South America to nail the implications of this dry weather.

Currency

Across the month Sterling strengthened against the Euro & Dollar by 1.67% and 1.95%, respectively. Sterling was supported as fresh restrictions were not imposed in England over the festive period, unlike in parts of Europe where measures were introduced.

Business activity in the US grew at the slowest pace in 18 months in the month of January. A winter spike in coronavirus infections had implication for labour shortages, which led to productivity short falls.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.