- Home

- News

- Analyst Insight: What does wheat availability and demand look like heading into next season?

Analyst Insight: What does wheat availability and demand look like heading into next season?

Thursday, 25 May 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £184.95/t, down £3.15/t from Tuesday’s close. The Nov-24 contract closed at £194.00/t, down £2.40/t over the same period.

- Domestic prices followed both Paris and Chicago wheat markets down yesterday. Forecasts of well needed rain in key wheat growing regions in the US pressured prices.

- Paris rapeseed futures (Nov-23) closed at €408.25/t yesterday, up €4.50/t over the session. The Nov-24 gained €6.00/t over the same period, to close at €417.50/t.

- Rapeseed futures followed gains in the wider vegetable oils complex. Dealers and cargo surveyors said on Tuesday that India’s palm oil imports are expected to fall to their lowest in 27 months and will be replaced by soya oil and sunflower oil.

What does wheat availability and demand look like heading into next season?

Earlier today, AHDB published the latest UK supply and demand estimates for wheat, barley, maize and oats for the 2022/23 season. The main revisions from March’s wheat estimates include further reductions for usage in animal feed (now at 6.81Mt), but increased human and industrial consumption (7.33Mt), with higher bioethanol demand outweighing a slight fall in starch and distilling usage. Wheat imports are also forecast up slightly at 1.2Mt, with marginally stronger demand for higher protein milling wheat. Wheat exports are also up by 150Kt from the previous estimates at 1.65Mt, with a stronger than initially expected export pace during the latter part of the season.

Despite greater exports, due to high production in 2022 and declines in animal feed demand this season, commercial wheat ending stocks remain high at 2.44Mt, up 32% on the year. So, how does availability look heading into the new season? And what does demand look like moving forward?

Wheat availability for the 2023/24 season

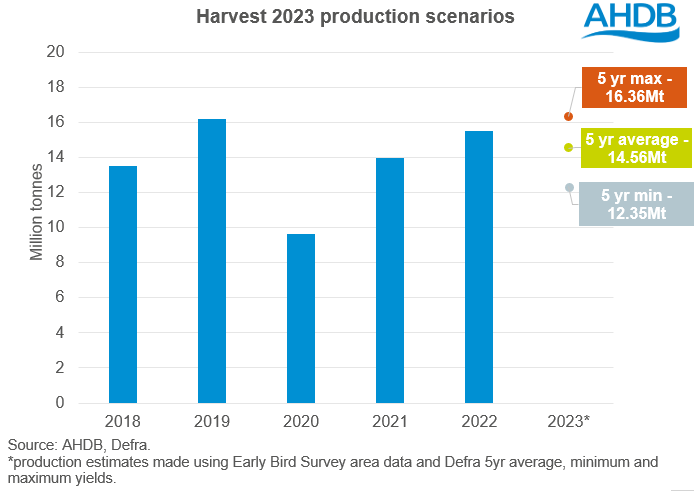

We know that we will be entering the new season with significant opening stocks, so the bigger question mark is over new crop production prospects. In AHDB’s Early Bird Survey of plantings and planting intensions, the total UK wheat area for harvest 2023 was estimated up 1% on the year, at 1,821Kha. Using this intended area and Defra five-year average, minimum and maximum yields, basic wheat production scenario projections for harvest 2023 can be made.

As at the week ending 25 April, 88% of the GB winter wheat crop was in good/excellent condition, ahead of 84% at the same point last season. Generally, crops are establishing well and following a lengthy wet period in March, we have seen improved weather over April and May. Long range forecasts for the coming few weeks also look favourable With this in mind, it seems likely that production will be nearer the five-year maximum production scenario (based on the highest average yield in the past five years) rather than the five-year average production scenario. As it stands at the moment, and based of the information we know, it's looking likely that production for 2023/24 could be in the realms of 15.5-16Mt (subject to final planted area and any weather events between now and harvest).

Domestic wheat demand for the 2023/24 season

While it was reported yesterday that inflation in April fell to 8.7%, the first dip below 10% since August last year, according to the Office for National Statistics (ONS), food costs are still 19.1% higher than they were a year ago. The chief economist from the ONS also added that it could take six to twelve months before supermarket contracts expire, and we see any changes in food prices.

So far this season, we have seen from the UK flour millers data that total flour production (excluding demand from the bioethanol and starch industries) has been slightly impacted by changing consumer habits and people eating out less. While usage by the brewing malting and distilling (BMD) sector is expected to be higher in 2022/23, there have been reports that some craft brewers have been struggling of late, due to the cost of living crisis. However, there has been an anecdotal shift from craft beers to cheaper own brand products. Looking ahead, with food and drink prices unlikely to fall much in the next six months, and out of home consumption likely to be down due to the rise in cost of living, wheat demand in these sectors could see a squeeze.

For the bioethanol and starch industries, wheat usage for the remainder of this season has been increased in today’s estimates due to its price competitiveness against maize. If wheat remains competitive against maize, we could see usage up further in the new season. The new season EU maize crop is currently pegged at 62.1Mt by Stratégie Grains, up 9.9Mt from this season’s estimate, but remains relatively low. According to anecdotal reports, cereal demand in the EU feed market for the 2023/24 season is expected to remain sluggish, which could see greater availability, something to watch out for.

Finally, at the moment animal feed production isn’t expected to rebound quickly heading into the new season. With pig and poultry feed being the main drivers of the decline in animal feed production, changes in demand will weigh largely on those sectors. According to AHDB’s pork market intelligence team, pig breeding numbers are seeing a slight climb at the moment. It’s thought that higher pig prices and lower feed costs could encourage growth; however it’s likely recovery will be slow, and we won’t see an immediate rebound at the beginning of next season. Energy costs and the impact of avian flu are also leading to slow poultry feed demand. Again, it’s unlikely that the sector will fully recover in the next few months.

Conclusion

With heavy carry-in stocks and another relatively bumper crop expected for harvest 2023, its looking likely 2023/24 will be another season of high available supplies. However, with a recovery in animal feed demand expected to be slow and the cost-of-living crisis continuing, we could also see another season of relatively lacklustre demand. If the S&D situation does pan out like this, then it's likely we will have another hefty balance and exportable surplus. It is worth noting that this situation could change as there is still a good couple of months before harvest, and animal feed demand may make a faster recovery than expected. However, 2023/24 is initially looking to be another season with a heavy balance sheet.

In terms of what this means for price direction, it’s likely as we head towards harvest we will continue to see UK wheat prices pressured as the surplus grows and if demand remains weak.

Other revisions from today’s balance sheet release:

Barley: Barley H&I demand is forecast down 10Kt from the last estimate based on actual data so far this season being lower than expected, but remains at record levels. Barley usage in animal feed was also cut 67Kt from March’s estimate, due to a cut in fed on farm, with growers able to yield more form selling grain. Full season exports have been increased by 150Kt since March, with a firm pace reported in April and May.

Maize: Maize H&I usage is down 44Kt from March’s estimate due to reduced demand from the bioethanol sector, with wheat pricing more competitively. Maize usage in animal feed is up 42Kt from the last estimate, with strong usage in Northern Ireland.

Oats: H&I usage is down 15Kt from March. Additional oat milling capacity is expected to impact next season's demand. Usage in animal feed is up 2Kt from March’s estimates. The export forecast is up 5Kt from the previous estimate at 160Kt, the highest level in 20 years.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.