Addressing the pig backlog: three scenarios

Monday, 7 February 2022

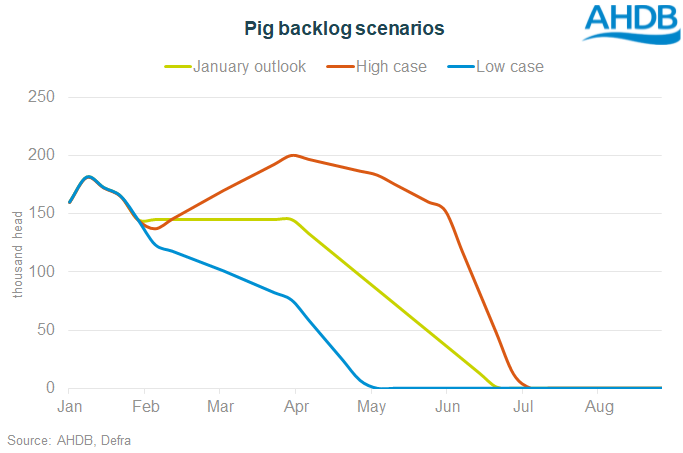

Our recent outlook for the pork sector suggested that the backlog of pigs on farm would not be cleared until the second quarter of 2022.

This was based on assumptions that UK sow numbers would eventually fall from 415k head to 385k head by mid-year, and that UK slaughter capacity was constrained to around 220k head per week.

But what if slaughter does not happen as laid out in the outlook? It is after all just one view of what we think is the most likely outcome, it is not the only possible outcome.

The following scenarios are based on varying the kill rate, in line with recently observed estimated slaughter. For simplicity, we have not varied the size in decline of the sow herd from that assumed in the outlook, or the number of new pigs. Changes to either of these could further delay or bring forward changes in the size of the backlog. However, most of the pigs available for slaughter in the first half of 2022, including the backlog itself, were already on the ground as at 1 Dec 2021, the date of Defra’s most recent survey of the English pig population.

Scenarios:

- The January outlook – GB slaughter of 186k head per week (approx. 220k for the UK). Based on the average weekly kill observed in Q4 2021, not including the last two (low) weeks.

- Backlog high case – GB slaughter of 178k head per week. Based on the average GB kill observed between September and November.

- Backlog low case – GB slaughter of 192k head per week. Based on GB weekly kill observed in the last 8 weeks of 2021 (again not including the final two (low) weeks).

In the January outlook, we suggested the backlog could not be addressed until Q2. Here, in the “high case” scenario, the backlog worsens before it gets better, and is with us until July. In the “low case”, it is dealt with around seven weeks earlier than the “January outlook” case.

The government’s revised Slaughter Incentive Payment Scheme, increases payments to abattoirs to £10/head, and runs until 31 March, which if taken up could increase throughputs. The arrival of additional butchers into the UK could also increase capacity. Some uptake of these schemes was already considered in January’s outlook.

Even in the low backlog case, the implication is that some farmers will face significant practical challenges for weeks to come. This analysis is also limited to the possible physical size of the backlog. Pig producers are also struggling financially, as pig prices fall and feed costs remain high, with backlogged pigs doing nothing for cashflow or profitability.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.