- Home

- News

- Dairy June forecast update: GB milk production for 2024/25 to slow due to challenging early season weather

Dairy June forecast update: GB milk production for 2024/25 to slow due to challenging early season weather

Thursday, 20 June 2024

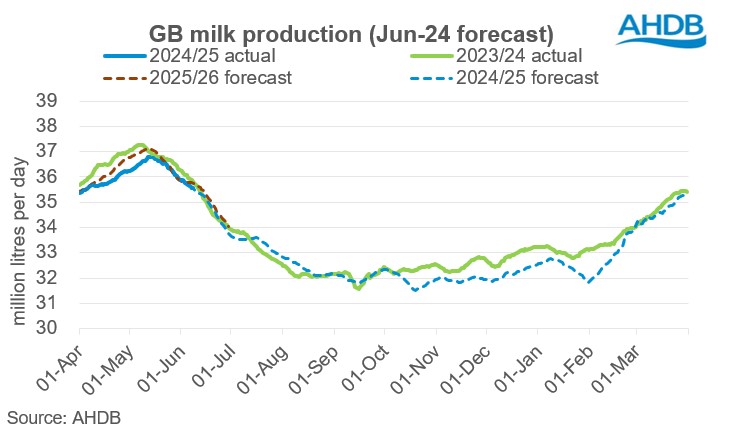

GB milk production for the 2024/25 season is forecast to reach 12.20 bn litres, 1.0% less than the previous milk year, according to our June forecast update

The milk year to date has run behind last year’s production due to the challenging amount of rain from Autumn 2023 through until Spring. The overall milking herd size remains stable but yields per cow have fallen. We have therefore revised expectations for the rest of the year downwards. This is estimated to be 48mn litres lower than our March forecast.

Deliveries in the first two months of the current milk year (April and May) totalled 2,205mn litres, which is 33m litres, or 1.5%, lower compared with last year. We are expecting production to be slightly higher in July and August compared to the previous year following good grass growth recently and positive prices announcements in June and July. Last June was exceptional in terms of high temperatures and drought conditions causing heat stress in cows and poor grass growth. For the remainder of the season, the decline in production is expected to continue, unless prices move more radically northwards.

The exceptionally wet Autumn, Winter and Spring caused issues with farmers being able to turnout their cows, poaching and damage to fields where cows did get out and ability to conduct groundwork on fields such as fertilising and weed control. Grass growth was behind the curve until the last month or so. As a result of the weather and damage caused to the ground, yield growth levels are likely to be below 1% compared to the normal levels of 2-3% during period of favourable weather.

The size of the GB milking herd remains flat year on year in April, which stood at 1.64 million head according to the latest BCMS data. Despite lower farmgate milk prices, farmers have maintained cow numbers and the decline in milk production is primarily due to lower yield levels. Going forward yield growth will be determined by grass growth during the summer months and availability of forage quality later in the year.

Milk prices are lower than last year, the average Defra figure sat at 37.21ppl (UK average farmgate price) for Apr-24. Recent positive price announcements for June and July will provide short-term impetus for milk production. However sustainability of price rises will depend on demand, which is more uncertain with a rise in short-term demand possibly tempered by continuing decline of import demand from China. Input cost inflation has eased in recent months, however costs remain at historically higher levels and any increase in feed costs could temper positive sentiment.

Farm margins could be under pressure later in the year dependent on forage availability and increasing feed costs. First round of silage cut has been done and ground preparations are going on for second round. The damage caused to the ground following wet weather could affect silage quality. It is likely that straw costs will increase due to a lower planted arable area this year. All these factors of higher production costs, lower yield levels and uncertainties in weather will continue to weigh on production during the season.

Improvements in demand and tight supplies are helping to balance the market to a certain extent. Latest wholesale prices would indicate milk prices should move in a positive direction, but the extent of recovery is uncertain and will depend on recovery in the global market. According to the latest report from Rabobank, China’s dairy imports in 2024 are expected to fall by 8% compared to previous year. China is one of the major drivers of the global dairy market. A slow start to the season and damage done to the ground will cause limitations through the 2024/25 season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.