UK cropping intentions indicate shift back to wheat: Feed market report

Thursday, 3 December 2020

By Megan Hesketh

Cereals

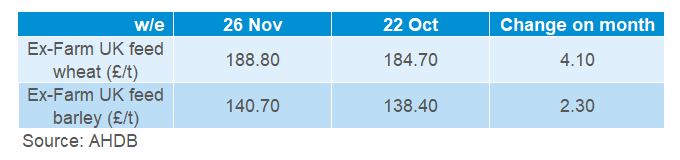

UK ex-farm feed grain prices have gained on the month, with nearby prices quoted at £188.80/t for wheat and £140.70/t for barley, in the week ending 26 November. The UK wheat supply and demand balance is tightest in over 20 years, as such UK prices have been moving up in line with global prices to attract imports.

For global grain markets, international export demand has provided support over the course of November. US wheat export sales in the week ending 19 November exceeded trade expectations of between 200Kt and 450Kt, at 795.7Kt. European wheat prices have benefited from strong export demand, in particular from Chinese buying of French wheat. French wheat shipments are expected to reach 1.6Mt in the first half of the season for 2020/21, in line with total export volumes for 2019/20.

Continued dryness in South America is also supporting global grains prices. Brazil’s first maize crop forecast estimate has been cut by the consultants Safras & Mercado, to 19.1Mt. This new estimate is 18% lower than 2019/20. Another of Brazil’s consultants, Conab, estimate the first maize crop at 26.4Mt (as at 10 November). Brazil produce three maize crops annually. The second (Safrinha) crop is the largest of the three, representing 73% of total Brazilian production in 2019/20.

In Argentina, drought issues have affected production estimates for both wheat and maize. Current estimates peg wheat production at 16.8Mt, down 10.6% from last year, whereas maize production estimate stands as 47Mt, down 8.7% from last year.

The most recent UK supply and demand figures for 2020/21 were published on on 26 November. Total wheat availability is estimated at 14.8Mt, 4.4Mt less than last year (2019/20). This year’s wheat availability is the lowest on record since 1999/2000. The balance of total wheat availability to domestic consumption is estimated at 1.3Mt, a reduction by 3.2Mt from last year.

The AHDB Early Bird Survey suggest a resurgence in the UK wheat area, with planting intentions for the crop up 28.3% from last year, at 1.815Mha. Winter barley planting intentions have increased 24% from last year, whereas spring barley is forecasted to fall by 30% from last year. Total barley acreage is still expected to be ahead of the 2015-2019 average of 1.140Mha, at 1.161Mha.

Proteins

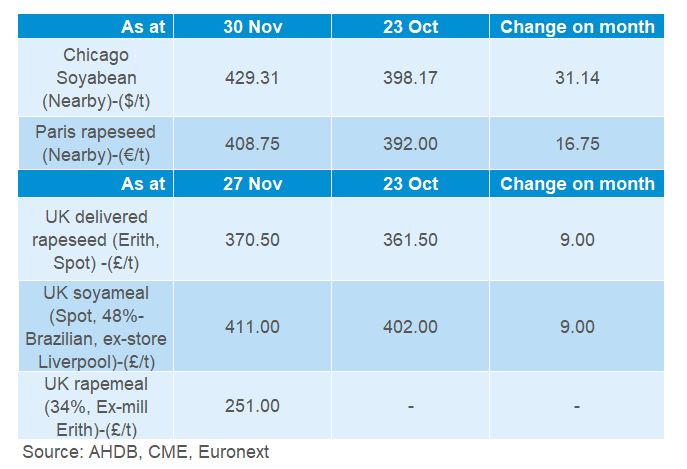

Chicago soyabean and Paris rapeseed futures experienced large price gains on the month. On 30 November, Chicago soyabean futures (nearby) closed at $429.31/t and Paris rapeseed futures (nearby) at €408.75/t, up $41.15/t and €22.75/t respectively on the month (30 October).

UK delivered rapeseed prices (nearby, Erith) also gained on the month, with the spot price increasing by £20.00/t, quoted at £370.50/t on Friday 27 November. UK delivered rapeseed values gained in line with Paris futures. Issues with the crushing facility at Erith had disrupted trade, but the plant is now crushing rapeseed again.

Brazilian 48% protein soyameal (nearby, ex-store Liverpool) prices gained £12.00/t from the end of October, quoted at £411.00/t on the 27 November.

A key driver of oilseeds prices is the continued support for vegetable oils. Firmer demand and tighter supply for rapeseed, sunflower and soya oil are all supporting prices. US export demand for soyabeans from China, has also supported the oilseed complex this season. Chinese demand is strong with the nation looking to rebuild its pig herd.

Going forwards there are some signs that this demand may be curbing. Some small importers and processors have looked to cancel US cargoes for December and January shipment.

Slow planting progress in Argentina has also contributing to climbing soyabean futures prices. But, recent rainfall has allowed planting to progress. In the week ending 26 November, Buenos Aires Grain Exchange reported that planting had progressed by 10.6%. While progress is ahead of last season, it remains 5.3 percentage points behind the five-year average.

In the long term, rapeseed may see continued support from reduced plantings. Planting intentions for harvest 2021 are down 18.1% year-on-year, to 318Kha in the UK, this would be the lowest area since 1986. France and Ukraine are forecast to see planted area declines as reported by my colleague Alex last week.

Currency

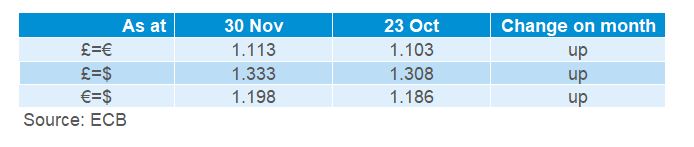

From last month, the pound sterling has seen some fluctuation but has witnessed overall gains against both the euro and dollar. From the 30 October to 30 November, the pound gained 0.4% against the euro and 2.8% against the dollar. This can be mostly attributed to EU exit negotiation progress and the progress of the COVID-19 vaccination.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.