Know your eating out customer

Wednesday, 13 March 2019

The value of the eating-out market is in decline as people are going out for food less frequently. Therefore, better targeting of advertising, offers and communication is important to encourage this valuable occasion.

MCA Insights has run a consumer segmentation in their Eating Out report 2018, splitting the population into groups, based on their habits and life stages. Understanding how these groups act, their missions when eating out and which channels they use, can help industry to better target consumers.

Key take-outs

- The eating out market is declining – think of the different missions of each consumer segment and tailor experiences to meet their needs

- For many, on-the-go foods for breakfast and lunch are just as important as sit-down evening meals – innovate offerings in all areas

- Eating environment is key – make it suitable for relevant targets, whether this is retired friends or young families during the day or young professionals in the evening; one size does not fit all

- Offering child-specific menus and deals for all ages could encourage parents to venture out to eat more often

- Menu engineering and deals for multiple missions allow people to think they’re getting the best value for money

Eating-out market segments

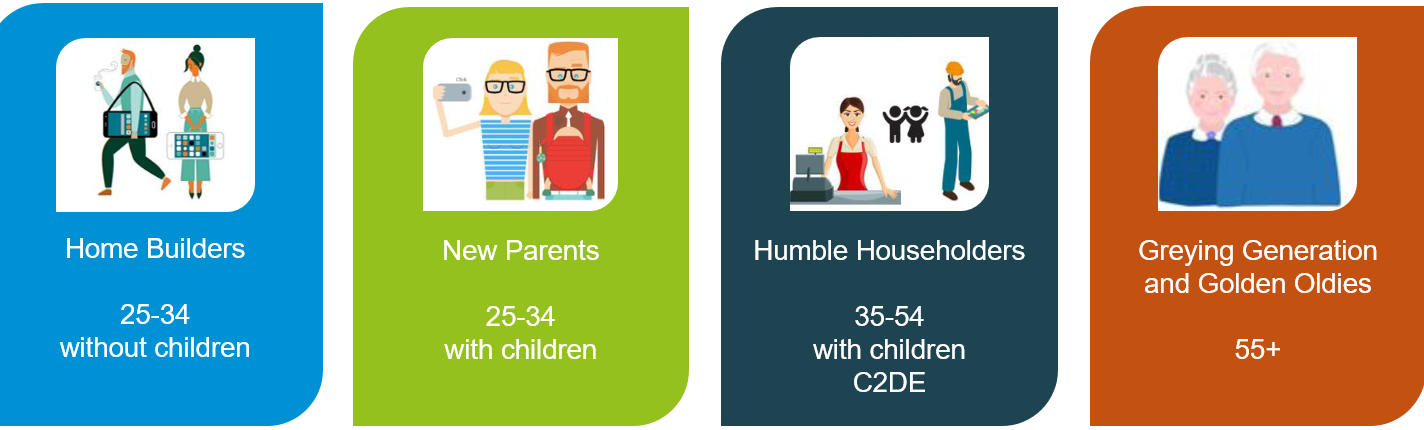

MCA splits the population into several segments, but we are going to look at four that could provide the biggest opportunities.

Those aged between 25 and 34 without children, whom MCA call ‘home builders’, make up the largest number of eating-out visits, accounting for 15% (1.4 billion per year) of eating out occasions, over indexing versus their 10% share of the population. Their eating-out occasions are primarily work-led so they need to be convenient, quick and readily available. Grabbing meals from the food-to-go section of the supermarket or going for a quick sit-down meal at a local or chain restaurant after work are popular with this category. However, this group is declining in their eating-out occasions; potentially, as money is squeezed, they may be making more packed lunches to save. There is a lot of innovation in food-to-go options but conveying these as value for money could be important to keep this group eating out.

The grey pound is growing in importance, and eating-out occasions are increasing for those aged 55–65 ‘greying generation’ and those aged 65+ ‘golden oldies’. Despite contributing to a smaller share of eating-out occasions versus their population contribution (19% vs 38%), they provide a big opportunity. Not only are they the biggest growth segment, they are also the most affluent consumers with the highest average spend at all meal occasions. They favour multiple courses, being more likely to have starters and desserts. This group values the social aspects of eating out and often meet up with friends and family. Because many of this category will be retired, breakfast and lunch occasions are popular. For those aged 55+, meal choice and cuisine are vital, this often leads them to pub chains and supermarket cafes. This shows that, even though they are the biggest spenders, they also want value for money.

Those aged between 25 and 34 with children, whom MCA calls ‘new parents’, are decreasing the number of occasions they eat out, with 21 million less occasions compared with the previous year. This is affecting all meal occasions from breakfast to dinner. Fast food chains are the most popular for an evening out with the kids, and branded coffee shops top the list for breakfast. This is due to the family friendliness of these channels. In contrast with new parents, those aged 35–54, C2DE, with children (MCA calls ‘humble householders’) are increasing their number of eating-out occasions. Breakfast and snacking occasions are driving this increase as brands tap into kids’ deals. Although less impacted by the economy, value for money is important for these consumers. This is reflected in their choice of restaurants, with fast food and pub chains proving the most popular. Taking learnings from the winning segment of ‘humble households’ could help turn around the performance for ‘new parents’. Having children’s menus that cater for all ages, with healthy options and flexibility for fussy eaters, as well as activities for multiple ages, can convey a family friendly atmosphere. Ensuring that new mothers with babies feel comfortable in the environment is also key to encouraging them to start eating out again.