UK provisional crop production estimates for 2023: Grain market daily

Thursday, 12 October 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £181.95/t, down £2.05/t on Tuesday’s close. New crop futures (Nov-24) closed at £197.00/t, down £1.60/t over the same period.

- Our domestic market followed broader pressure in both Paris and Chicago wheat markets. Wheat markets were pressured from on-going Black Sea grain coming to the market. Furthermore, there is expectation that US end of season wheat stocks will be increased in the October USDA report, according to a poll released by Reuters. All eyes are on this report which is out this evening (5:00pm).

- Paris rapeseed futures (Nov-23) closed at €411.50/t yesterday, down €8.25/t on Tuesday’s close. Rapeseed followed the pressure in Chicago soyabean futures.

- Soyabean prices were down as there is anticipation that US soyabean ending stocks are going to rise in the October USDA report (Reuters). Further to that, Argentina’s Rosario Stock Exchange, upped its soyabean crop estimate by 2 Mt as area switches from maize. It now estimates that Argentina will produce 50 Mt of soyabeans for the 2023/24 marketing year. This information will further add to the current bearish long-term sentiment.

UK provisional crop production estimates for 2023

Defra and the Scottish government released provisional data crop areas, yields and production this morning. This information gives us a first insight into what the UK production is for 2023 harvest.

Wales and NI have not yet released area and production data, so within this article they are assumed to be the same as last year. This follows Defra’s methodology from when a UK provisional figure was last released in 2021.

Here are the highlights; there is a breakdown of each respective crop below:

- UK wheat production is estimated at 14.1 Mt for 2023. This production figure is below initial expectations; trade estimates were sitting around 16 Mt+ at the end of spring. However, the lower wheat area year-on-year, combined with a large variation in yields nationally, means that the UK wheat surplus might be lower than initially anticipated.

- Despite an increase in the total barley area, production is estimated at 7.0 Mt for 2023, down from 7.4 Mt harvested in 2022. The UK average spring barley yield has reduced year-on-year, driving the production cut.

- UK oat production is estimated at 841 Kt for 2023; this is down by 166 Kt from 2022 harvest. This will be the lowest oat crop since 2016. Prices in 2022 incentivised a switch back to planting oilseed rape (OSR), reducing the oat area for harvest 2023.

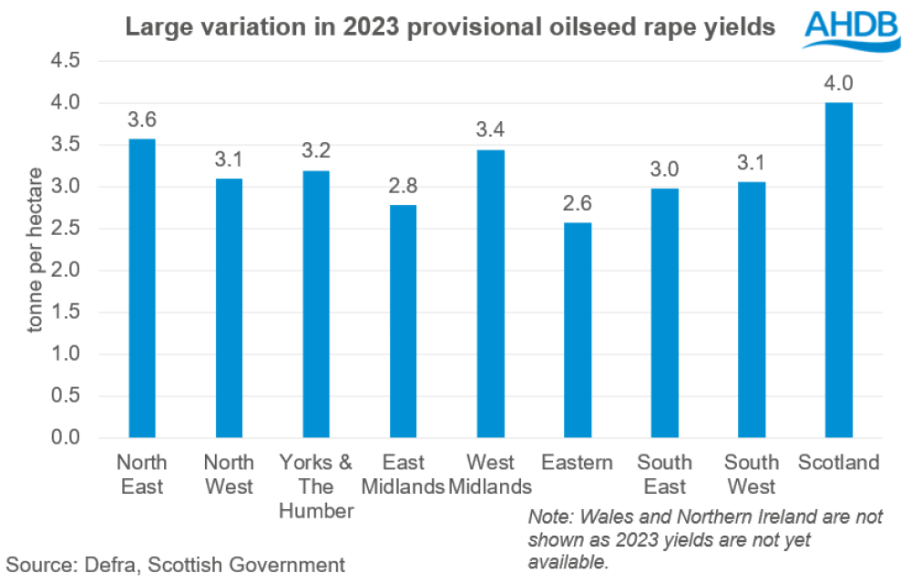

- UK OSR production is estimated at 1.2 Mt for 2023, down by 154 Kt from 2022 harvest. Despite an increase in area, OSR production has reduced from poor yields nationally. There has also been huge variation, with yields averaging as low as 2.6 t/ha in the Eastern region of England but as high as 4.0 t/ha in Scotland.

UK wheat production is estimated at 14.1 Mt for 2023; this is down from 15.5 Mt harvested in 2022. However, this is above the five-year average (2018–2022) of 13.8 Mt.

The UK wheat production figure is in part due to a lower area for 2023 of 1,720 Kha, down 5% on the year. All areas within the UK have a reduced area of wheat for 2023 apart from the North West, which marginally increased (+1%).

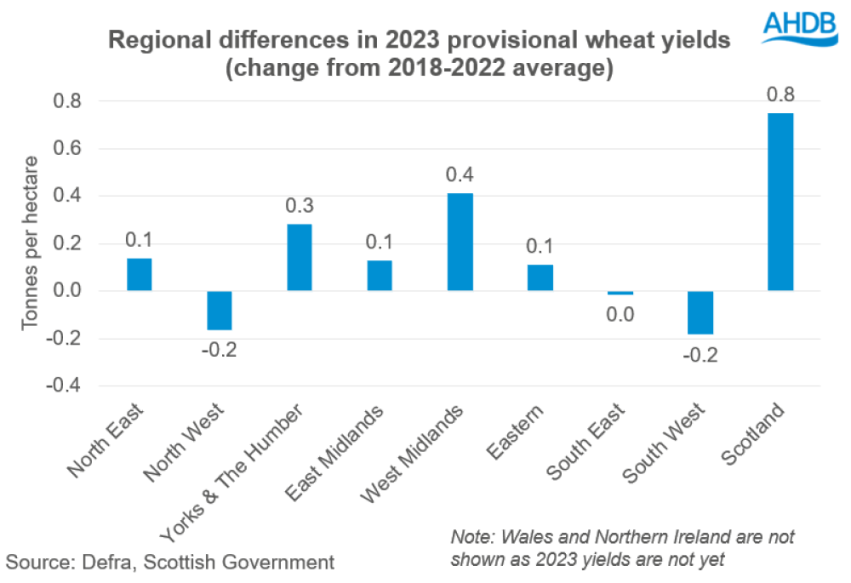

Also, the lower wheat crop is due to reduced yields from last year’s exceptionally good yields. Every region in England and Scotland has lower yields than last year; however, in most cases they are still above the five-year average.

As the figure above shows the only regions with yields below the five-year average are the North West (at 5.8 t/ha), South East (8.2 t/ha) and South West (7.7 t/ha) of England. With the South of England contributing 21% of UK area, reduced yields here have a greater impact on the total fall in production.

In Scotland yields have held up, provisionally estimated at 9.1 t/ha. This is down from 9.3 t/ha last year but remains 9% above the five-year average.

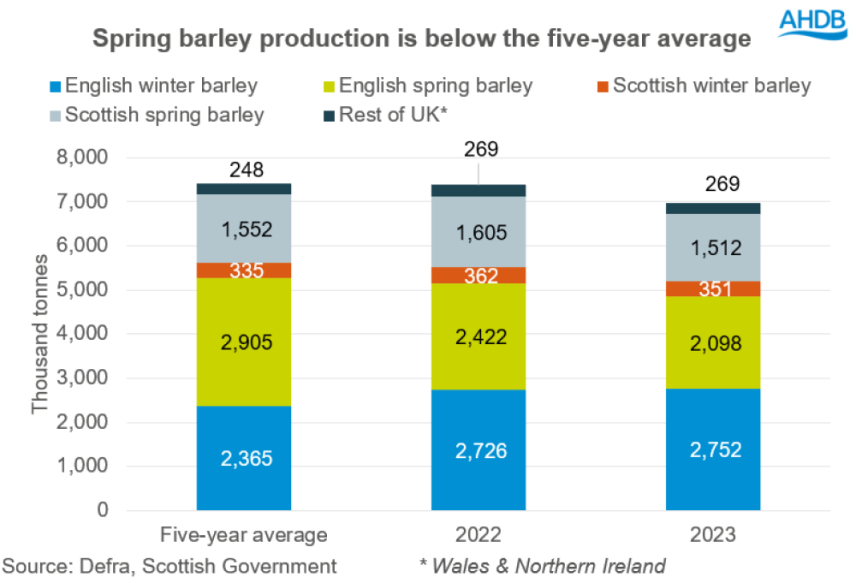

UK total barley production is estimated at 7.0 Mt for 2023. This is down from 7.4 Mt harvested in 2022 and is below the five-year average (2018–2022) of 7.4 Mt.

Total barley area for harvest is provisionally estimated at 1,126 Kha, up 2% year-on-year. However, production is down overall, notably due to lower spring barley yields.

Winter barley

UK winter barley production is estimated at 3.2 Mt for 2023. This is marginally up (+14 Kt) from 2022 harvest, and is above the five-year average (2018–2022) of 2.8 Mt.

Similar to wheat, most regions in the UK have lower yields than last year. The exceptions are the Eastern region where yields are estimated at 7.3 t/ha, up from 7.1 t/ha in 2022 and the West Midlands where there’s marginal increase. When regional yields are compared to their previous five-year averages, all areas are higher, apart from the North of England and the South East.

Spring barley

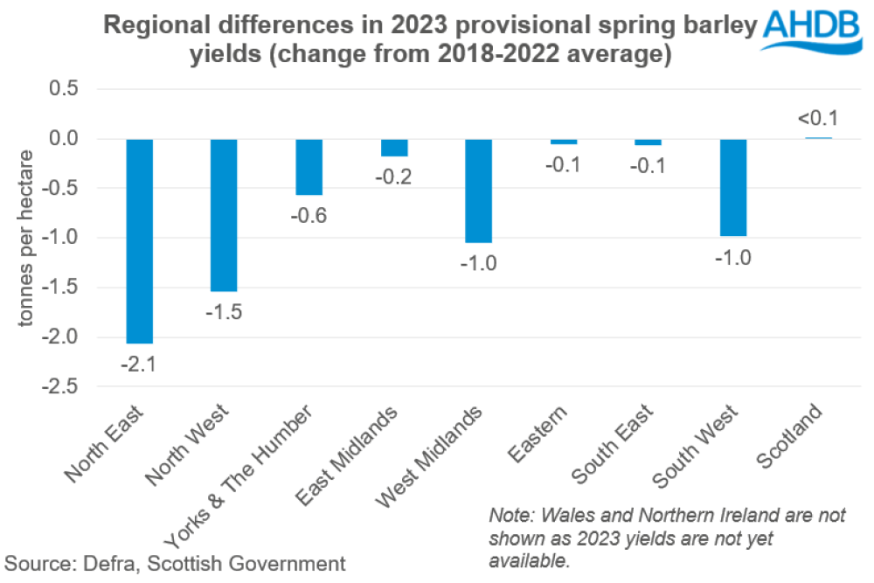

UK spring barley production is estimated at 3.8 Mt for 2023; this is down by 418 Kt from 2022 harvest, and is below the five-year average (2018–2022) of 4.6 Mt.

Nationally spring barley yields have reduced this year, with every region in England and Scotland being down on both the year and on the five-year averages. But there is large variation nationally.

Yields in the North of England were poor, with the average North East and West yields estimated at 3.9 t/ha and 3.0 t/ha, respectively. This is 35% and 34%, respectively below their five-year averages. However, only marginal reductions from the five-year average are recorded in the South East (-1%) and Eastern (-1%) region of England.

UK oat production is estimated at 841 Kt for 2023. This is down by 166 Kt from 2022 harvest, and is below the five-year average (2018-2022) of 1.0 Mt.

All regions have reduced yields when compared to 2022. The most notable reduction is in the North West where regional yields are estimated at 3.1 t/ha, down 39% in comparison to 2022, and below the five-year average of 4.9 t/ha. Yields in Scotland (6.2 t/ha), South East (5.7 t/ha) and North East (6.3 t/ha) are all above five-year averages.

UK oilseed rape (OSR) production is estimated at 1.2 Mt for 2023; this is down by 154 Kt from 2022 harvest, and is below the five-year average (2018–2022) of 1.4 Mt. Despite a national area increase of 6% year-on-year, poor yields have contributed to the annual decrease in OSR production.

Every single region in England and Scotland has seen a reduction in yields year-on-year. The largest percentage reduction is in the East Midlands, with yields estimated at 2.8 t/ha, down 26% year-on-year. In Scotland, despite a reduction (-6%) year-on-year, yields are estimated at 4.0 t/ha; this is marginally higher than the five-year average.

There is a huge variation in yields nationally, ranging from lows of 2.6 t/ha in the Eastern region to highs of 4.0 t/ha in Scotland.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.