Tightest UK wheat balance in decades leads to end-season deficit: Analyst Insight

Thursday, 26 November 2020

Market Commentary

- UK wheat futures (May-21) closed yesterday at £193.00/t, down £1.00/t from Tuesday’s close. The Nov-21 contract closed down £0.90/t, at £159.60/t.

- Pressure was felt both in Paris and Chicago wheat futures. US traders have taken profit from the recent surge in wheat futures ahead of Thanksgiving. Dec-20 Chicago wheat futures closed at $216.15/t, down $8.45/t.

- Yesterday, Chicago soyabean futures (nearby) closed down $2.66/t, at $435.05/t, falling for the second day in a row. According to Reuters small, private importers and crushers are looking to cancel U.S. soyabean cargoes beyond December. The recent rally in Chicago futures means that crush margins have fallen.

Tightest UK wheat balance in decades leads to end-season deficit

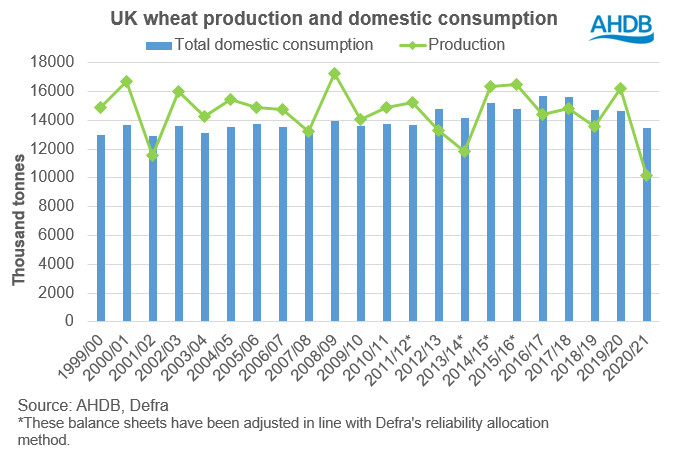

The first official UK cereal and supply and demand estimates for the 2020/21 season were published this morning, including a wheat ‘deficit’ for the first time. Normally when the estimated operating stock requirement is taken away from the balance of supply and demand, a surplus is available for either export or free stock. However, with the wheat balance currently forecast as the tightest in decades, a deficit has been identified, due to many supply and demand factors. These include, but are not limited to, changes in demand later in the season, accuracy of official data and uncertainty around the future of trade after the Brexit transition period.

Tightest wheat balance in decades

Defra have provisionally pegged wheat output for 2020 at the lowest level since 1981, at 10.1Mt. This has outweighed a projected uptick in imports and opening stocks, leading to total availability falling by 23% on the year to 14.8Mt.

Total domestic usage of wheat is also forecast to decline, but by less of an extent (-8%), to 13.4Mt. The fall is driven by reduced demand from the bioethanol, starch and animal feed. This leaves the balance of supply and demand at 1.3Mt, over 3Mt less than last season.

An operating stock requirement of 1.5Mt has been estimated for this season. An operating stocks requirement is an estimate of the minimum tonnage processors require to get through from the start of the next season (1 July) to the point at which ‘new’ crop can be utilised. When the operating stock requirement is taken away from the supply and demand balance, a deficit of 166Kt is identified. Factoring in exports to date, the deficit currently sits at 224Kt.

What’s caused the deficit?

With significantly smaller total availability, it could be assumed that some processors will import more wheat at the start of next season, instead of carrying stocks over. Therefore, the full operating stock requirement is unlikely going to be carried over. This could lead to some volume being taken off the deficit, but not all of the deficit volume can be attributed to this.

All estimates in the balance sheet are made with the best information at that time. We look at historical data, undertake analysis and seek information from key industry stakeholders to build the estimates.

While the current usage estimates are based on the best knowledge we have to date, market sentiments and usage trends could change as the season progresses due to a number of reasons. For example, other feed grains could be used at the expense of wheat later in the season due to price. Again if this was the case, then total domestic consumption of wheat would come down, shrinking the deficit.

Another area which has likely caused this deficit, is the accuracy of official figures. Casting our minds back to last season and we had a significant residual in the end-season 2019/20 balance sheet. As we highlighted at the end of September, some of the large residual identified for wheat could well be attributed to on-farm stocks. The on-farm stocks data had a very large confidence interval. Therefore, opening stocks for 2020/21 could in fact be higher than currently estimated. This would lead to higher availability and widen the balance of supply and demand, shaving more volume off the deficit.

Similarly, we are currently using provisional production estimates, with the final output figure not scheduled to be released until late December. I would be surprised if the production figure was revised much higher, with some in the industry already expressing that the provisional estimate is on the high side.

We also need to throw Brexit uncertainty into the mix. As of yet we only have limited information on what tariffs will be in place post the EU exit transition period.

As of 1 January 2021, we could see milling wheat coming into the UK from the EU being subject to a £79/t tariff. We could also see our exports of grain subject to a tariff too. At the moment there is a lot of uncertainty in the industry around this. If we did get a trade deal with the EU with no tariffs on grain we could see more wheat coming into the UK in the New Year.

Looking ahead

In a season such as this, when we have significantly lower production levels and many uncertainties ahead, the accuracy of the official data and estimates will face more scrutiny. We could see the deficit, which has been identified this early in the season, shrink due to changing supply and demand trends as the season progresses. With uncertainties around COVID-19 and Brexit, cereal usage in the UK will be closely monitored throughout the season.

To view the latest balance sheet for all cereals in full, please click here.

The second official UK cereal supply and demand estimates are scheduled to be published on 25 February 2021. These estimates will include the final Defra production figures for 2020. By this point I would hope there will be a clearer picture of how the UK will trade with the EU going forward.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.