Where next for GB cattle prices?

Friday, 3 March 2023

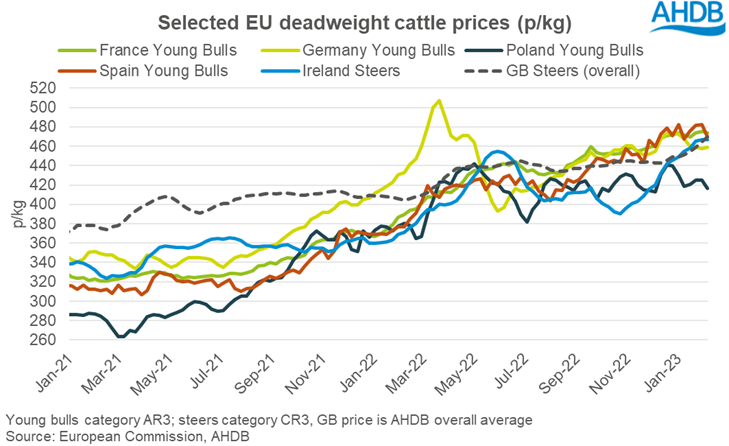

GB deadweight cattle prices have shown remarkable strength so far in 2023, with prime cattle and cull cows posting weekly gains since the start of the year. In the week ending 25 February, the GB overall average steer price reached 480p/kg, up 71p from the same week a year ago. At the same time, the overall deadweight cow measure averaged 379p/kg, up 80p year-on-year.

The price rises come despite pressures on retail and consumer spending, linked to higher cost of living and price inflation. So, what other factors are at play?

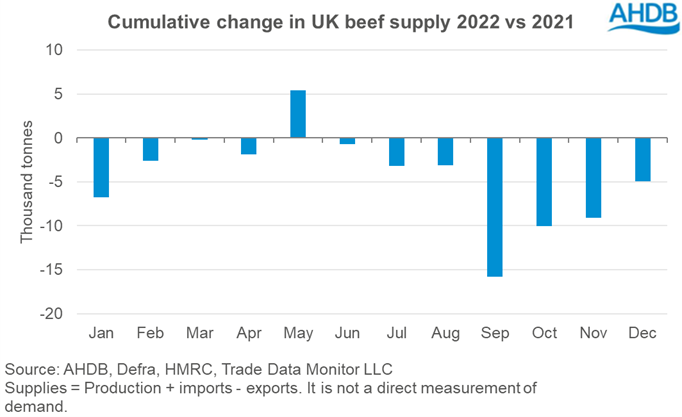

The UK beef market came into 2023 following a tighter supply situation in 2022, keeping prices elevated. A slight uplift in production, balanced with relatively stable imports and growth in exports pointed to lower available beef supplies for consumption during the year. This was particularly prevalent during the third quarter. Supplies grew in the fourth quarter as cattle slaughter rose ahead of Christmas and winter housing, but firm demand kept prices high.

Cattle markets are generally described as “tighter” the world over currently, particularly in the northern hemisphere where prices are being supported. Starting closer to home, Ireland is expecting lower cattle kill in 2023 – particularly in the spring – driven by declines in breeding herds. Weekly throughput insight from Bord Bia suggests that slaughter numbers are starting to go short versus a year ago, with processors competing fiercely for cattle. Indeed, Irish cattle prices have rallied since November, spurred by anticipated supply tightness.

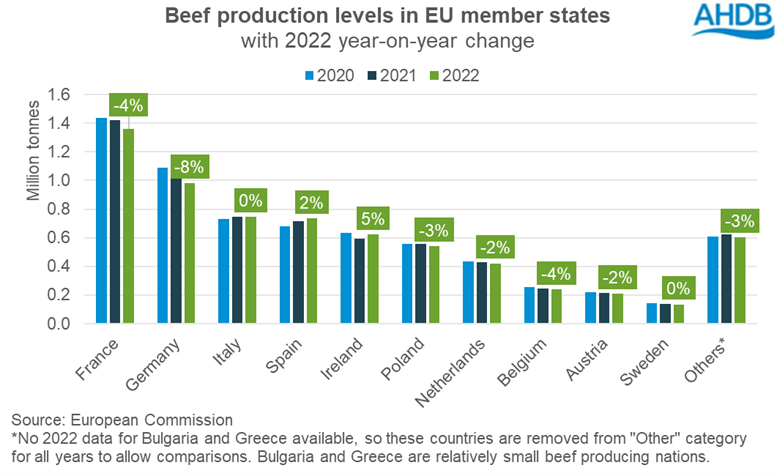

On the continent, a similar story is expected to play out for production levels in 2023. Output fell from several of the key producing countries in 2022, including France and Germany, off the back of reduced breeding herds. Industry forecasts expect this trend to continue in 2023, with total production for the bloc expected to fall by between 0.5-0.7%.

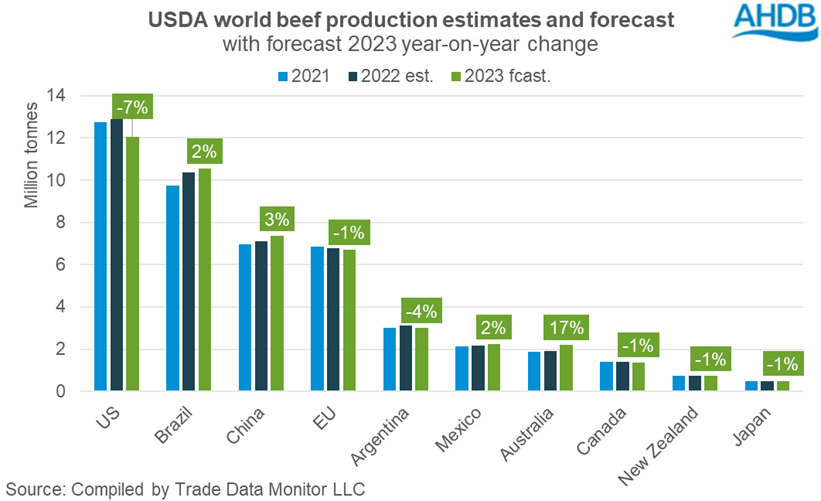

Further afield, beef markets globally are also anticipated to remain tighter during the coming year. US production is expected to be hit particularly hard, following drought pressures and destocking over the past year. This is expected to outweigh growth in production in Brazil and Australia.

Such trends would suggest that underlying support for cattle prices generally will remain in 2023. A relatively weak outlook for sterling could also be beneficial for beef trade flows.

However, we must consider the other end of the market – demand. Our latest outlook points to lower UK domestic consumption in 2023, driven by inflationary-related cutbacks in spending. Cheaper cuts are expected to be favoured by consumers, and so how the value of the carcase is balanced with marketing of more premium cuts will be key to farmgate returns. Elsewhere, EU consumers have also not escaped the challenges presented by cost-of-living pressures.

As we head into March cattle prices continue to rally, with live sales also seeing record returns. Reports of beef stocks in store running tight supports a momentum in this trend. How consumers have responded to the current economic challenges through February is the next piece of the puzzle. Kantar data for February is due imminently - importantly covering Valentine’s Day - which will allow us to explore how trends in domestic consumption are impacting this tight market.

In the meantime, you can find latest consumption figures below:

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.