Year to date EU pig meat trade highlights importance of relationship with the UK

Friday, 2 December 2022

Imports

EU imports of fresh and frozen pig meat (including offal) for September totalled 14,100 tonnes, up 1,150 tonnes (8.9%) on August. When compared with last September, imports were up 979 tonnes (7.5%).

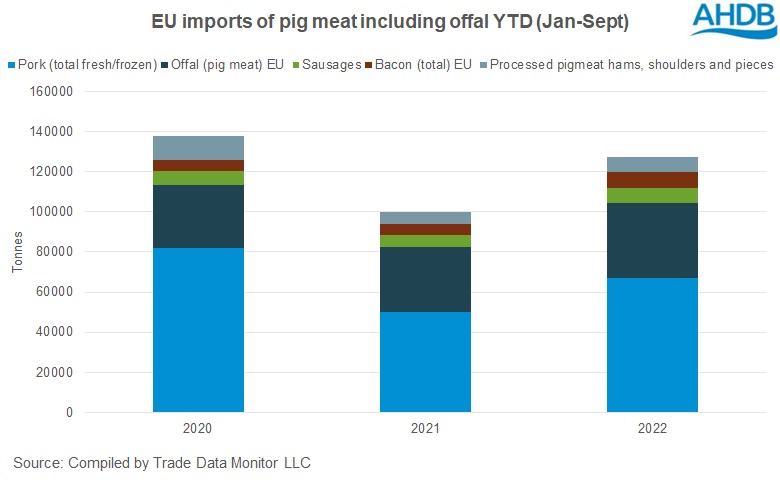

Year to date (Jan-Sept) there has been 127,300 tonnes of fresh and frozen pig meat imported by the EU. This is 27,500 tonnes (27.6%) up on the same period last year.

Increases in imports to the EU were seen across all pig meat products, with bacon seeing the largest percentage growth on a year-to-date basis, up by 44.2% (2,400 tonnes) to 7,800 tonnes. Pork (fresh and frozen) increased by 34.7% to 67,200 tonnes and remains the largest category for imports. Offal imports have risen steadily over the last three years, and currently sit at 37,100 tonnes imported in the year-to-date.

The UK is a significant contributor to the EU market and in the year-to-date has accounted for 81.2% of the market share, supplying the EU with 103,300 tonnes. For reference, Switzerland is the next largest supplier and in the year-to-date has supplied the EU with less than 9,000 tonnes of pig meat.

Increases were seen across all categories of fresh and frozen pork imported from the UK with the uplift in imports accounting for almost the entirety of the increased EU imports seen year-to-date. Research by Aston University indicated that Brexit legislation impacted trade in early 2021, when monthly imports from the UK dropped considerably, however the market continues to return towards earlier trading trends in a year-on-year uplift, albeit at a slight decrease compared with 2020.

Exports

September saw 415,600 tonnes of fresh and frozen pig meat (including offal) exported from the EU. Month-on-month, exports saw a slight increase, up 11,600 tonnes (2.9%) on August, however, when compared with the same month last year there has been a decrease of 13,900 tonnes (3.2%).

Year-to-date, 3.64 million tonnes of fresh and frozen pig meat (including offal) has been exported from the EU, a decrease of 743,100 tonnes (17%) on the same period last year. Within this decrease, pork and offal were most affected, down 665,800 tonnes (23.5%) and 100,700 tonnes (9.6%) respectively, whilst sausages, bacon and processed pig meats all saw slight increases.

The EU’s largest export partner is China. Year-to-date, exports to China have totalled 1.07 million tonnes, a decrease of 1 million tonnes (48.4%) compared with last year. The largest decrease was seen in fresh and frozen pork, back 888,000 tonnes (59.6%), followed by a decrease in offal by 114,500 tonnes (19.7%) on 2021 levels. The EU short term outlook was forecasting that exports would decrease overall by 17% in 2022, with further reduction seen into 2023 largely due to decreased demand by China due to recovery of their domestic pig herd. Currently, this appears to be an accurate assumption.

After China, the UK is the second largest export market for the EU. Year-to-date, exports to the UK have totalled 589,900 tonnes, back 2,400 tonnes (0.4%) on 2021. Fresh and frozen pork made up the majority, with 230,700 tonnes entering the UK. Like China, these exports are at a lower level than last year, down 5.4% (13,100 tonnes), however processed pigmeat and bacon have seen uplifts.

Southeast Asian countries (the Philippines, Japan and South Korea) are the next largest export markets. Although at much lower total volumes than China and the UK, they are all showing positive growth year to date. This contributes an additional 225,000 tonnes of exported product when compared to 2021.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.