- Home

- News

- Consumers express strongest positivity towards British agriculture in six years, with trust in farmers going from strength to strength

Consumers express strongest positivity towards British agriculture in six years, with trust in farmers going from strength to strength

Thursday, 24 October 2024

Signals point towards a wave of optimism from consumers towards British agriculture and farmers. Latest findings from the AHDB consumer trust study shows optimism rising through the agricultural supply chain and across the agricultural sectors. The need for farming and consumers to be joined by more than just supply and demand is a constant. So, what are the opportunities for agriculture and farmers with consumers?

Consumers hold strong positivity towards British agriculture

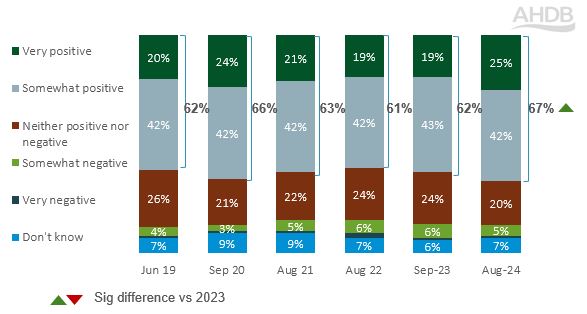

Latest findings from AHDB consumer trust study highlight the strong positivity that consumers currently feel towards British agriculture. The study, run in partnership with independent research agency Blue Marble, collects views from over 2,000 UK consumers on an annual basis. The scores collected in August 2024 indicate the highest level of positivity compared with the previous six years, a win for farmers and the wider British agricultural supply chain. The current upward curve exceeds previous peaks set in 2020, where consumer relayed strong positivity towards British agriculture during the challenges of the COVID-19 pandemic.

Consumer impressions of British agriculture over time

Source: AHDB/Blue Marble Trust Survey 2024

There are particular increases in positivity towards British agriculture from those aged 65+ (78%), those who describe themselves as being in a ‘comfortable’ financial situation (74%) and those who feel well informed about farming (73%).

As part of the study, consumers were asked their impressions of different agricultural sectors. The research showed that all agricultural sectors had risen in consumer positivity since 2019. Positivity was highest in the Fruit and Veg and Cereal sectors, with scores of 77% and 71% respectively. The positivity of dairy (68%), sheep (67%) and beef (64%) sectors all showed strong increases compared to 2019, and while pig (59%) and poultry (58%) positivity scores were lower than other sectors, they were still significantly higher than they were in 2019.

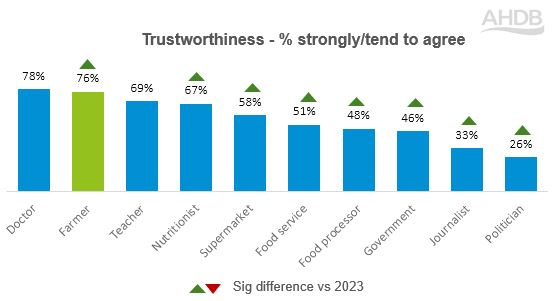

Consumers see farming as a trustworthy profession

Consumer trust in farmers is impressively high, with 76% of UK adults agreeing that farming was a trustworthy profession in the 2024 study. Another positive for farmers is that this percentage has also significantly risen compared to last year (up from 71% in 2023) as consumers learn more about British agriculture and show appreciation for the people who help put food on their tables. Farmer trust scores are up with doctors (78%) and scored ahead of other well-respected professions like teachers (69%) and nutritionists (67%).

Trust across the professions

Source: AHDB/Blue Marble Trust Survey 2024

Trust can vary across consumer groups; for instance, the UK average was 76% (for farmers), with higher-than-average scores for those who are aged 65+ (82%), those who felt well informed about farming (80%) and those describing themselves as omnivores (79%). While, on the other side of the coin, trust was lower than average for those aged 18–24 (66%), those who felt poorly informed about farming (69%) and those who classify themselves as vegan/vegetarian (61%).

The AHDB/YouGov Consumer Tracker also indicates positive sentiment towards British food and farming. With 74% agreeing that British farmers and growers are doing a good job producing food (AHDB/YouGov Tracker Aug 24), a growth of five percentage points since May. There is also positive news for shopping habits, as 56% agree that they will proactively look for British food/produce over imported foods (AHDB/YouGov Tracker Aug 24).

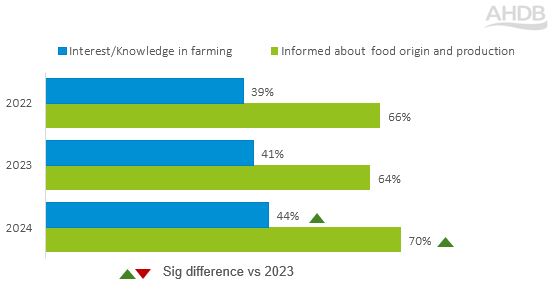

Rise in consumer interest and knowledge of farming

A big positive for agriculture from the findings of this research is the positive direction that consumer interest in farming and food production continues to head in, with both seeing steady rises over the last couple of years.

Knowledge/interest in farming and food production

Source: AHDB/Blue Marble Trust Survey 2024

A total of 44% of consumers stated they have an interest/knowledge in farming, and this positive increase in interest has also coincided with a strong increase in consumers who feel they are informed about food origin and production.

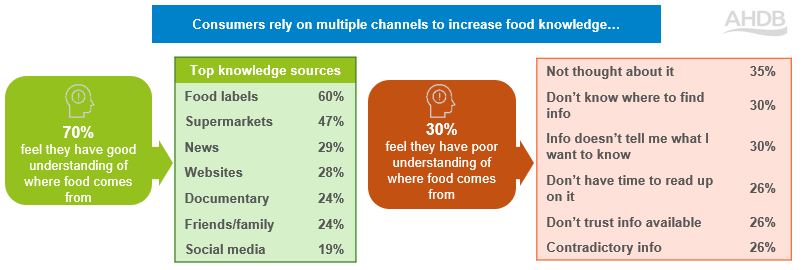

Consumers rely on multiple channels to increase their food knowledge. In total, 70% of consumers feel they have a good understanding of where food comes from, with top knowledge sources coming from food labelling and supermarkets. AHDB’s research into meat labelling and the in-store and online experience explored these in more depth and picked out industry opportunities.

Source: AHDB/Blue Marble Trust Survey 2024

There remain pockets of consumers (30%) who feel they have a poor understanding of where food comes from. With typical responses being they had not thought about it, they are not sure where to find information, finding contradictory information and not having enough time to read up on the subject. This highlights the importance for AHDB and others in the supply chain to ensure they share information with consumers in a way which breaks down (often complex) topics into consistent and digestible messages for consumers.

Consumers recognise the values of farmers

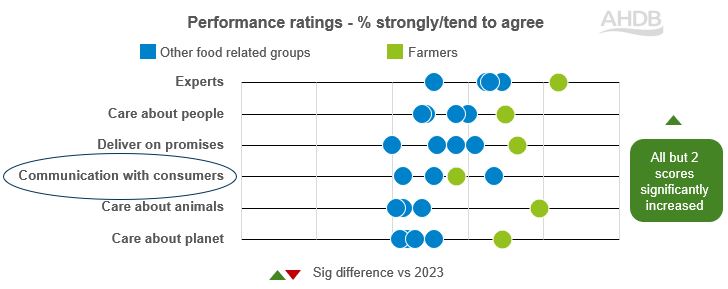

Digging deeper into the values of farmers, it’s clear that consumers hold farmers in a strong regard. In this study, farmers outperformed other food-related groups in the supply chain in almost all value categories. More consumers believed farmers were experts in their field, care about people, deliver on promises and care about animals and the planet vs other food-related professions. The only area where farmers performed relatively weaker, in contrast to other food-related groups, in this study was in communication with consumers.

Farmer values

Source: AHDB/Blue Marble Trust Survey 2024

Influences on consumer food choices

When looking across channels that consumers said influenced their food choices, it comes as no surprise that TV and social media was top of mind. When asked the same question on sources that influenced food choices, consumers picked out supermarkets (42%) and health professionals (36%) as the top two. While farmers featured lower down on this list, the score did show improvement over the last 12 months.

Key implications and opportunities

The Consumer Trust study highlights that there is opportunity to build on the strong trust consumers clearly hold for farmers in producing food brought into their homes. Consumers are more optimistic, with reduced concern over the cost of living, alongside more favourable attitudes toward food purchases and increased positivity towards farming. This further strengthens a platform for those working in agricultural to communicate to an audience who are interested and keen to hear more.

With consumers feeling more informed about farming, there remains an opportunity to further enhance the role of farmers in telling the story behind the products consumers see on shelves.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: