What will the new UK-India trade deal mean for red meat and dairy?

Monday, 12 May 2025

A UK–India Free Trade Agreement (FTA) was announced on 6 May 2025. In this article we outline what we know about the deal and discuss the implications for red meat and dairy.

Background

The UK Government believes building closer links with India will boost the economy by providing opportunities for exports of goods and services. Forecasts suggest that population and economic growth in India are leading to a surge of Indian middle-class consumers with more disposable income. This means that, by 2030, India is expected to grow to be the third-largest economy in the world (World Economic Outlook, IMF).

Key aspects of the agreement include:

- Tariff reductions – with India agreeing to reduce tariffs on 90% of UK exports and the UK eliminating tariffs on 99% of Indian exports. We are waiting for the detail of how specific agricultural and food products will be impacted

- Maintained food standards – the UK Government has stated that there is nothing in this agreement that will compromise the UK’s high food standards, and imports will still have to meet the same UK food safety and biosecurity standards

- Labour mobility – there are provisions to ease visa regulations for Indian professionals

Current UK–India trade

India takes a protectionist stance to its domestic agriculture industry. As we outlined in our Growth prospects for agri-food exports study there are substantive tariff barriers including a 30% tariff on fresh/frozen beef, lamb and pork. Dairy tariffs are even higher at 42% for milk powders, 40% for butter and 32% on cheese.

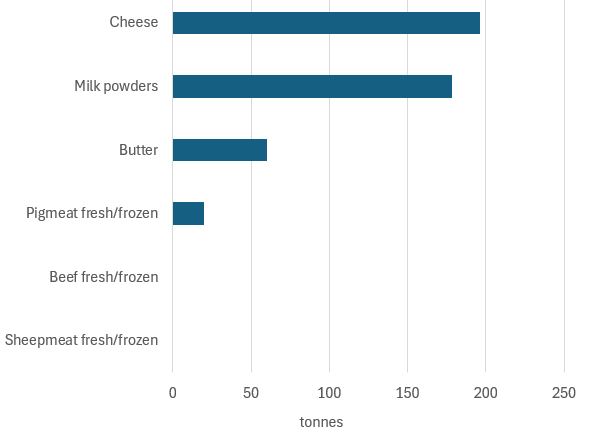

These tariffs restrict trade between the UK and India. Figure 1 shows that current UK exports to India are very small, accounting for just 196 tonnes of cheese, 178 tonnes of milk powders and limited volumes of butter and pork.

Figure 1. Current UK red meat and dairy exports to India (2024)

Source: Trade Data Monitor based on UK HMRC data

Opportunities for UK red meat and dairy

We did not identify India as a ‘best’ or ‘good’ prospects market in our Growth prospects for agri-food exports study, with markets such as China, Japan and the Philippines seen as offering greater potential within the Asia Pacific region. However, this does not mean there aren’t opportunities for the red meat and dairy sectors.

Opportunities in India for red meat and dairy sectors

| Lamb |

Despite the notion that India is mainly a vegetarian country a report by Natarajan and Jacob (2021) highlights that meat eating is common and estimated only 20% of Indians are vegetarian. Specific details regarding tariff reductions on lamb have not been disclosed. Currently there are practical challenges for UK lamb exports, so if the FTA improves market access with substantive tariff reductions, or tariff-free quotas, there is potential for UK exports to grow in the longer term as India’s middle-class population expands. |

|---|---|

| Beef |

India maintains a strict control on beef imports due to religious and cultural reasons. These controls are unlikely to be lifted under the FTA, meaning UK beef exports to India are unlikely to grow. |

| Pork |

Given India's relatively low pork consumption the immediate impact of the FTA on UK pork exports may be limited. However, the agreement could lay the groundwork for improved market access in the future. |

| Dairy |

There could be market opportunity for UK value added dairy products, notably cheese and butter. During the FTA negotiations, the UK aimed to reduce India's dairy tariffs or secure generous tariff rate quotas. However, reports indicate that India excluded duty concessions on dairy from the final agreement to protect its domestic dairy industry. If there is an absence of tariff reductions, UK dairy exporters will continue to face high tariffs when exporting to India. This situation limits the competitiveness of UK dairy products in the Indian market. |

Threats for red meat and dairy

The UK did not import any India products within the red meat and dairy area in 2024.

India is a large producer of dairy products, but the industry has a strong domestic focus. In 2024 only 103,000 tonnes of dairy products were exported, mainly to the Middle East. In context, this level is around 10% of UK dairy exports in the same year (Trade Data Monitor).

India is also a large producer of buffalo meat, with cultural and religious factors limiting the amount of beef production from cattle. In 2024, around 1,100,000 tonnes of buffalo and other bovine meat were exported (UK fresh/frozen beef exports were around 140,000 tonnes in the same year). Key export markets are in Asia and the Middle East.

Next steps

Now that negotiations have concluded, the UK and India will finalise the legal text and produce a legally binding treaty. Following this, the UK’s independent TAC (Trade and Agriculture Commission) will be commissioned to scrutinise the deal. Any legislative changes required to give effect to the FTA will then need to be scrutinised and passed by Parliament before ratification of the agreement can take place.

Conclusions

The UK-India FTA is not a ‘game changer’ for the UK red meat and dairy sectors. The deal does offer some opportunities by improving access to a large and growing market. However, these opportunities are likely to be realised in the longer-term rather than immediately.

We expect the deal will be positive overall, with any threats from India imports into the UK appearing to be very limited.

The full impact of the deal will become clearer once the Government provides more detailed information of exactly how tariffs will be impacted for specific products.

Topics:

Sectors:

Tags: