The half way point of 2023/24: Grain market daily

Friday, 22 December 2023

Market commentary

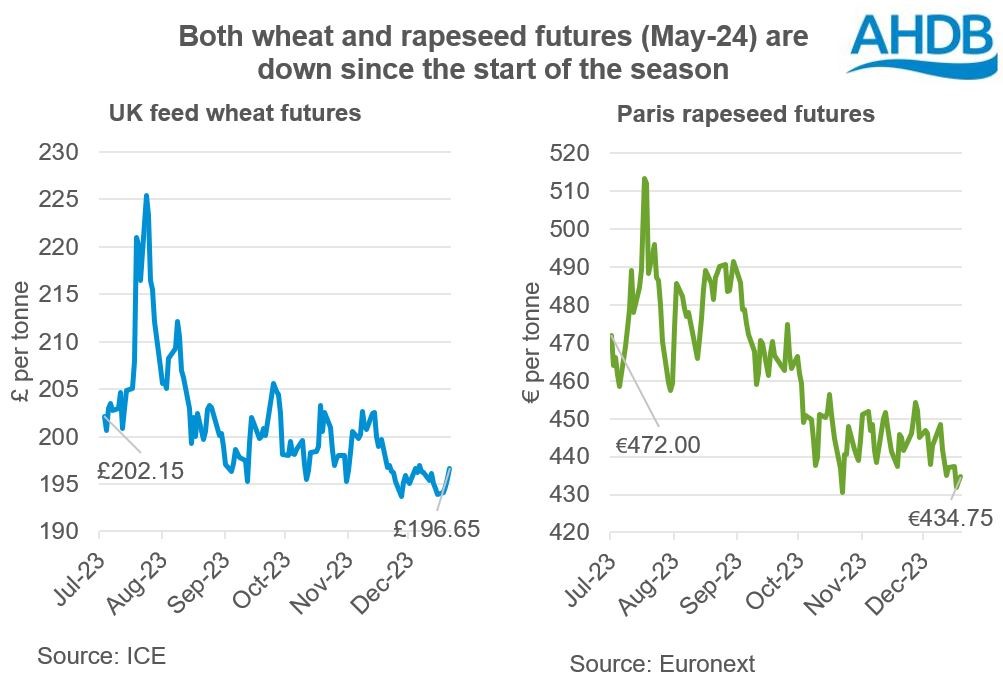

- May-24 UK feed wheat futures rose £1.05/t yesterday to close at £196.65/t following a rise in Chicago futures. Chicago wheat futures were stronger due to technical buying activity after prices fell on Wednesday. New crop UK feed wheat (Nov-24) futures rose by a lesser amount of £0.35/t over the same period, to close at £208.50/t.

- May-24 Paris rapeseed futures gained €1.25/t yesterday to close at €434.75/t (approx. £377.50/t). The new crop (Nov-24) futures contract closed at €439.50/t (approx. £381.50/t), up €0.25/t from Wednesday’s close. The rise came despite Chicago soyabean futures edging lower due to forecast rain in Brazil, which should support prospects for developing soyabean crops.

- German farmers planted just 2.61 Mha with winter wheat for harvest 2024, according to the German statistics agency (Destatis) this morning. This is down 7.3% from harvest 2023 and the lowest since 1999 due wet weather this autumn. The winter rapeseed area is also down 4.7% to 1.11 Mha, though the winter barley area is up 2.5% at 1.32 Mha.

The half way point of 2023/24

Over the first half of the 2023/24 marketing season, more confidence in global supplies has brought down prices, but what could the second half of the season have in store?

As our Grain Market Outlook conference highlighted last month, there is more confidence in global supplies this marketing season (2023/24), with surpluses for both grains and oilseeds. The continued flow of grain from the Black Sea region, despite the ongoing conflict, also contributed to the greater confidence in supplies. This increased confidence has pressured prices. Between 3 July and 21 December, May-24 UK feed wheat futures are down 3%, while May-24 Paris rapeseed futures are down 8%.

However, more recently global prices have drifted sideways due to uncertainty over the size of the Brazilian maize and soyabean crops. Uneven rainfall and high temperatures delayed soyabean planting and hampered crop growth. The delays to the soyabean crop will likely delay planting of the Safrinha maize crop, which follows the soyabean harvest. The size of these crops is the key factor for both grain and oilseed markets in early 2024.

In the past few weeks, forecasters have trimmed their expectations. Earlier this week, private forecaster Céleres projected the soyabean crop at 156.5 Mt, which is 4.5 Mt below the latest USDA forecast of 161.0 Mt. But, while cuts of this size would reduce the expected global surplus of 14.9 Mt, (assuming no other changes), it would not be enough to overturn it.

So far, the forecasts show a similar situation for maize. Although, the margin for tipping the global grain market from surplus to deficit is smaller than soyabeans, at 8.9 Mt.

Where next?

If the Brazilian crops shrink further, it could well tighten global supplies and support prices. However, unless that happens, the outlook for both grains and oilseeds in early 2024 remains more bearish than bullish.

Beyond the early months of 2024, the outlook will increasingly be influenced by prospects for the 2024/25 crops. It seems likely that European wheat and rapeseed plantings will fall for harvest 2024, with lower areas in top producers France and Germany (see above) due to wet weather. This could provide some support for European wheat and rapeseed prices, relative to the wider grain and oilseed markets.

However, there are multiple key aspects that we’ll need more insight into to fully understand the outlook for global grain and oilseed markets in 2024/25. These include US maize and soyabean, Russian and South American crop areas. These crops will have considerable bearing the overall market direction, along with any macro-political events and conflict developments.

Closer to home, the market is again focused on grain imports both this season, and likely next too. This is due to the lower quality and size of the 2023 crop, along with the wet weather reducing winter planting intentions for harvest 2024. As a result, UK prices for both old and new crop have risen relative to global prices. With our market already close to or at import parity, most future price direction will again come from the global outlook, rather than our relationship to the global market.

Key dates to look out for in early 2024:

- Brazilian production forecasts (Conab): 4 January

- US winter wheat and canola area, plus global supply and demand forecasts (USDA): 12 January

- UK supply and demand forecasts (AHDB): 25 January

- US spring crop planting intentions (USDA): 28 March

We’ll also get the first projections of global supply and demand in 2024/25. The International Grains Council usually releases its first projections in its April report, (scheduled for 18 April). The USDA’s first global supply and demand forecasts for 2024/25 are due on 10 May 2024.

This is the last Grain Market Daily of 2023. The first AHDB Market Report of 2024 will be on 2 January, with the first Grain Market Daily of 2024 on 3 January. We wish you a very merry Christmas and a happy and prosperous 2024.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.