With commodity prices boosted what are the prospects for UK dairy?

Thursday, 27 June 2024

After some stalls and uncertainty dairy markets are entering an exciting period with the tide progressively turning towards higher prices. What is driving this and will it continue?

The Spring’s (and Autumn and Winter’s) endlessly wet weather did more than dampen spirits. It damaged prospects for turnout, grass growth and ground work meaning the milk season got off to a very slow start with the spring flush being muted to non-existent with volumes back by 1.5%. Global production has also been on a downturn and dropped by 0.5% in April.

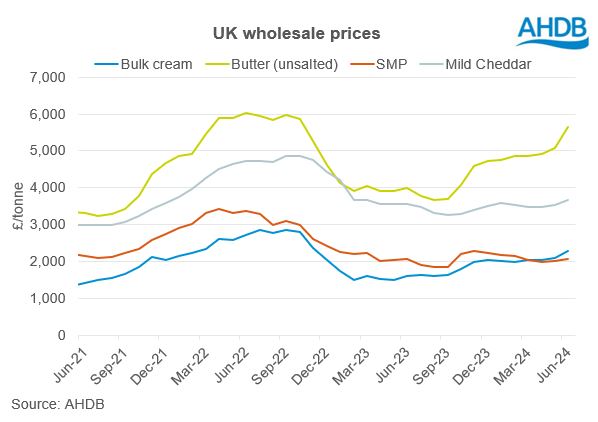

Shortages of milk have sparked fears for buyers who have finally stopped sitting on their hands and started buying, particularly fats. Latest commodity prices indicate butter is up a significant £580/t, bulk cream £190/t, mild cheddar £130/t with SMP lagging at only £50/t growth. This has boosted both AMPE by 3.5ppl and MCVE by 1.8ppl in a single month. Not quite the heady 5.6ppl growth in AMPE we saw in the volatile days of March 2022 but still impressive.

AMPE is The Actual Milk Price Equivalent and is an indicator of the factory gate value of a litre of milk which goes into Butter and SMP. MCVE is The Milk for Cheese Value Equivalent and is an indicator of the factory gate value of a litre of milk which goes into mild cheddar and whey powder/butter.

The question is how long will this continue?

Supply is tightening but demand will play a role. Chinese demand continues to disappoint due to increased domestic production with dairy import volumes back by 12% in Q1 leaving a lot of displaced NZ product on the market to service new markets.

UK retail demand is healthy for both cheese and yogurt, according to Nielsen, seeing uplifts of 5 and 12% respectively (Source: NIQ Homescan Panel 12we 18 May 2024). Butter is still back based on cost of living pressures.

Supply wise, our latest milk production forecast is back by 1.0% for the 2024/25 milk year which should offer further support to farmgate prices. However, supply and demand are finely balanced and the market situation will benefit from increased global demand to keep prices heading north.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: