2019/20 – the unbalanced balance sheets: Analyst's Insight

Thursday, 24 September 2020

Market commentary

- London wheat futures (Nov-20) fell £2.00/t from Tuesday’s rally to close at £180.00/t yesterday. By 11:00am (GMT), the contract had fallen a further £1.00/t. The May-21 contract closed yesterday at £181.50/t.

- US maize and soyabean futures (Chicago – nearby) have seen pressure this week from the beginning of both harvests, with 8% and 6% completed respectively so far. This pressure will continue over the next few weeks with favourable weather conditions forecast. A stronger US dollar currency rate has also offered a degree of pressure.

- UK feed barley for export (FOB) was quoted at £143.50/t for October loading. With feed rations reportedly close to limits for barley, a greater focus on barley exports is expected this season.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

2019/20 – the unbalanced balance sheets

The final balance sheets for the 2019/20 season were published today, which include a ‘residual’ for wheat, barley, maize and oats. In theory, at the end of the season, all official data relating to supplies, usage, trade and stocks should lead to a ‘balanced’ balance sheet. However, with a number of the statistics feeding into the balance sheet collected via a survey rather than a full census, there is going to be margins of error, which leads to an imbalance or a residual.

While a certain amount of imbalance is to be expected, the 2019/20 final balance sheets shows a substantial residual for all cereals, driven largely by wheat.

Accuracy of forecasts vs actuals

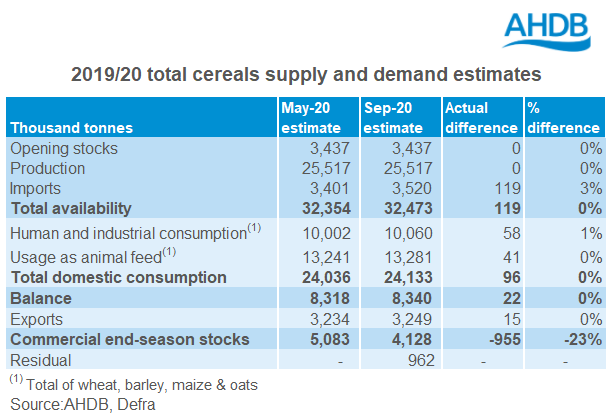

The third official 2019/20 UK cereal supply and demand estimates released back in May, showed higher availability of total cereals outweighing relatively stable demand, leading to larger closing stocks (especially for wheat). When undertaking the preparation for the May balance sheets, including consulting with industry, it wasn’t unrealistic to estimate end-season wheat stocks at circa 3Mt.

As you can see from the table above, the majority of the final estimates for all cereals (which is made up largely of actual survey/ trade data) are relatively in line with that forecast in May, with the exception of end-season stocks and a large residual. 824Kt of the total cereals residual can be attributed to wheat.

Reliability of the figures

The question really arises, in which area of either supply and or demand is there a gap leading to these residuals? This is not really a simple question to answer. There will always be a certain margin of error with any survey, however we can be fairly confident with the reliability of the cereal usage surveys and trade data.

There is obviously the fed on farm (FOF) figure which is not informed by a survey and is based on market information. That said, FOF seems to be a consistent inconsistency throughout each season. It is without a doubt that the large imbalance identified at the end of 2019/20, especially for wheat, does not belong in FOF, especially with the way the market was aligned last season.

The other areas in which there is a question mark around reliability, especially for 2019/20 are the Defra on-farms stocks and production figures.

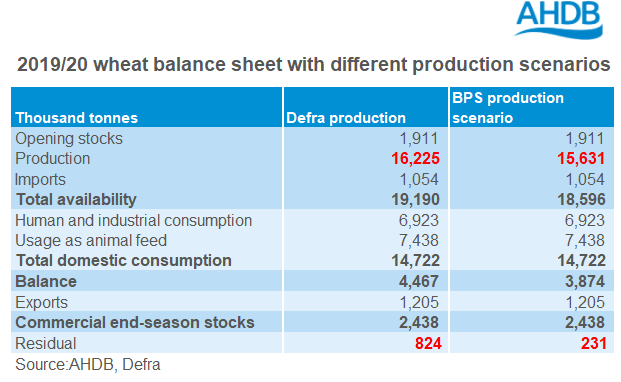

The final 2019 Defra production figure for wheat was estimated at 16.23Mt. However, the actual size of the crop was questioned throughout the season, with many in the industry suggesting the total area and yield figures were too high. This was emphasised more when the Basic Payment Scheme (BPS) area figure was published for England, which was over 3% less than the Defra June survey figure.

If you apply this difference to the Defra area figures for the other UK countries you get a total area figure of 1.76 Mha. If you multiply this area by the average yield from the 2019 ADAS Harvest reports of 8.9 t/ha, you get a production figure of 15.63Mt for wheat in 2019. If this was the actual production figure for 2019, then the residual in the final balance sheets would be closer to 200Kt than 800Kt. It should be noted that there are some differences between the area reported for the Defra June survey and the BPS data. However, a production figure closer to that in the scenario discussed above, would seem more realistic than the official figure published by Defra.

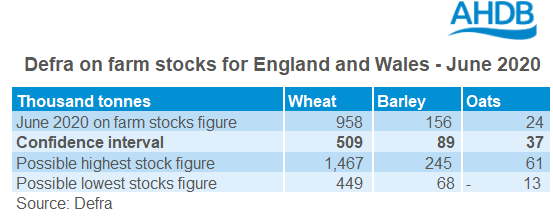

At the end of August Defra published the results of its on farm stocks survey for England and Wales. What came as a shock to me was the significantly large confidence intervals for all grains. We believe the large confidence intervals for this year’s June survey is because of a reduced sample size due to COVID-19.

While this may be the case, the large confidence interval means that the wheat on-farms stocks figure could be over 500Kt more than what has been estimated. A higher on-farm stocks figure combined with a lower production figure could almost eliminate a residual for wheat. Likewise for barley, a lower on-farm stocks figure would see the deficit identified in the balance sheets reduce.

Looking ahead

Arguably, 2020/21 is going to be one of the most uncertain seasons we have seen in a while, where accurate information is going to be key to determine the UK’s position. However, as highlighted above, we could be going into the season with inaccurate opening stocks. Furthermore, the planned Defra June Census in 2020 being replaced by a smaller survey will only put more emphasis on the accuracy of the official production figures, in a year where we could see wheat production at the lowest level in decades.

AHDB are meeting with Defra to discuss in detail the information that is produced to ensure accurate data is provided to the industry and fed into the balance sheets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.