Analyst Insight: UK old crop prices helped by new crop worries

Thursday, 30 November 2023

Market commentary

- Global grain and oilseed markets mostly rose yesterday, supported by ongoing concerns about the weather in Brazil, and its potential impacts on maize and soyabean production. The rise in prices also triggered by short covering by speculative traders in Chicago wheat, which in turn may have added to the price rises. Speculative traders have been holding sizeable net-shorts in Chicago wheat and maize futures.

- May-24 UK feed wheat futures gained £0.65/t yesterday to close at £195.85/t, while the Nov-24 contract rose £1.15/t to close at £208.05/t.

- May-24 Paris rapeseed futures rose €4.50/t to €454.25/t, while the Nov-24 contract gained €2.50/t to €457.25/t.

- Data on cereals usage in October by the GB animal feed and UK human and industrial sectors is now available. The data shows more imported wheat being used by UK flour millers (inc. for starch and ethanol production) in October, while GB animal feed production remains below 2022 levels. A year-on-year increase in wheat imports driven by the lower quality of the 2023 harvest is included in UK cereal supply and demand estimates, released earlier this week.

Analyst Insight: UK old crop prices helped by new crop worries

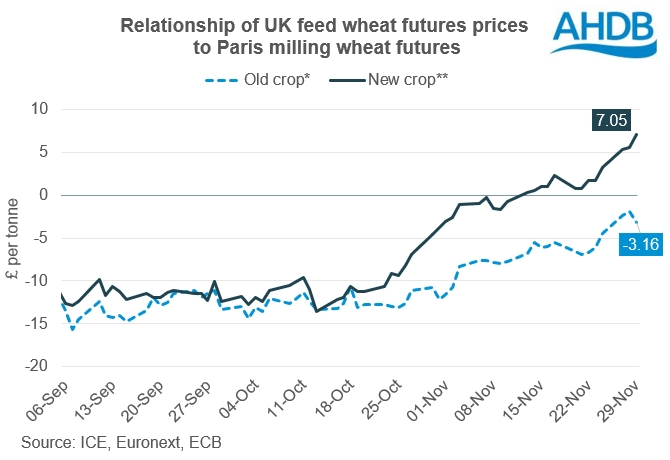

The rise in UK feed wheat futures for harvest 2024 relative to world markets over recent weeks, has benefited old crop (May-24) prices too. New crop prices rose due to the wet weather this autumn and the likeliness of lower winter cropping for harvest 2024.

Earlier this month AHDB’s Early Bird Survey of planting intentions indicated that the wheat area could fall 1% to around 1.698 Mha. This survey was a snapshot of the position as of early November. But unfortunately, it has carried on raining since. The indicated Early Bird survey area for 2024 will be updated when Defra release final area data for harvest 2023 in a fortnight’s time. However, this won’t be based on updated survey data – it just applies the intentions as of early November to the final UK 2023 areas. AHDB will provide an update on the planted area / planting intentions in spring 2024, when spring planting allows.

While it’s not clear yet what the final UK 2024 wheat area will be, the pricing relationships for new crop have already shifted, and that’s having impacts on old crop prices too. Since 20 October, when new crop UK futures began to stretch above the May-24 contract, the Nov-24 contract has risen £4.95/t or 2.4% to £208.05/t.

Meanwhile, UK feed wheat futures for May-24 fell £6.65/t or 3.3% over the same period under pressure from the global market to £195.85/t. But this is a much smaller fall than May-24 Paris milling wheat futures, which fell €16.75/t (6.8%). This is despite a recovery in the strength of sterling against the euro and even more so the US dollar. Stronger sterling usually results in steeper falls (or smaller rises) in UK prices compared to global markets as it makes UK grain less competitive on global markets.

As new crop prices rose, this started to stretch the price gap from May-24 UK feed wheat futures to Nov-24 futures. A wide gap or carry would likely signal a larger incentive to store grain and carry into the new season. The gap between May-24 and Nov-24 futures is currently over £12/t, nearly double gap between May-20 and Nov-20 futures in November 2019.

A wider carry is more likely now compared to previous seasons as it now costs more to carry grain in terms of electricity, financing etc. However, there’s still a limit to how wide the carry can get, while keeping an incentive to sell grain in this season. As a result, May-24 (and other old crop futures prices) also had to rise too relative to the European and global markets.

The rise in old crop prices relative to the European futures will prevent further export sales in the current season and in some parts of the country could start to make grain imports more attractive. A rise imports this season is already forecast, largely on the back of the poorer quality of the 2023 crop.

As imported grain prices look more attractive, or indeed begin to price in, this sets a limit to how far UK prices can now rise relative to the global market. In short, future price rises must come from the global market.

This part of the analysis of the UK market outlook presented at AHDB’s Grain Market Outlook conference on Tuesday. Over the coming days we’ll also be publishing highlights of the global market outlook in Grain Market Daily. You can also read highlights of Megan’s analysis of crop margins.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.