Organic retail sales rise 13%

Friday, 18 December 2020

The value of the organic food and drink* market in GB retail is now worth £1.2bn. With increased focus on household budgets expected in 2021, how can the organic market continue to grow?

Current market performance

In the year ending 1 Nov 20, total organic food and drink* volumes in GB retail rose by 12.9% (Kantar). This is ahead of the market growth for the non-organic equivalent, which increased by 8.9%.

In value terms, spend on organic food and drink* increased by £137m over this same time period. By comparison, the increase for non-organic equates to £7,961m.

Despite recent growth rates, organic remains a small part of the market, accounting for 1.29% of food and drink* spend last year, rising only slightly to 1.33% this year.

Variations by category

Organic performance varies greatly by category, with organic products in some categories outperforming their non-organic equivalents, and vice-versa. The variations are even seen within aisles and are linked to a variety of different factors, such as promotional activity and changes to product mix.

Just over one in ten consumers consider organic when purchasing food to consume in or out of the home. AHDB’s continuous consumer tracker, conducted by YouGov, hasn’t shown any increase in consumers citing organic as a consideration during the pandemic. This indicates that the current heightened growth for organic may not be a conscious decision for all shoppers.

![]()

Price challenge

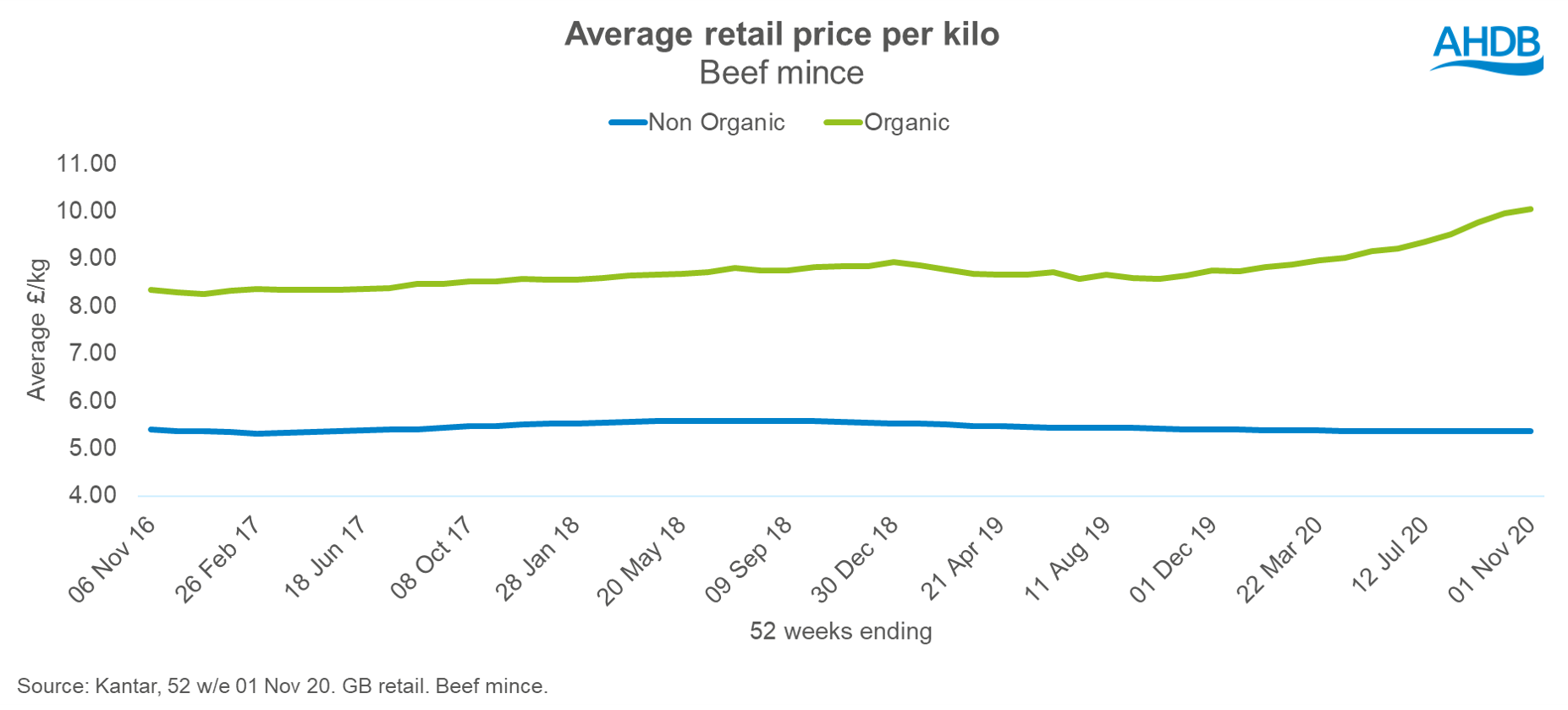

During the coronavirus pandemic the same consumer tracker has shown that price has become more important to consumers. Price is the biggest barrier to the organic market, with previous research highlighting that 59% of GB adults agree that organic food is too expensive for them to consider. Over time, the price differential between many organic and non-organic products has increased. The household staple, beef mince, is one such example of this; the price paid for organic beef mince was £4.69/kg greater than non-organic in the 52 w/e 1 Nov 20, up from £2.95/kg four years ago.

Some consumers are willing to pay more for organic, but in order to command this price premium, organic products need to reiterate perceived benefits over non-organic. Previous research shows that animal welfare is the main factor of organic produce respondents are willing to pay more for, while claims regarding flavour and taste, as well as overall health benefits would also encourage trade up. Communicating consumer benefits like this will be particularly important for the organic market to continue on its growth path throughout 2021, as household budgets come under further pressure.

Notes

*Total food and drink excludes alcohol

All figures sourced from Kantar, for the 52 w/e 01 Nov 20 unless otherwise stated

GB Retail only (supermarkets and independents). Excludes foodservice and box schemes.

Total beef, pig meat and lamb includes primary, processed and added value products.