Arable Market Report - 30 October 2023

Monday, 30 October 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

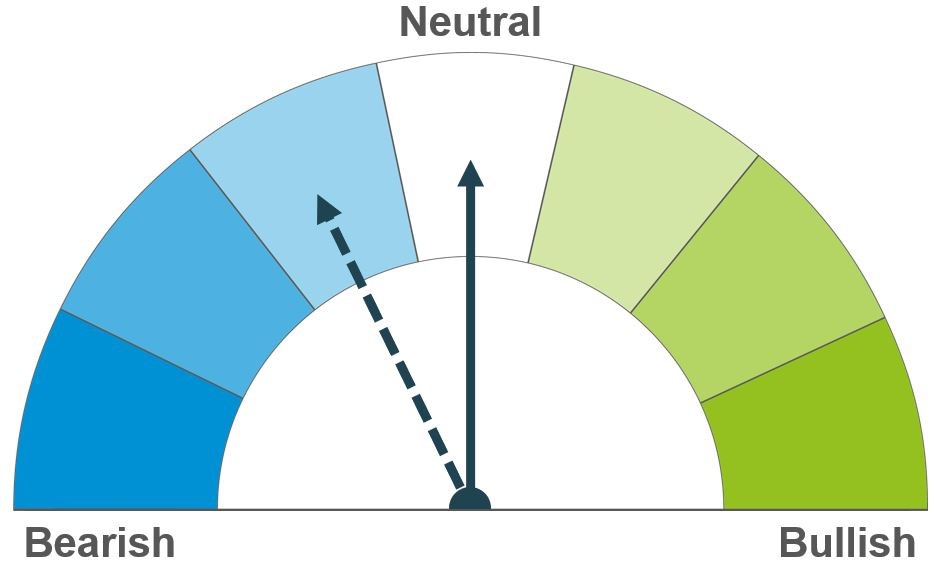

Grains

Wheat

Maize

Barley

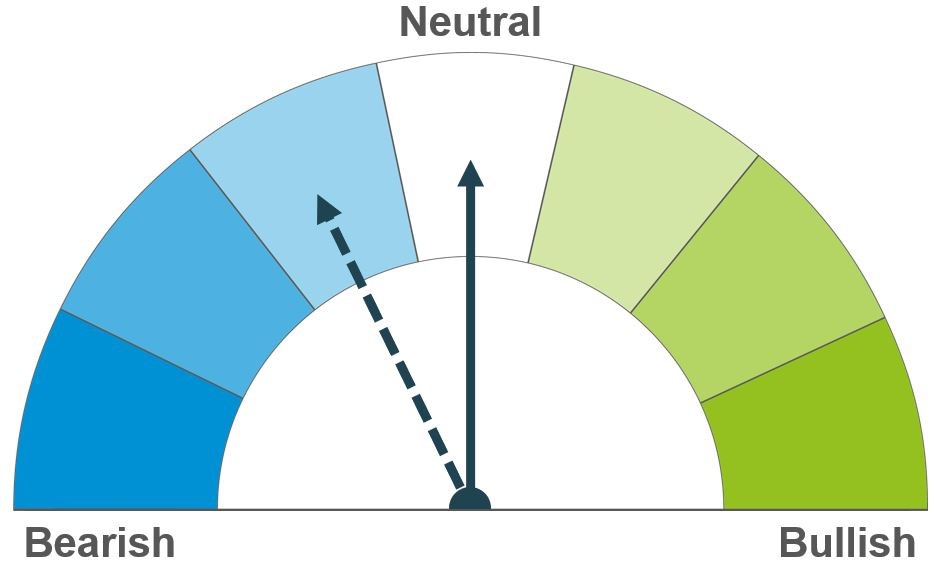

Short-term markets will remain volatile and reactive to news on South American weather and Black Sea exports. Longer-term, heavy global feed grain supplies are expected to weigh on wheat prices.

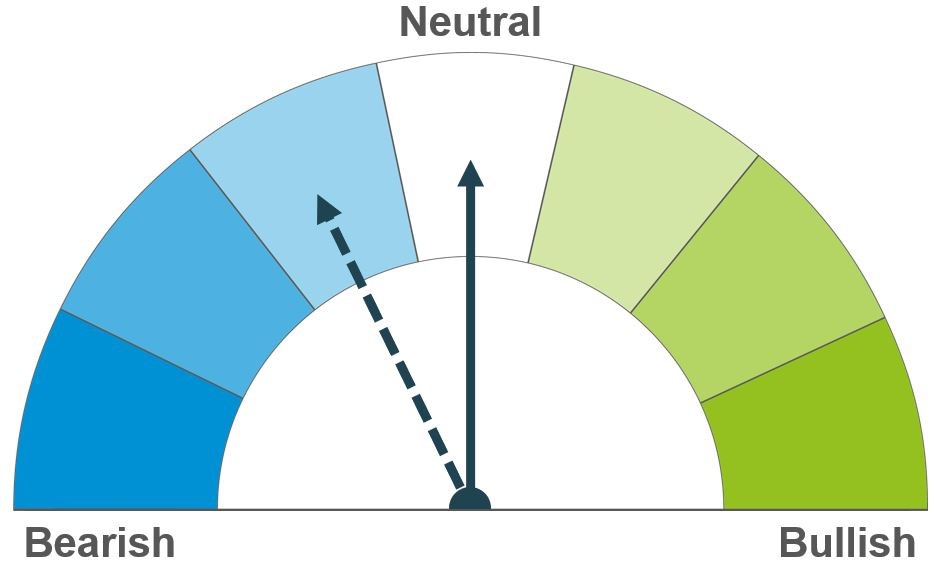

South American weather is the key watchpoint for maize markets at the moment. Longer-term plentiful global maize supplies are expected.

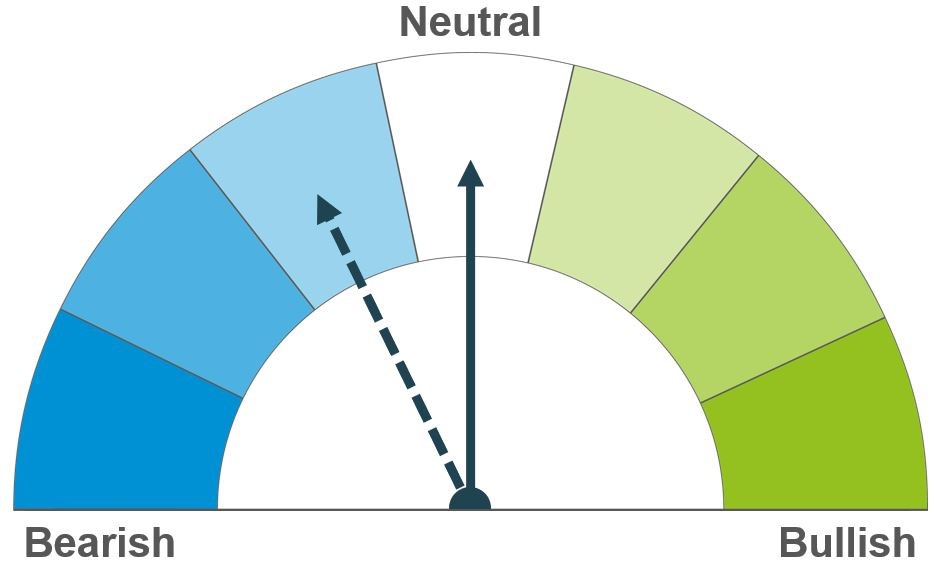

Barley will continue to track movements in the wider grains complex. Much like wheat, anticipated heavy maize supplies will likely weigh on the overall feed grain markets.

Global grain markets

Global grain futures

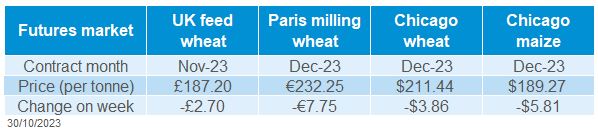

Global grain markets were slightly pressured last week. Chicago wheat futures (Dec-23) were down 1.8% Friday to Friday. Paris milling wheat futures (Nov-23) were down 3.2% over the same period. Pressure was largely due to welcomed rains in Argentina, as well as continuing competitive Black Sea exports.

South American weather remains a key watchpoint currently. Drought conditions in Argentina remain a concern for maize plantings, as well as the wheat crop which is now in its filling-heading stage, making it sensitive to moisture stress. However, over the past seven days, up to 4mm of welcomed rain fell in key wheat producing regions including Cordoba and Santa Fe. On Thursday, the Buenos Aires Grain Exchange rated 13% of the wheat crop in good/excellent condition, up from 11% a week earlier.

Scarce rainfall is also an issue in Brazil, where there are longer term concerns that the Safrinha (second) maize crop will be impacted by the current conditions when it is planted at the start of 2024. Looking ahead, both Brazil and Argentina are due fairly minimal rain over the next seven days, something to watch.

The flow of competitive Black Sea supplies continues to weigh down on grain markets. Last week, there was a temporary pause in Ukraine’s ‘humanitarian corridor’ due to threats from Russian warplanes and sea mines. However, on Friday, shipping resumed, with four vessels leaving Ukrainian Black Sea ports in the Odesa region. While exports continue to flow, data from the Agriculture Ministry this morning showed that Ukraine’s grain exports in October have almost halved on the year at 2.15 Mt. This is down from 4.22 Mt last season (Refinitiv). The volume of grain exports leaving through the new corridor will remain a watchpoint over the next few weeks.

UK focus

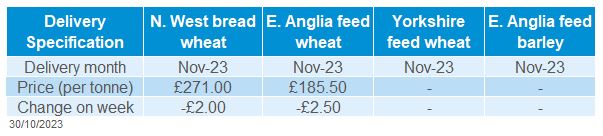

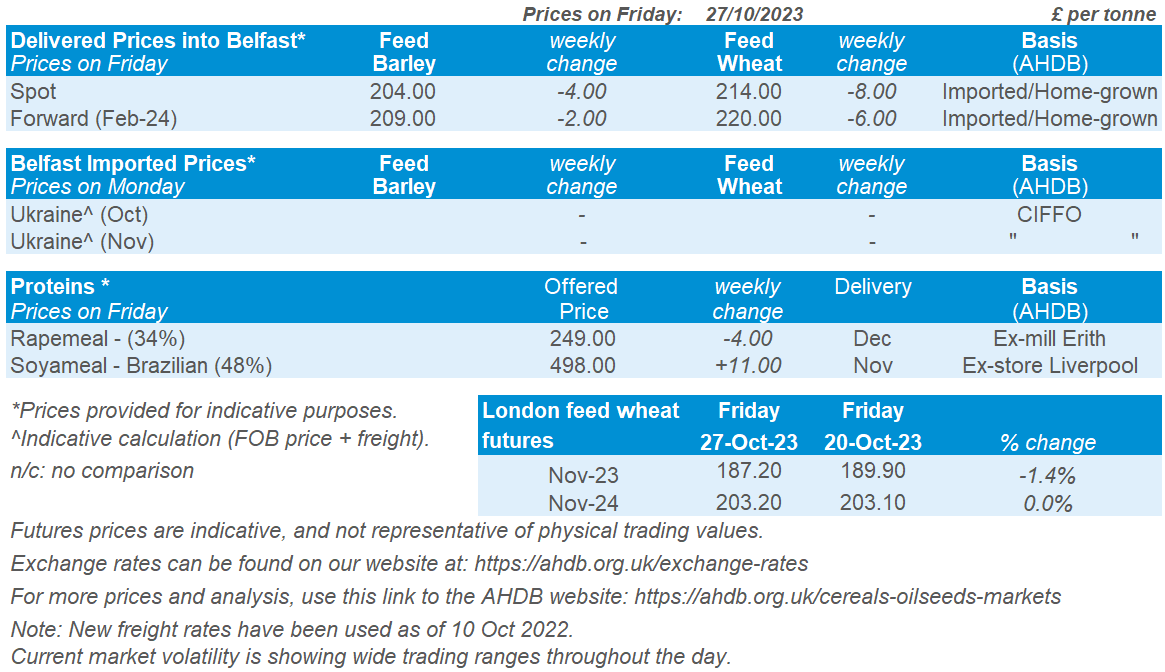

Delivered cereals

UK feed wheat futures (Nov-23) closed at £187.20/t on Friday, down £2.70/t on the week. While the Nov-24 contract gained £0.10/t over the same period, ending Friday's session at £203.20/t. Domestic wheat futures followed global price movement last week. Gains towards the end of the week following uncertainty regarding Ukrainian exports were outweighed by competition from Russian exports and rains in Argentina.

UK delivered prices followed the downwards pressure, as feed wheat into East Anglia for November delivery was down £2.50/t Thursday to Thursday, quoted at £185.50/t.

Bread wheat delivered into the North West for November delivery was quoted at £271.00/t on Thursday, down £2.00/t on the week, with premiums holding historically firm.

On Friday, the 2023 Cereal Quality Survey results were published, looking at the key parameters of wheat and barley quality from harvest 2023 in the UK. Wheat reaching UK Flour millers group 1 specification saw a substantial drop to 13% this year, from 33% in 2022. With quality down in the UK, as well as in Europe, the premium for bread wheat in the UK is up on the year. For barley, results show that specific weights across all barley samples is likely to be the lowest since data collection began for the CQS (1977), with the 2023 GB average at 62.6kg/hl

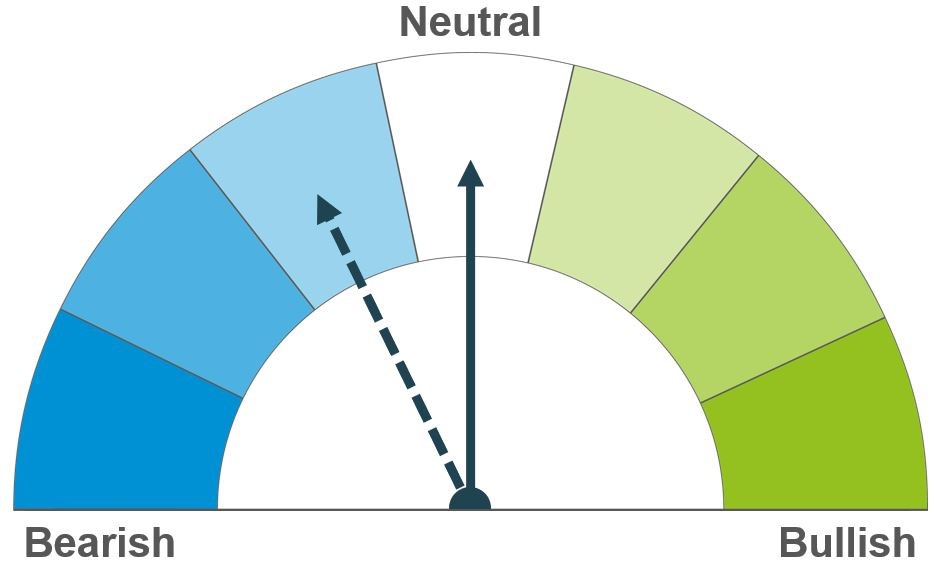

Oilseeds

Rapeseed

Soyabeans

Short-term support in soyabeans is filtering into rapeseed prices. Long-term if a large South American soyabean crop comes to market there will be pressure on oilseed markets.

Brazilian weather is at a critical watchpoint right now which is driving both short and long-term sentiment. On paper a large Brazilian crop is expected, but weather over the next two weeks is critical for plantings and early development.

Global oilseed markets

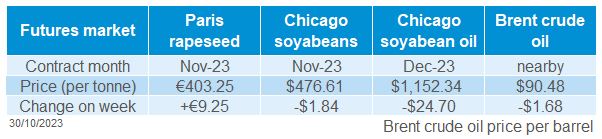

Global oilseed futures

Nearby Chicago soyabean futures (Nov-23) were pressured overall 0.4% across the week, closing Friday at $476.61/t. While the May-23 contract gained 0.2%, closing at $494.80/t on Friday.

Largely contributing to this pressure in the nearby market was the US soyabean harvest progression. Though there was an uptick in support at the end of the week from increased demand for US origin soyabeans. Further to that, the potential weather impacts in South America (notably Brazil) could be bullish for the market, but there is possible bearish weather on the way.

Last week the USDA estimated that the US soyabean harvest (to 22 Oct) was 76% complete, ahead of the five-year average of 67%. Benign weather across the US Midwest is aiding this rapid progression, a further update will be released this evening.

US soyabean export sales (13-19 Oct) were estimated at 1.38 Mt for 2023/24, a marketing year high, and up 43% on the prior four-week average. China accounted for 1.17 Mt of the sales. The US further reported soyabean cake and meal export sales at 507.5 Kt over the same period. There is currently strong demand for US origin from Argentina’s reduced crop in 2022/23.

Looking longer term, the oilseed market is focused on Brazilian weather. The dry weather notably in the Northern part of Brazil is impacting plantings of their expected record soyabean crop. Latest information shows that Brazil have planted 38.4% of their soyabean crop, this is down from 52.3% the same point last year (Patria Agronegocios). The next couple of weeks will be critical for this region, and from this Thursday, widespread rains are forecast in much of Northern Brazil which should aid plantings and early crop development. This could potentially ease some longer-term concerns if realised.

Rapeseed focus

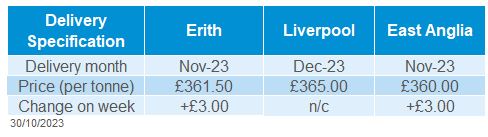

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed at €403.25/t on Friday, gaining €9.25/t on the week. The May-24 contract closed at €448.00/t, gaining €3.25/t over the same period. Rapeseed futures were supported last week from an element of support in forward soyabean markets. Towards the end of the week rapeseed gained with palm oil futures, which were supported off strength in China’s vegetable oil market.

Domestic rapeseed delivered into Erith for November was quoted on Friday at £361.50/t, gaining £3.00/t on the week. However, delivered prices for May-24 into Erith fell £1.00/t over the same period, quoted at £374.50/t.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.