Continuing price inflation means tight margins for farmers

Tuesday, 1 March 2022

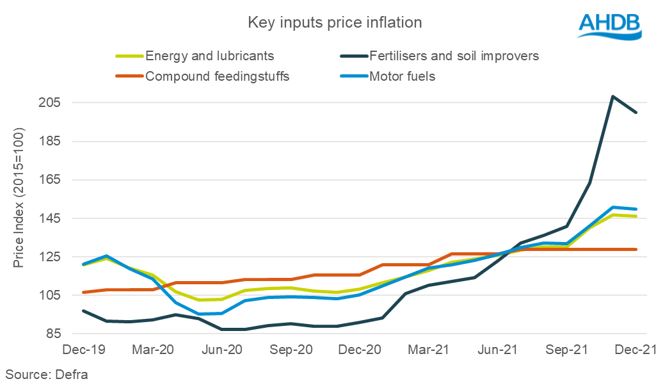

Everyone is aware input costs have been rising. For the first half of 2021 the focus was on feed, where prices increased 6%, the cost of feed then remained steady for the rest of 2021. However as we reached summer, energy, fuel and fertilisers caught up.

Fertiliser costs increased exponentially during the Autumn, doubling in price over the space of 3 months (September to November). This has led some farmers to contemplate if they should cut back on fertiliser application. Energy and fuel costs also had a steep price increase during the autumn months, increasing by 13% and 14% respectively.

Despite costs tailing off a little in December we expect to see increases throughout 2022 due to volatile prices on wholesale fossil fuels and grain markets (and that’s before we factor in any global fall out over supplies from Russia due to the current invasion of Ukraine).

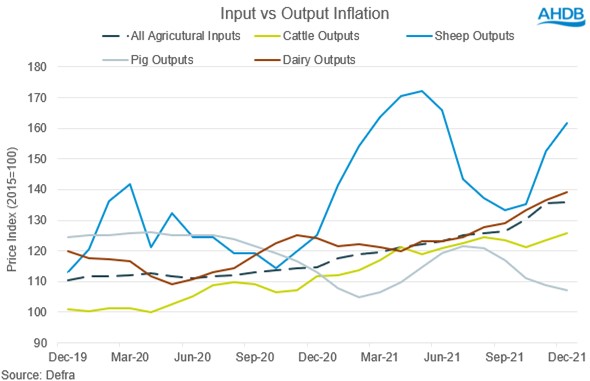

Using the Defra agricultural price indexes (API) the picture for outputs in the livestock sectors over the last 12 months is rather mixed. The sheep industry has been having a fruitful year with rises in outputs out pacing that of inputs throughout 2021 despite a dip over the summer months.

Cattle farmgate prices have been steadily increasing since spring 2020 (up 21% from April 2020 to Decmber 2021). However increases in input prices have been larger, tightening margins for farmers, not aided by the reduction in basic payments. You can register for our Farm Business Review service to receive free, impartial, expert advice and support for you and your business through this transition period.

Since summer 2021, dairy output prices have risen roughly inline with input inflation, outpacing it in December. For the season so far (April - December 2021), dairy output prices increased by 16% compared to a 12% increase in input prices (although we anticipate further cost inflation to come).

The pig industry has had a very challenging 12 months with inputs far outweighing outputs in 2021. Outputs are currently limited in this sector, and for the foreseeable, due to a large backlog of pigs and limited slaughter and butchery capacity which is lowering prices. There are no quick fixes to resolve these issues (with Europe also suffering a large volume of pork), but we explored three scenarios based on our January market outlook.

As 2022 continues to bring uncertainty, both in terms of how long the inflationary period will last and global supply availability, keeping an eye on markets, planning ahead and understanding on-farm costs of production and margin returns will be critical to profitability in all sectors.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.