The organic market sees a dip in performance in 2022

Monday, 3 October 2022

Since October 2021 the organic food and drink market has seen a decline in volume sales, down by 16% for the 12 w/e 10 July 2022.

This decline has occurred after a long period of growth. Organic meat and dairy have seen an increase in prices correlate with a drop in volume sales. Whilst consumers are willing to buy organic, price remains a key barrier, made worse by inflation. In the long term, organic needs to continue to increase its visibility and justify that price premium by highlighting its environmental and health benefits.

Organic has seen a steady increase in total market volume share over time as, up until recently, sales were outperforming the rest of the market. It now makes up 1.2% of total food and drink volume, this is up from 1% in 2019 (Kantar, 52 w/e 10 Jul 2022). The organic food and non-alcoholic drink market is now worth £1.2 billion (Kantar, 52 w/e 10 July 2022).

Inflation vs. organic and how this compares to the rest of the market

The rising cost of food and drink is causing a change in consumer behaviour, this is no different for those who buy organic. Of those who are struggling with their finances, 27% have stated they are cutting back on buying organic food (AHDB/Blue Marble, Aug 2022).

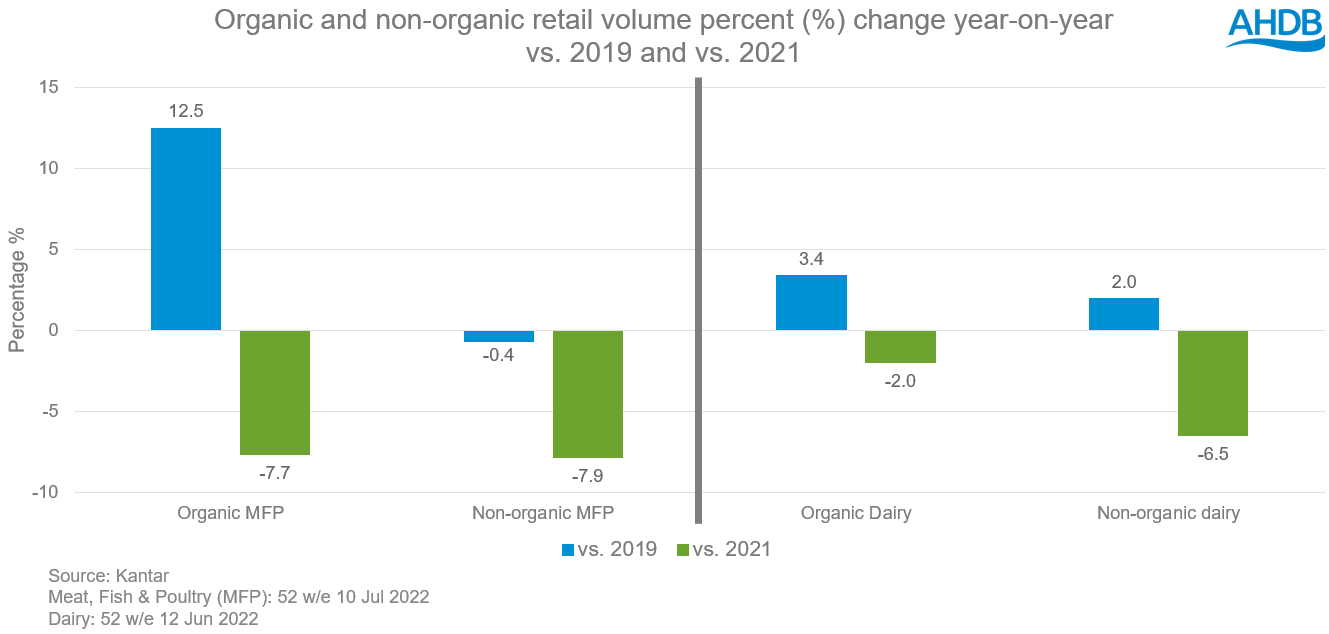

Although sales of organic meat and dairy have dropped since 2021, this reflects the impact of inflation, which is being felt across the market and affecting consumers buying habits. If we look back to pre-pandemic (2019), organic meat and dairy is still performing relatively well considering the current climate and outperforms the non-organic equivalent.

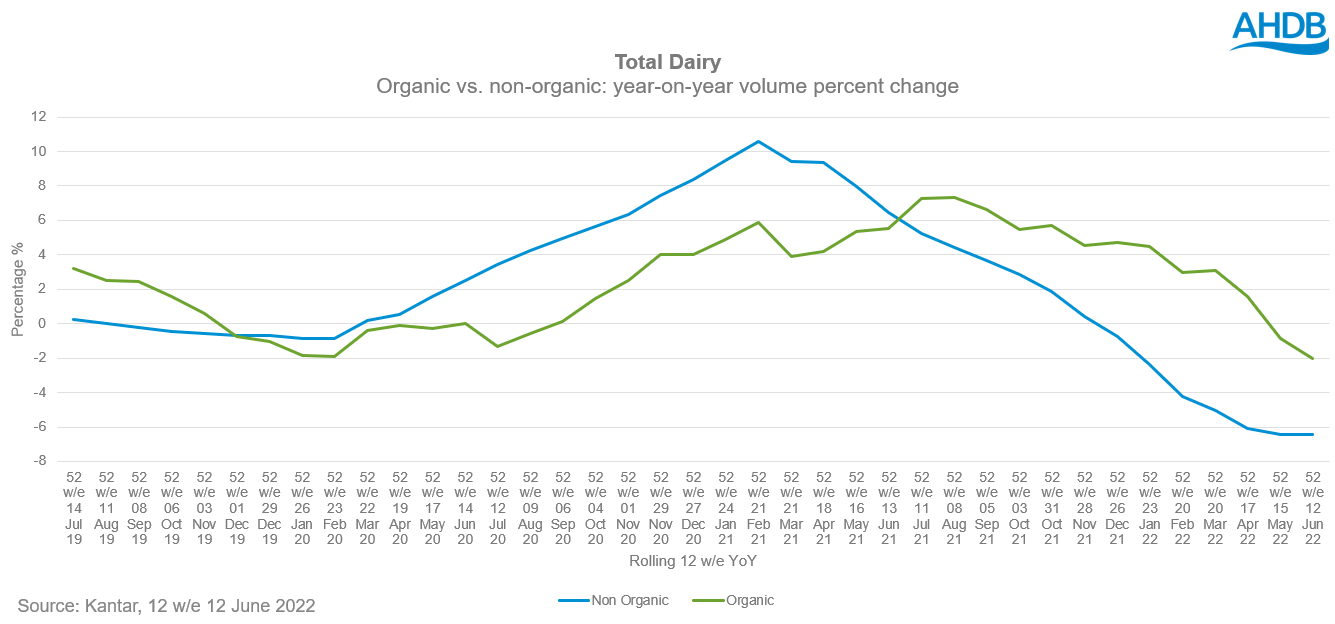

Dairy

Organic dairy accounts for 2.9% of total dairy retail volumes After a relatively long period of growth, organic dairy has seen a steep decline in volume sales since January 2022, which correlates with a swift increase in price. This price point is heavily influenced by milk and yogurt which make up the majority volume share of organic dairy sales (77.1% and 19.5% respectively).

Despite both organic and non-organic dairy experiencing a 3% increase in price, organic dairy has only seen a 2.0% volume decline year-on-year whilst non-organic dairy recorded a sharper decline of 6.5% year-on-year (Kantar, 52 w/e 12 Jun 2022). The nature of these products and the role of brands within these categories contribute to the fact that there is only a 7p/litre difference between organic and non-organic dairy (52 w/e 12 Jun 2022), making organic dairy a more accessible purchase for consumers than some other organic products.

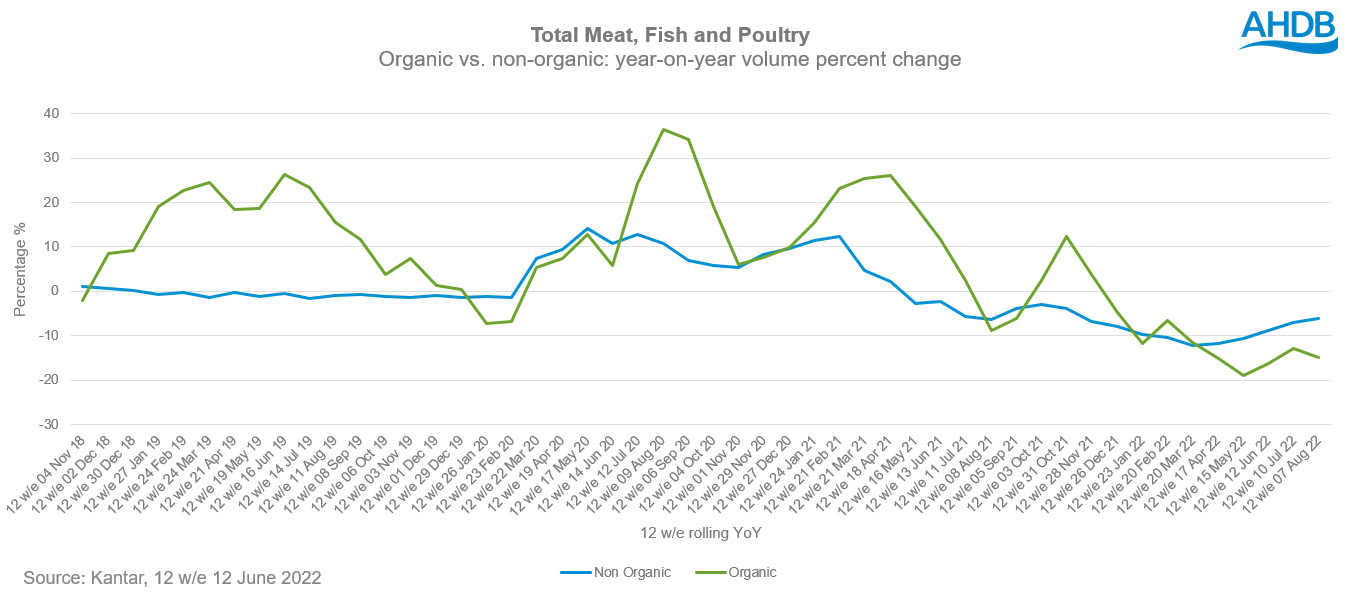

Meat, fish and poultry

In the 52 w/e 10 July 2022, organic meat, fish, and poultry (MFP) made up a 0.2% share of the total MFP market volume. Volume sales of organic MFP have seen consistent decline since October 2021, when organic saw its highest volume sale levels to-date. This decrease in volume coincides with a significant rise in price since October 2021, with the average price of organic MFP increasing by 5%, from £11.83/kg to £12.40/kg. The average price of the non-organic equivalent is now £6.52/kg, a 4% increase from October 2021 (Kantar, 52 w/e 10 July 2022).

Beef, lamb, chicken, and fish have all seen volume declines year-on-year. The main source driving this decline in volume are shoppers no longer buying organic meat off promotion. This suggests that as price becomes an increasing issue for organic MFP shoppers, many are now only engaging when there is a promotion on. Given that the main reason for this decline is previous shoppers buying less, volume-driving promotions could improve sales of organic meat in the short term. Unlike the other proteins, pig meat has performed well, this is owing to 89% of sales coming through processed pork, which generally have a more accessible price point (52 w/e 10 July 2022).

With more than half of consumers (52%) planning to spend less on visiting pubs and restaurants than usual over the next three months (Two Ears One Mouth, Aug 2022), this provides a significant opportunity for retailers to capture organic steak meal occasions lost from out-of-home. In-home organic steak occasions are seen as more social and celebratory than the non-organic equivalent with taste and enjoyability being the most defining elements (Kantar Usage, 104 w/e 15 May 2022). Here consumers are willing to pay more for taste and will buy organic steaks for these premium moments. Retailers should look to highlight the perceived quality of premium organic cuts and include meal deals and recipe inspiration that helps households deliver (IGD ShopperVista).

What to communicate to shoppers

Organic has greater perceived benefits related to environment and health but justifying the price premium remains a key objective. More than a third of adults feel that organic foods are healthier than non-organic foods, rising to 48% of under-35s (Mintel, Attitudes Towards Healthy Eating, April 2022). This is particularly relevant for organic dairy, where volume share growth from 2019 is coming through younger shoppers.

With 23% of consumers now claiming to be following some form of meat reduction diet – up by 2%pts on a year ago, waverers remain a critical group for organic to target. Flexitarian consumers are more likely to make purchase decisions with ethical and health considerations in mind. Therefore, by reassuring this audience of the health, sustainability, and welfare credentials of organic red meat and dairy, retailers can demonstrate to these environmentally conscious consumers the benefits of paying that price premium and promote quality over quantity.

Organic dairy is in a position to convey this to shoppers however messaging could go beyond generic sustainability claims to provide transparent detail. For example, organic can gain support by communicating its soil health and biodiversity credentials (Mintel, Dairy and Dairy Alternative Drinks, Milk and Cream, UK, 2022).

Conclusion

Retail sales of organic meat and dairy remain higher than pre-pandemic. Defra data suggests some farmers are looking to capitalise on this, with a 3.6% increase land farmed organically between 2020 and 2021, mainly driven by a 34% rise in the area of in-conversion land contributing to this. With Defra set to announce the organic part of the Sustainable Farming Incentive in 2025 for England, further recognition for the ecosystem services organic provides is forthcoming.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.