2022, a year of growth for UK sheep meat trade

Friday, 24 February 2023

The recent release of December trade data by HMRC allows us to look back at the trends that characterised UK lamb trade throughout 2022. For a look ahead at our trade expectations for 2023, read our latest Lamb Market Outlook.

Imports

Trade figures for the final month of the year showed fresh and frozen primary sheep meat imports at 2,400 tonnes (product weight), 13% above November’s volume, but 39% (1,500 tonnes) below December 2021. Lower imports from New Zealand drove the overall decline, continuing the trend from November.

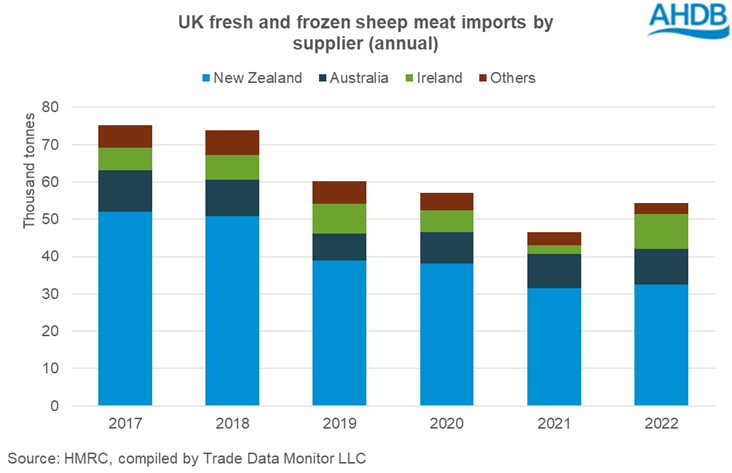

For the full year of 2022, imports reached 54,300 tonnes, up 17% (7,700 tonnes) versus 2021. A 12% increase in the average price of these shipments brought the total value to £342 million, up £81 million year-on-year.

A near four-fold increase in shipments from Ireland was the main driver of growth, with Ireland overtaking Australia as the second largest supplier of sheep meat to the UK in 2022. Monthly data shows that volumes were above 2021 levels all year. Nearly all product categories saw increases, but particularly fresh boneless product.

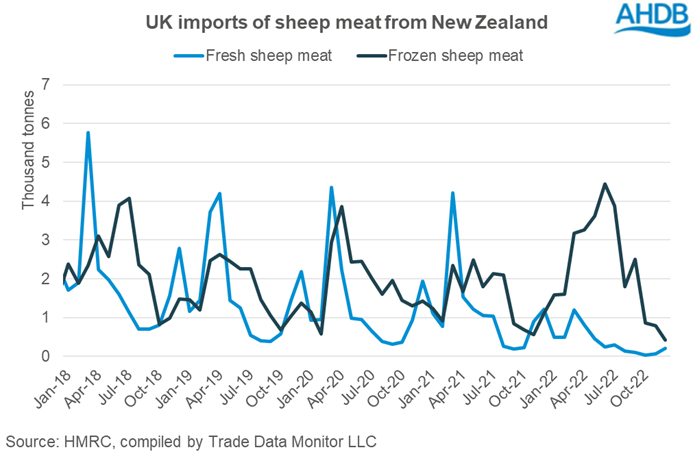

Total volumes from New Zealand remained relatively stable by contrast (+900 tonnes). The majority of sheep meat imported from New Zealand is frozen (as legs), but as has been documented before, in 2022 the product mix of imports showed a more pronounced swing towards frozen and away from fresh. This was particularly noticeable in March-April, when (frozen) imports typically spike to fulfil Easter demand. Total imports from New Zealand did uplift around this time, but not by as much as previous years, with fresh driving the growth. Volumes saw more growth year-on-year through the summer, before falling in the fourth quarter.

Imports of Australian product rose slightly (+6%, +500 tonnes). As with New Zealand, the uplift came predominantly from frozen legs, with growth also in frozen boneless lamb. The growth came particularly in the first half of the year, as trade eased in the second.

Exports

December trade figures showed the typical seasonal uplift in exports from November (+8%, +500 tonnes), with volumes very similar to the same month a year ago (-2%). Exports to France stood-on from November but remained lower year-on-year. This outweighed annual export growth elsewhere during December, including to Germany, Belgium, Ireland and Italy.

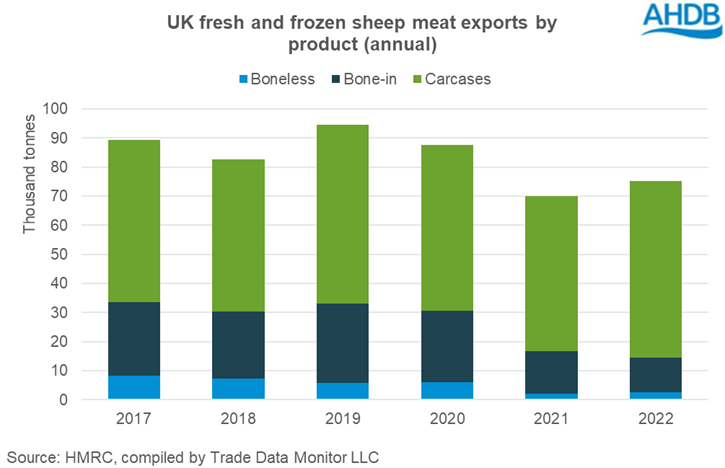

For the full year of 2022, UK exports of fresh and frozen primary sheep meat stood at 75,300 tonnes, up 8% (+5,400 tonnes) versus 2021. A 5% increase in the average price of these shipments contributed to a £56 million annual uplift in value, with the annual total at £494 million.

Overall, shipments to the EU rose 9% (5,800 tonnes) year-on-year, driven in particular by trade to Ireland, Germany and Belgium. Non-EU exports remained a small proportion of total volumes, easing further in 2022, largely driven by lower exports to Hong Kong.

On a product basis, carcases saw the largest uplift in shipped volume, especially in the first half of the year. The proportion of UK sheep meat exports sent as carcases has been increasing for some time, with the category accounting for 81% of exported volumes in 2022. Volumes grew the most to Ireland and Germany, as trade fell year-on-year to France. Shipments of bone-in product fell 18% (2,600 tonnes), while boneless product volumes rose 18% (+400 tonnes).

Exports of sheep offal are relatively small in comparison to fresh and frozen sheep meat but are important for adding value to the carcase. The UK shipped 3,100 tonnes of sheep offal in 2022, up 9% (+300 tonnes) year-on-year but notably less than in previous years. The reliance on the EU for sheep offal trade has generally risen over the last five years, with 94% of shipments going to the EU in 2022, up from an average of 76% for the three years previous. Hong Kong has previously been an important destination for UK sheep offal, but in recent years this trade has diminished.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.