UK pig meat trade: China drives export volume growth in Q1 2025

Wednesday, 28 May 2025

Key points

- UK pig meat exports have grown 4% year-on-year in Q1 2025 driven by increased shipments of offal as well as fresh and frozen pork to China

- Imports of pig meat into the UK have declined by 1% year-on-year in Q1 2025 driven by smaller volumes of processed pig meat and sausages

- The FMD outbreak in Germany has resulted in a changing supply base within the EU27

Exports

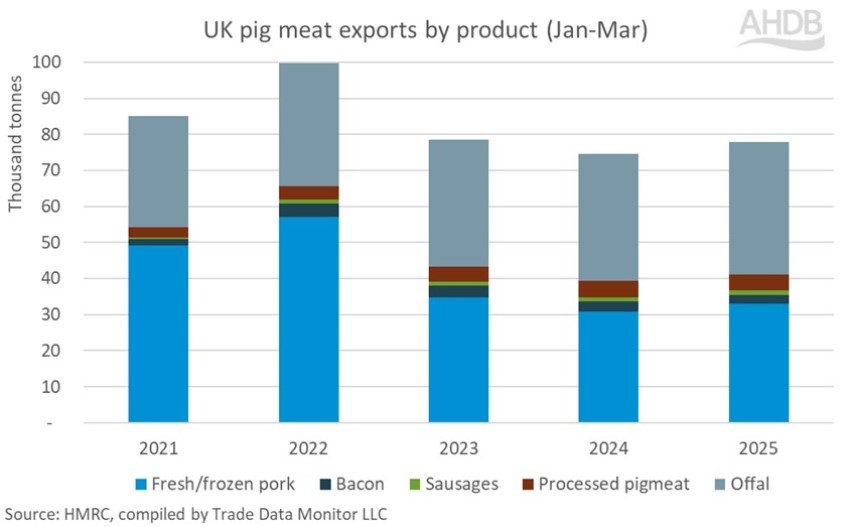

UK exports of pig meat totalled 77,800 tonnes in the first three months of 2025, an increase of 4% year-on-year (YoY). All product categories except bacon recorded volume growth.

Shipments of offal remain the largest contributor to the export basket at 36,700 t (47%), with the majority of this product (22,100 t) sent to China. Despite volumes to China increasing by over 3,000 t (18%), overall category growth was more muted (4%) as shipments to the Philippines fell by over 1,000 t (26%)

Fresh and frozen pork exports grew YoY for the first time since 2022, up 2,000 t to 32,900 t in Q1. Although the EU27 is the main destination for this product (48%), growth in the category was driven by increased shipments to China.

Exports of bacon have been steadily declining for the last couple of years, with Q1 2025 volumes back 5% compared to the same period last year. 97% of this product goes to the EU27 with the decline driven by Ireland and Germany. On the contrary shipments of processed pig meat have been picking up (1%), with Ireland the key destination.

Imports

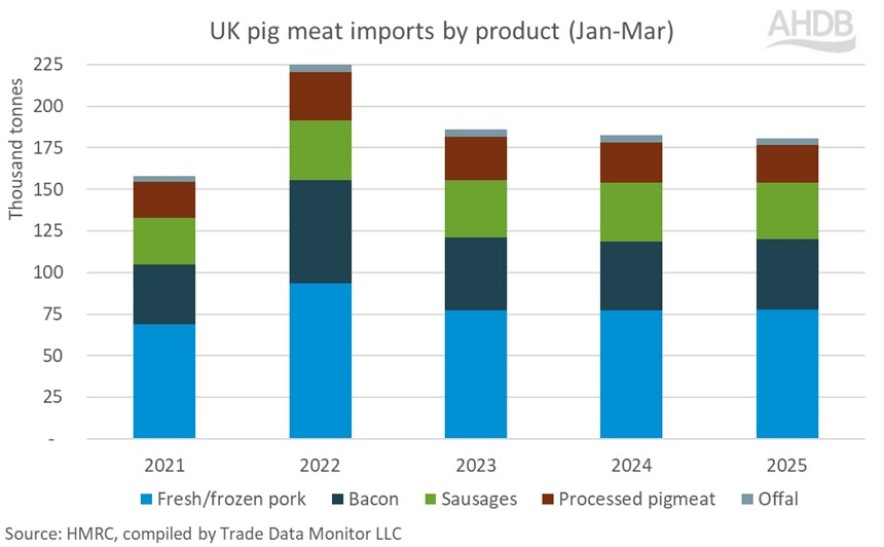

In the first three month of 2025 the UK has imported 180,500 tonnes of pig meat, a small decline of 1% (1,800 t) compared to the same period last year.

Bacon was the only category to record growth YoY, up 3% to 42,600 t, while fresh and frozen pork held steady at 77,500 t, continuing to hold the largest market share (43%). However, declines in processed pig meat and sausages of 1,300 t each drove the overall trend.

Impact of FMD in Europe

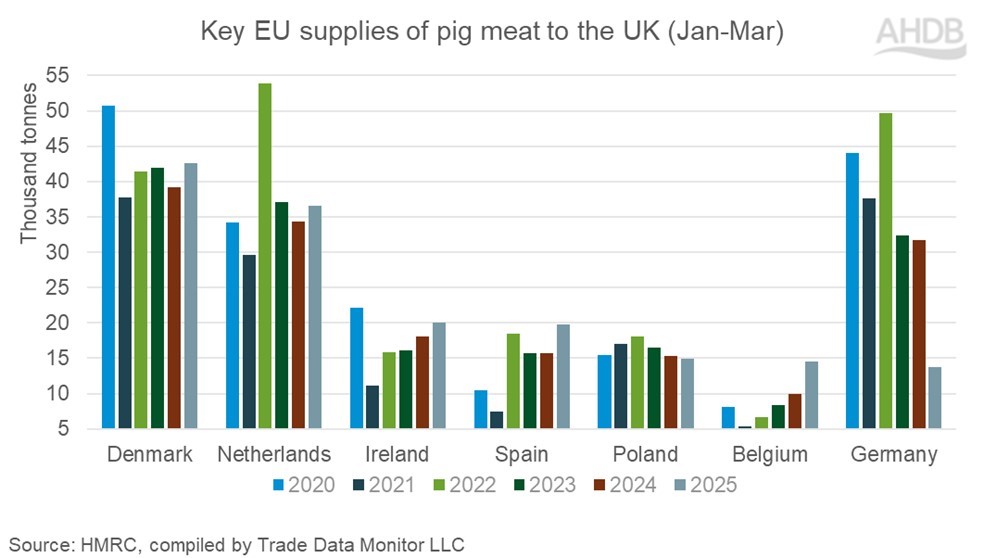

The confirmation of foot-and-mouth disease (FMD) in Germany on 10 January initially had a significant impact on trade flows. The UK saw significant YoY decline in both imports (-8%) and exports (-13%) of pig meat that month as Germany lost its export licence to the UK, resulting in more product availability within the European market and additional pressure on pig prices. However, trade volumes in February and March picked up as supply chains adapted to the new supply base.

The EU27 accounts for over 99% of pig meat imports to the UK. Over the last five years (2020-2024) Germany has been constantly in the top three trade partners, with Q1 shipments averaging 39,100 t. This is a stark contrast compared to 2025, where Q1 volume reached just 13,800 t, placing Germany as the UK’s seventh largest supplier.

Changing supply bases have meant significant volume increases from other key trading partners. Belgium, Spain and Denmark have seen volumes up 4,500 t, 4,200 t and 3,300 t on the year respectively, while the Netherlands and Ireland have recorded an increase of around 2,000 t each.

Germany was granted regionalisation by the UK government on 24 March, allowing trade from outside the containment zone to resume. As of 14 May, Germany is recognised as FMD free without vaccination by the UK, meaning all trade restrictions associated with the disease have been formally removed.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.