Continental EU lamb prices remain supported

Thursday, 20 April 2023

With key lamb producing regions seeing flock declines, EU production is forecast to decline by 1.2% year-on-year (YOY) in 2023, potentially supporting prices on the continent. Yet Irish lamb prices have bucked the trend, being pressured YOY much like domestic GB prices. Linked to this, UK lamb supplies are set to improve this year, but how will high EU prices contribute to our domestic price matrix?

What’s happening with prices on the continent?

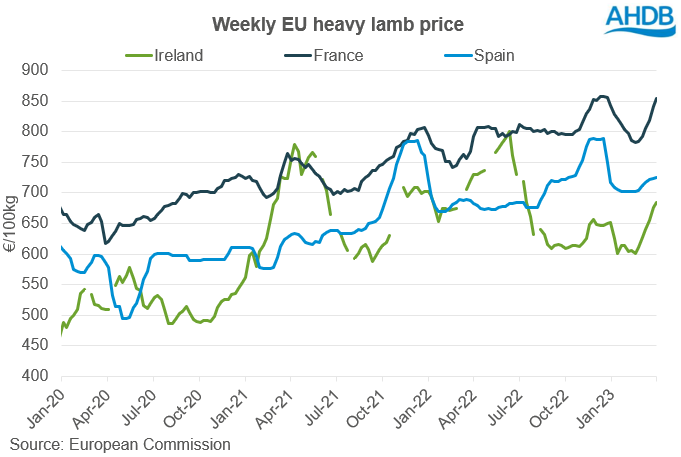

Lamb prices for key producers France and Spain remain supported with prices at €855.00/100kg (+7.8% YOY) and €724.70/100kg (+6.0% YOY) respectively (w/e 09 April). The EU sheep population declined by 1.8% in 2022, driven by declines to the Spanish and French flocks which accounted for 57.3% and 36.2% of the total EU decline respectively. This led to a decrease in EU slaughtering’s which has continued into 2023 for key producers such as France.

Alongside this, global exports from the EU in January increased by 11.8% YOY, driven by greater volumes going to Israel and Switzerland despite an 8.4% decrease in exports to the UK, as pressures on demand remain.

Prices closer to home

However, Irish lamb prices sat at €684.70/100kg in the w/e 02 April, 6.1% lower YOY, continuing the trend of lower prices seen since the start of October 2022. This trend opposes the overall EU sentiment as Irish production has increased recently, with year-to-date (YTD) throughputs currently 4.0% higher YOY (w/e 08 April). Coupled with reduced demand, this is weighing on prices. With greater supplies and Irish lamb prices more competitive, exports to the EU were 5.7% higher YOY in January and grew over 20% YOY in the two months prior.

With YTD throughputs up on the year so far but Irish forecasts predicting production declines in 2023, could we see this slaughter rate slow and supplies tighten in comparison to the second half of 2022?

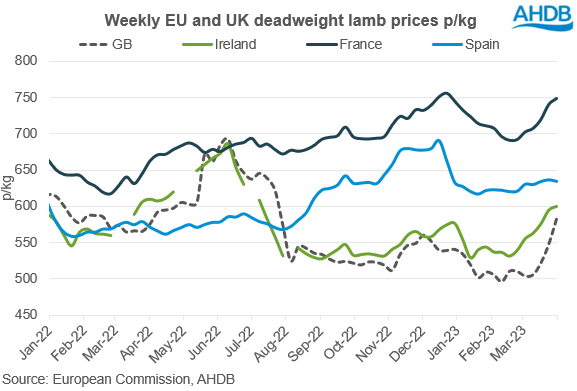

Much like in the EU, the UK has experienced a period of lower prices, due to seasonal trends and reduced demand. But we have seen a change in market sentiment since the beginning of March as lamb prices started to rise rapidly, as we approached a period of important religious festivals such as Ramadan and Easter. The strong continental prices, caused by tight supplies have also added to this recent price support as GB prices continue to track EU trends.

This pressure on UK lamb prices has increased the price competitiveness when compared to mainland EU. We have seen increased demand from the EU with YTD (Feb) exports to the continent increasing by 18% compared to the 5-year average. This was driven predominantly by YTD exports to France increasing by c.600t (+c.27%) compared to the 5-year average. With the UK’s lower price point, this has enabled product to become increasingly favourable in destination markets.

What might happen to GB lamb prices?

The price relationship between GB and EU prices remains essential, while the EU market balance will be key to watch in terms of our export competitiveness as we move through the year and into a net exporter position for sheep meat. The European Commission is forecasting greater imports to the bloc this year to mitigate high domestic prices. This could lessen any seasonal pressure on GB prices as supplies increase.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.