UK lamb exports increase whilst imports ease

Wednesday, 21 December 2022

Imports

Imports of fresh and frozen lamb totalled 2,400 tonnes in October, a 36.9% (1,400 tonne) decrease on September. This decrease is largely due to a seasonal drop in imports from New Zealand.

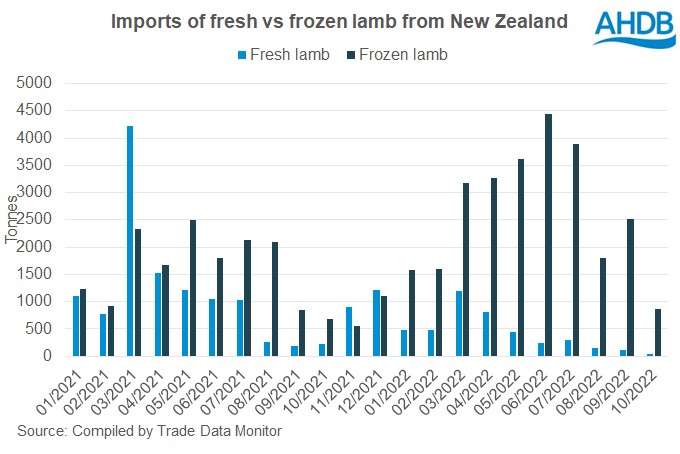

In October, just under 900 tonnes of lamb was imported from New Zealand, which is more than 1,700 tonnes less than the previous month. The drop of imports during the month of October has been seen over the last few years, with imports in 2021 and 2022 averaging 902 tonnes. Shipments were significantly impacted during 2021 due to COVID and container shortages, however, averages for October 2019 and 2020 where considerably higher at 1,540 tonnes.

Products Categories

It appears that the products being imported are continuing to change, with a significant shift towards frozen lamb entering the UK from New Zealand. In October, 95.7% of New Zealand lamb imports were frozen. When compared with the same month last year, just 75.8% of imported lamb was frozen. Historically, yearly averages have ranged between 56 – 63% frozen product from New Zealand, however trends since mid-2022 have shifted towards more than 90% of these imports being frozen. Recent industry talk has focused on risk management potentially driving this change in imported products away from fresh and towards frozen, as delays at sea or ports could create large supply chain disruption. Research is also indicating that there has been pressure on lamb sales over the last 12 weeks, adding additional strain for fresh product categories.

Retail Insights

Frozen lamb currently accounts for 13% of total lamb volumes sold through retail (Kantar, 12 w/e 27 November 2022). With the cost-of-living crisis, there is a broader trend towards cheaper, frozen products. Fresh red meat declined by 4.1% year-on-year whereas frozen red meat only fell by 0.4%.

However, this isn’t the case with lamb as frozen products declined faster than fresh, down 17.9% and 16.9% respectively. While it is much cheaper to buy frozen (£7.54/kg) rather than fresh (£10.81/kg), this doesn’t currently seem to be swaying shoppers towards frozen lamb, highlighting an opportunity for retailers to encourage this tasty, but cheaper, alternative.

Imports from the EU and Ireland in October saw comparatively large increases in imports, up 137% and 291% respectively on a year-to-date basis. While significant increases, both trading partners remain below the levels imported from New Zealand.

Year-to-date, imports are up 24.2% on last year, totalling 49,800 tonnes. New Zealand is still the largest supplier within this time frame, but growth in imports from the EU, Australia and Ireland has been seen.

Exports

UK exports of fresh and frozen lamb totalled almost 6,700 tonnes in October, up 4.4% (297 tonnes) on September, however 3.9% (271 tonnes) down on the same month last year. Export volumes to France saw a 400 tonne (13.9%) increase, whilst Belgium saw a 100 tonne (17.3%) decrease, the greatest reduction seen in any of our regular trade partners.

The EU remains the largest export market, supplied with 6,100 tonnes of fresh and frozen lamb in October. This is a 91.3% market share of UK exports. This is slightly back on 2021, when they accounted for 96.1%.

Fresh, chilled carcases and half carcases remain the largest category in lamb exports. They accounted for 72% total trade in October, with 4,800 tonnes exported. Fresh lamb also accounted for 90.2% (6,000 tonnes) of exports, largely due to the proximity of trade partners and international demand for high quality, fresh British produce.

Year-to-date 60,600 tonnes of fresh and frozen lamb has been exported from the UK, up 10.4% (5,700 tonnes) on the same period last year. Overall, the EU has seen an 11.8% (6,000 tonnes) increase in exports.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.