GB lamb prices rumble on, culls strengthening

Friday, 17 March 2023

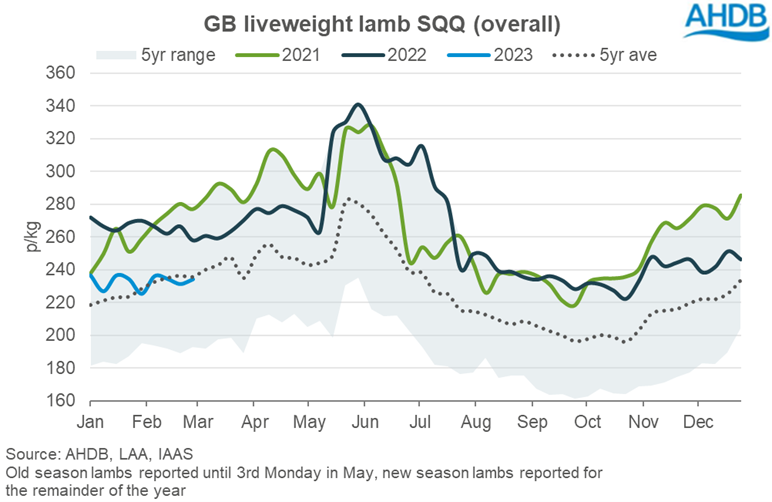

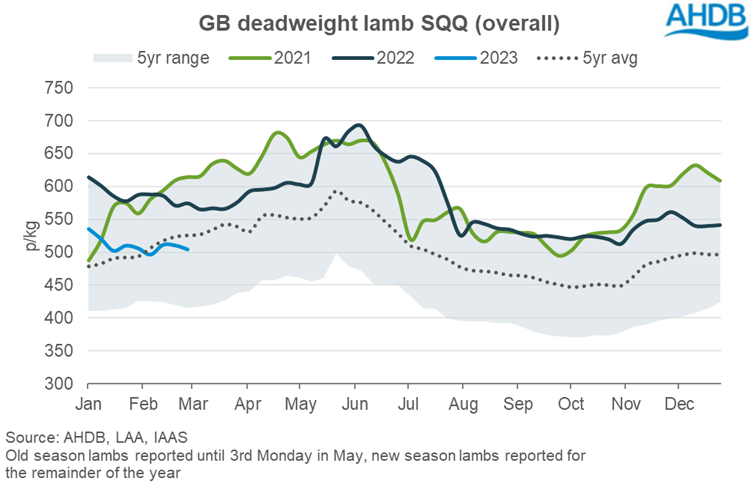

GB lamb prices have largely moved sideways since the beginning of the year, weaving close to five-year average levels, but remaining pressured versus a year ago.

For some headline figures, the liveweight OSL SQQ averaged 234.25p/kg in February, down 29p year-on-year, while the equivalent deadweight measure stood 74p lower at 506p/kg.

What’s driving prices?

Supply

More lambs are estimated to have come forwards for slaughter during the first ten weeks of the year than the same period in 2022. This aligns with our expectation of a larger carry-over of hoggets, following slower kill in the second half of last year. An estimated 2.2 million lambs have been processed in GB during the first ten weeks of 2023, 6% (125,000 head) more than the same period a year ago.

Demand

Domestic retail demand remains sluggish. The most recent Kantar data (12 weeks to 19 February) shows the total quantity of lamb sold via retail was 6% lower versus a year ago. It should be noted that this data does include the uplift in sales recorded during the Christmas period.

We are fast approaching a key period of demand for lamb from upcoming religious festivals. Ramadan and Easter begin 10 days earlier this year, on 23 March and 9 April, respectively. While we are finally free of COVID restrictions – meaning families can gather as normal – household budgets remain pressured by price rises. This could be detrimental to lamb performance over this key period. However, we did see uplift in sales of key categories over Christmas, so well-timed promotional activity may deliver a boost to sales.

Looking at international lamb trade, industry reports suggest that levels of imported product are high currently. However, the latest official figures from HMRC show that the volume of lamb shipped into the UK during January 2023 was largely stable from December at 2,400 tonnes. In addition, trade was significantly lower on the year, with January’s quantity 46% below the level recorded in January 2022. This was largely driven by less product from New Zealand and Australia, continuing the trend seen through the final quarter of 2022.

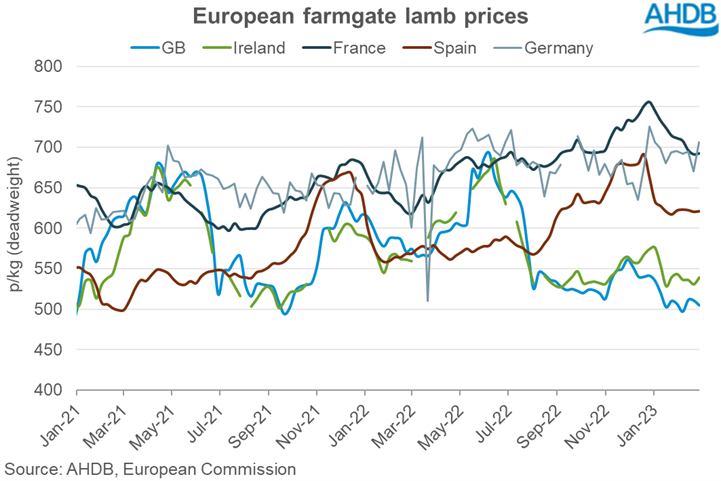

By contrast, UK lamb exports rose by 45% in January year-on-year to nearly 6,000 tonnes, driven mainly by increased shipments to France. The EU market has generally seen prices weaken since the start of the year, in line with seasonal trends and weaker demand post-Christmas. Consumers on the continent are also facing cost-of-living pressures. However, early production figures showed that French lamb slaughter was 8% lower year-on-year in January, no doubt helping to keep French lamb prices above year-ago levels, and further benefitting our price competitiveness.

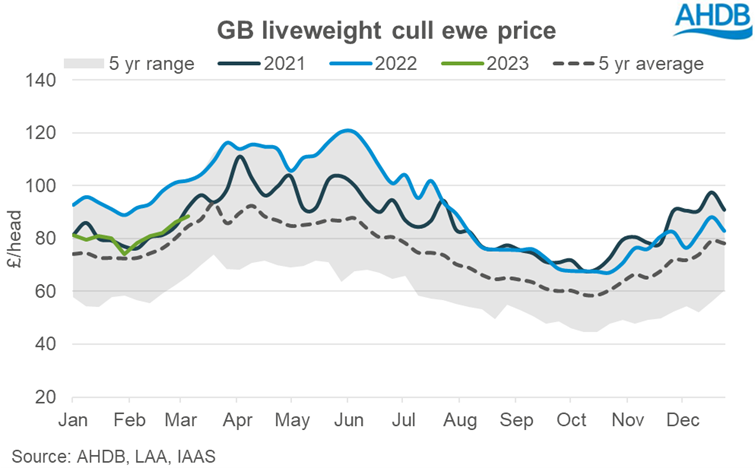

Cull ewe trade strengthening

Prices for cull ewes have seen more strength in recent weeks following seasonal trends, and are largely moving in line with prices seen in 2021. The GB average price stood at £88.50/head in the week ending 11 March, up £10/head from the price recorded four weeks previous.

However, as with prime sales, cull prices remain pressured year-on-year. For context, the February average of £81.96/head was £14.30 below the same month in 2022. More ewes have come through auction markets since the start of the year compared to last year, with total numbers since the start of the year up 8% (+27,000 head). Weekly numbers have fluctuated around an average of 36,500 head.

Key upcoming dates for sheep meat demand

-

23 Mar: Ramadan expected to begin

-

9 Apr: Easter Sunday

-

21 Apr: Ramadan expected to end

-

28 Jun - 1 Jul: Eid-al-Adha / Qurbani festival

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.