What will happen with dairy markets in 2020?

Thursday, 9 January 2020

By Chris Gooderham

Despite the uncertainty in 2019, the market value of milk in the UK was the most stable it’s been for a decade. But as we enter the next decade, how long will that stability last? We take a look at the key dynamics that are playing out in the dairy markets at the moment.

Globally:

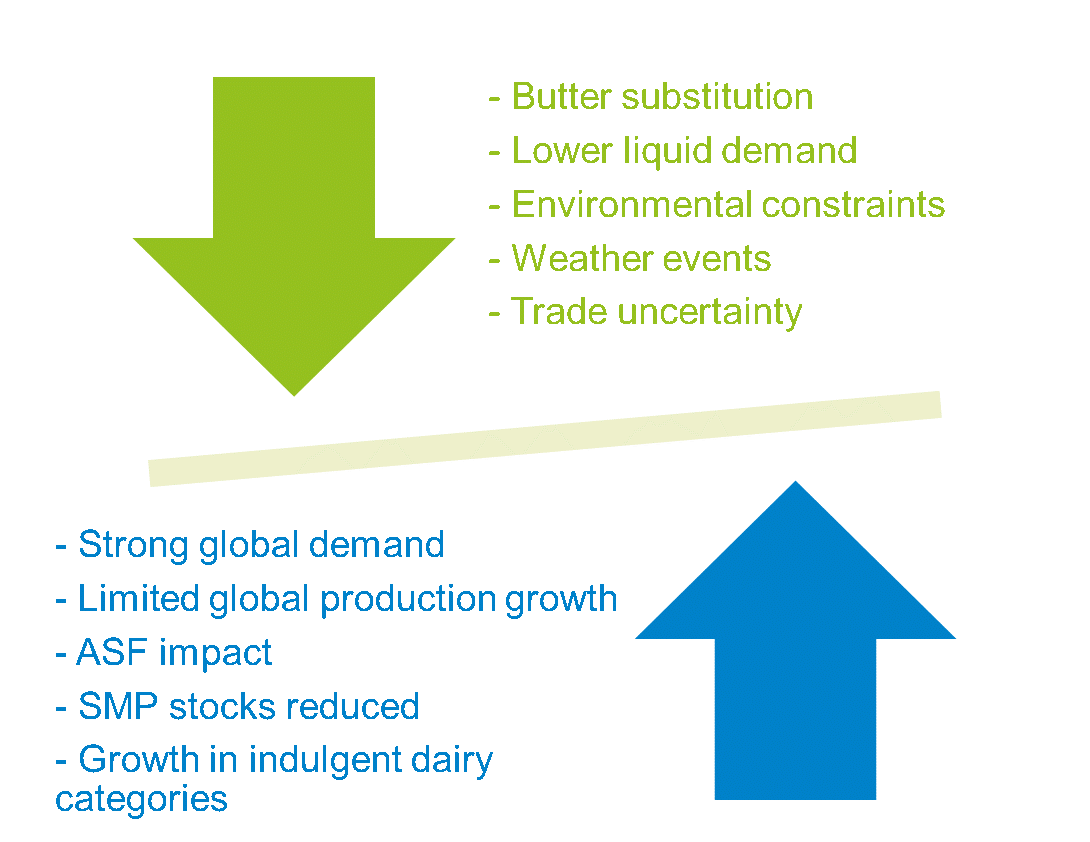

- Global milk production is set to grow by just 1% in 2020. The majority of the additional milk is expected to come from the US and EU. Australian production has been declining as it struggles with impacts of record high temperatures and drought, and the recent widespread bush fires. Growth in New Zealand production is expected to be relatively flat.

- Global dairy demand is forecast to rise by 2.1% for fresh product and 1.5% per annum for processed products, according to the latest FAO-OECD predictions. Demand may however be impacted by a slowdown in economic growth over the coming year, particularly from the oil rich countries who are large importers of dairy.

- The increased frequency of trade wars presents a risk to the smooth flow of goods, potentially increasing the cost of trade and lowering prices.

- African Swine Fever (ASF) continues to dominate protein demand globally. Chinese consumers are looking to replace lost pork meat, which will continue to support demand for alternative protein sources. The one exception is whey demand which has suffered from the smaller pig herd in China.

- The modest growth in milk production compared with demand means global commodity prices are expected to remain firm, at least for the first half of 2020.

- While public SMP intervention stocks cleared some time ago, some of this product initially went to private stocks. Over the last year we have seen SMP prices gradually increase as those private stocks are sold. With the additional demand for protein from ASF, and intervention stocks gone, we would expect to see further upward pressure on SMP prices.

- For butter, prices are still being held back slightly by the overhang of prices in 2017 and 2018. Following those peaks, some food manufacturers reformulated their products to reduce the reliance on butter prices. However, it’s worth noting that global butter prices are currently sitting below the average for the last 5 years, so comparatively speaking butter is not expensive.

Domestically:

- According to Kantar the dairy market is having a challenging time with volumes down 1.2% as some shoppers buy less per trip (52 w/e 1st Dec 19). Performance varies across categories, with declines in the volume of fromage frais, yoghurt and fresh milk sales, while more indulgent dairy categories, like cheese, continue to see volume growth.

- The pressure on margins for liquid milk manufacturers has resulted in the loss of one liquid processor and financial pressure on others. We already know some farmers will be losing their liquid milk contracts in 2020, but further changes can be expected as the industry adjusts to lower cream returns and changes in domestic consumption.

- Our milk production forecast for 2019/20 is the highest for 29 years. Spring 2020 volumes are expected to be slightly lower than 2019, but the full year looks set to reach similar levels to 2019, weather permitting.

- Currently, wholesale markets are relatively stable, and our milk market value indicator suggests there is no downward pressure from the markets on milk prices through to March. However, high milk quality and seasonal bonuses have been boosting average milk cheques through the autumn, and both of those will reduce as we move into the New Year.

- Brexit is now looking more certain, although there is still uncertainty over what the final trade relationship will look like. Exchange rate risk and general trade disruption remain a concern and that uncertainty is likely to make the whole supply chain more risk adverse.

2020 will be the start of a new era for the dairy industry, with many challenges and opportunities already starting to develop. Extreme weather events will likely become more frequent and continue to impact production, while environmental concerns will increasingly drive consumer decisions around food choices.

Changes will need to be made to food supply chains to meet the Government’s pledge to be net zero by 2050, and we can expect to see both political and consumer pressure on food producers to help the country meet this challenge.

We will also see the implementation of measures by some milk processors to ban the euthanising of healthy bull calves on farm. This has implications for breeding and inseminations decisions, production costs and the beef supply chain. It could also impact milk production levels further down the line.

As we exit from the EU, the UK supply chain will need to reassess its view of demand from consumers both domestically and internationally. This may require an adjustment in milk utilisation to ensure we are producing the right products for the right consumers. As the proportion of milk used for manufactured products increases, compared with the liquid market, the importance of milk solids will become ever more evident.

This reassessment also gives the industry an opportunity to decide what information it needs to compete, while giving the right level of transparency for everyone in the supply chain to support decision making in the uncertain years ahead.

Our Dairy Markets Weekly publication will continue to keep you informed about the key factors influencing the market. Ensure you are on the subscription list by managing your preferences.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.