New crop wheat futures on the rise: Grain market daily

Friday, 3 November 2023

Market commentary

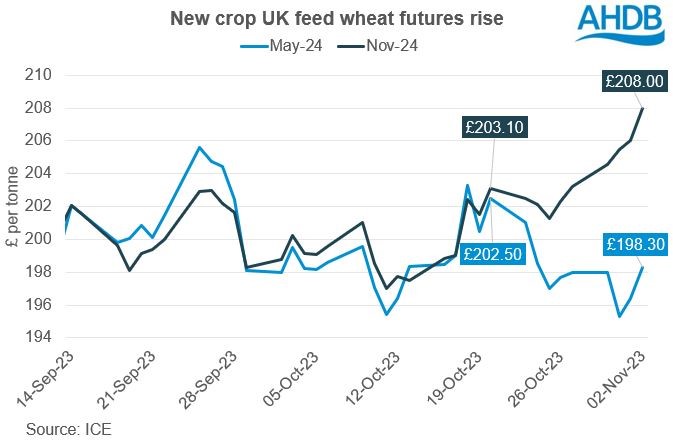

- May-24 UK feed wheat futures closed at £198.30/t yesterday, up £1.90/t from Wednesday. Nov-24 futures rose £2.00/t over the same period to £208.00/t. The Nov-23 contract is in the notice period ahead its expiry on 23 November, with prices being driven by technical factors related to the notice period. The May-24 contract has the most trade of the old crop contracts, so should be used for old crop price insights.

- Global wheat prices rose yesterday due to short covering by speculative traders in Chicago wheat futures and ongoing worries about Southern Hemisphere wheat crops. The Buenos Aries Grain Exchange cut its forecast for this season’s Argentinian wheat crop from 16.2 Mt to 15.4 Mt yesterday.

- May-24 Paris rapeseed futures gained €5.25/t yesterday to close at €444.25/t (approx. £388/t), while Nov-24 prices gained €4.50/t to €451.50/t (approx. £394/t).

- Rapeseed prices were pulled up by rises in US soyabean prices. These rose due to hopes that China will buy more US soyabeans after US agricultural trade bodies visited China, plus continuing concerns about Brazilian weather. There are also early forecasts that demand for vegetable oils could exceed supply in 2024, which could support oilseed prices. The head of Oil World made the forecast at a conference in Bali.

- Yesterday AHDB released data on cereals used in September by the GB animal feed sector, UK flour millers, brewers, maltsters and distillers. Data on oats used by UK oat millers from July to September is also available.

New crop wheat futures on the rise

New crop (Nov-24) UK feed wheat futures have risen £4.90/t since Friday 20 October, closing at £208.00/t yesterday. This rise is largely driven by the wet weather hampering winter wheat planting in the UK as the May-24 contract fell £4.20/t over the same period.

Furthermore, new crop wheat futures in the rest of the world fell over the same time period, as planting has been going well in most of Europe and the US. Between 20 October and 02 November new crop Paris wheat futures (Dec-24) fell €4.50/t, with Dec-24 Chicago wheat futures down $7.25/t.

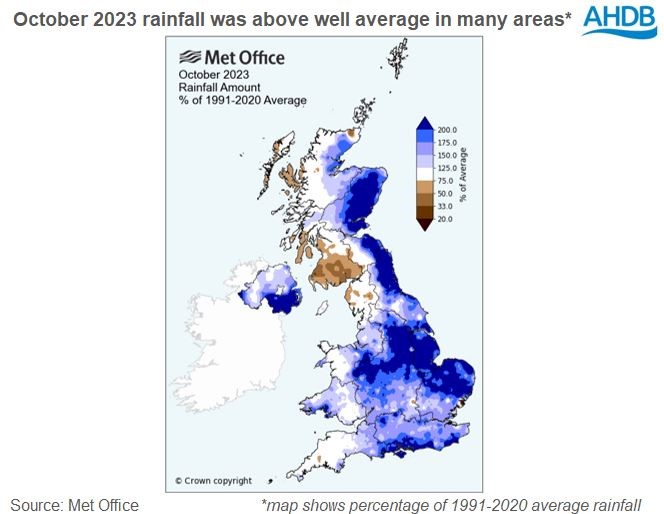

Many parts of the UK experienced heavy rainfall in October, following a wet end to September. The Met Office releases full statistics for October in the next few working days, but in the meantime the higher rainfall can clearly be seen on the map below.

The worry is that the UK wheat area for harvest 2024 could fall, and lead to a smaller crop. The area for harvest 2023 is estimated at 1.72 Mha, with production at 14.1 Mt. So, to potentially begin to position the UK in case higher imports are needed in the 2024/25 season (and prevent exports), new crop prices are up. Nov-24 UK feed wheat futures are now just £2.62/t below the Dec-24 Paris milling wheat futures contract, while they were £11.23/t below nearly a fortnight ago.

After the severely wet autumn of 2019 limited the UK wheat area to just 1.39 Mha, Nov-20 UK futures rose relative to Dec-20 Paris wheat futures. The highest the Nov-20 UK feed wheat futures reached over the Paris Dec-20 contract was £7.14/t on 25 September 2020. This suggests there’s a limit to how much further Nov-24 UK feed wheat futures can rise, without a rise in the wider market.

While there’s doubt cast by less-than-ideal weather in Brazil, if the forecast crops are harvested the global grain market looks well supplied this season (2023/24). Unless the situation in Brazil deteriorates, these high projected supplies could limit global grain price gains over the next few months.

The UK planted area for harvest 2024 is not certain yet but Nov-24 UK feed wheat futures are now their highest since late-July. So, where winter is wheat safely in the ground, it might be worth speaking to your merchant(s) and considering how prices compare to budgeted costs.

The next information that could give some insight to the crop situation will be AHDB’s Early Bird Survey. Each autumn AHDB carries out a survey of early plantings and planting intentions and the results of this year's survey are due later this month.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.