Brazilian weather critical market watchpoint: Grain market daily.

Wednesday, 25 October 2023

Market commentary

- Nov-23 UK feed wheat futures closed at £186.00/t yesterday, down £2.65/t from Monday’s close. The Nov-24 contract also fell over the same period by £0.40/t, ending the session at £202.10/t.

- Global wheat markets faced pressure yesterday as recent rainfall in Argentina and Australia has relieved some drought concerns. Recent rainfall in Europe and over the US wheat belt has been beneficial where farmers are currently sowing crops for harvest 24.

- Paris rapeseed futures (Nov-23) gained €14.25/t from Monday’s, ending yesterday’s session at €405.50/t. While the Nov-24 contract closed at €444.00/t, down €7.00/t from Monday’s close. Chicago soyabean markets gained yesterday from spill over support in Chicago soymeal markets.

Brazilian weather critical market watchpoint

Longer-term outlooks for oilseed markets have been marginally bearish. This is on the expectations of large South American soyabean crops coming to the global market at the start of 2024.

However, right now Brazilian weather is a huge watchpoint for markets and weather developments over the next 2 to 4 weeks are critical for this soyabean crop. Plantings got off to a rapid start, however, have since stalled. Brazilian soyabean planting progression at the end of last week was estimated at 30% complete, down from 34% last year (AgRural).

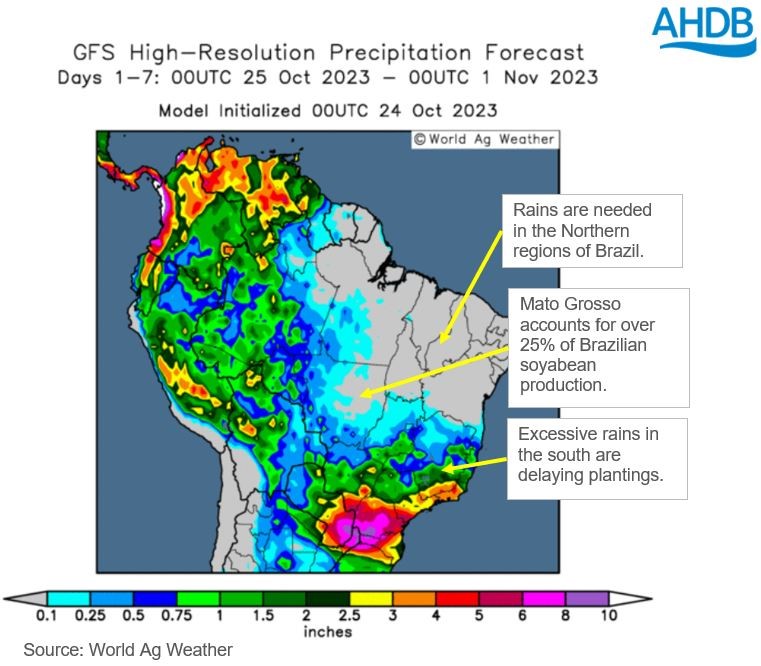

Recent dry weather has the potential to put this crop at risk as many Central and Northern growing regions of Brazil have had insufficient rainfall which has led to low soil moisture and abnormally high temperatures have ensued. This is creating poor conditions for germination and early growth – there have even been reports that some crops will require replanting.

Over the next 7-days prospects are not forecast to significantly improve as a lack of rainfall is expected to continue in places like the Mato Grosso state, which account for over 25% of Brazil soyabean production on average.

If conditions do not improve and significant rainfall isn’t received soon, then there are expectations that Brazil soyabean production estimates might be reduced. Currently many agricultural consultancies are estimating this soyabean crop at over 160 Mt+, with the USDA estimating the crop at 163 Mt. There are expectations that this crop could be sub 160 Mt if dry conditions continue in Northern regions. Soybean & Corn Advisor estimate that at least 30% of the soyabean acreage in Brazil is in need of immediate rainfall.

What does this mean for prices?

There is still time for Brazil to receive the much-needed rain required for this soyabean crop, but we are imminently entering a critical stage. If dryness continues cuts will be inevitable to this crop, but obviously it’s too early to predict the extent of the (potential) damage.

Rapeseed markets are relatively well supplied – therefore they will not be sitting at a huge premium to soyabean markets for the 2023/24 marketing year. However, if there is support in soyabean markets, we could potentially see an element of support for the wider oilseed complex which will feed into rapeseed prices. But this is just a critical watchpoint. Weather over the next 4-weeks could potentially set or reset the tone for oilseed markets longer-term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.