- Home

- News

- UK dairy product availability Q3 2023: Powder supplies shrink as huge boost to exports in Africa and the Middle East

UK dairy product availability Q3 2023: Powder supplies shrink as huge boost to exports in Africa and the Middle East

Wednesday, 10 January 2024

Key trends

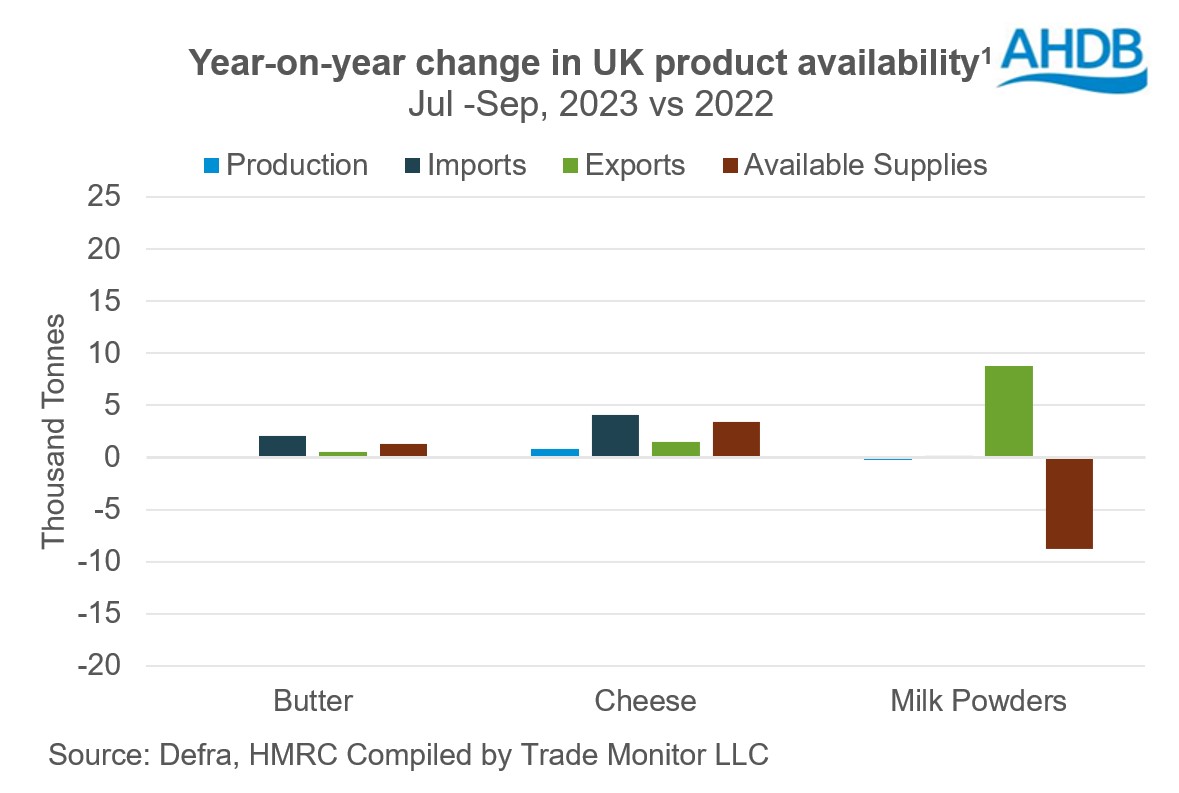

- Available supplies of cheese and butter increased while that of milk powders plummeted.

- Good demand from Africa and the Middle East drove exports higher.

- Lower prices in UK have made exports attractive across the board.

The availability* of manufactured dairy products remained mixed in the third quarter of 2023 compared to the same period previous year. UK milk deliveries in the third quarter of 2023 (Jul–Sep) increased modestly, by 0.2% at 3,574m litres year-on-year. However, in the first eight months of the milk year (Apr–Nov), milk deliveries have declined (0.4%) to 9,916m litres year-on-year. This could impact dairy product availability in the coming months.

Looking at the latest available data (Q3 2023), with production roughly consistent year-on-year, trade had an important role to play in determining dairy product availability in the market. Good demand during the summer holidays boosted demand on the continent and also in the global market.

Powders

Milk powders were the hero product, with available supplies trending lower. Exports increased by an impressive 48.3% (9,000 tonnes) and this drew the available supplies lower by 86.5%. Good demand from Africa and the Middle-East drove exports. Production overall declined by 0.9% year-on-year and imports increased by 2.1% to 8,000 tonnes.

Cheese

Cheese exports increased by 2,000 tonnes (3.6%) year-on-year, and imports also increased further, by 4,000 tonnes (4.0%). With production recording an increase of 1,000 tonnes during the period, available supplies increased by 1.8%.

Butter

Butter exports stayed stable and production remained on par with last year. Imports increased by 2,000 tonnes (14.7%) and therefore available supplies increased by 1,000 tonnes. (2.7%)

*product availability is defined as: production + imports – exports

Rabobank expects milk supply growth to be sluggish in 2024 in most export regions, tightening supplies. Demand will also be an important driver in the market through 2024. Although the overall macro-economic scenario remains gloomy amidst ongoing geopolitical instability and the cost of living crisis, the return of China into the market will be an interesting factor to watch for. China had been quiet for some time and it is expected to start some buying activities ahead of the Chinese New Year. There are also some signs that UK retail sales are beginning to pick up again.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.