New-crop EU and US drilling progressing: Grain market daily

Wednesday, 1 November 2023

Market commentary

- UK feed wheat futures (Nov-23) fell £3.90/t yesterday, to close at £183.20/t. May-24 futures fell just £2.70/t over the same period to close at £195.30/t. Whereas, Nov-24 futures gained £0.95/t, to close at £205.50/t.

- Paris wheat markets followed pressure on Chicago wheat markets yesterday on easing concerns for Southern Hemisphere wheat supply, despite some support for Chicago maize markets. Though, Paris wheat futures (Dec-24) resisted downwards pressure like UK feed wheat Nov-24 futures, ending the session unchanged.

- Looking ahead, China is set to import record volumes of wheat this year, with rain damage to their crop according to Refinitiv.

- Paris rapeseed futures (May-24) also felt slight pressure yesterday, falling €1.75/t, to close at €440.25/t. Nov-24 futures closed down just €0.25/t over the same period, to €447.25/t.

- Despite support for Chicago soyabean futures yesterday, rapeseed prices eased with wider vegetable oil and oil prices yesterday. Oil prices followed news of the easing of potential supply disruptions concerns from the Middle East as foreign captives are released, alongside data showing rising output for OPEC and the US in October.

You're invited to the Grain Market Outlook Conference 2023

Speaker line up announced

Date: Tuesday 28 November 2023

Time: 9.30am - 2.30pm

Where: York Racecourse (YO23 1EX)

What can you expect from the day?

- AHDB Market Outlook - AHDB experts dive into global and domestic markets, as well as investigating business performance, optimising margins, and life after direct payments.

- Characteristics of Top Performing Farms - presented by Anderson's Graham Redman.

- Understanding mindset as a tool to release business potential - presented by Becki Leach, Senior Consultant & Head of People at Kite Consulting.

- A discussion on decision making in practice - with panellists Neil White (Farmers Weekly’s Arable Farmer of the Year 2023, from Berwickshire), Jock Willmott (Partner, Ceres Rural) and Laura Smith (AHDB Farmbench Manager).

To find out more and book now, please use this link.

New-crop EU and US drilling progressing

Drilling of winter crops continues across the UK for many, though recent storms and heavy rainfall has been making conditions much more difficult too for some. This week Storm Ciarán will be the latest to hit particularly the south coast, though impacts are expected across the UK.

But, how is drilling and crop condition progressing elsewhere? Today we look at key Northern Hemisphere crops going into the ground for harvest 24. What we can expect from new season wheat supply will be something to consider for the longer-term price direction for markets as we progress through this season.

EU drilling progressing despite late harvest

For most parts of Europe, winter cereal drilling is progressing well, according to the European Commission’s latest crop monitoring report. This is despite a later start, as delayed crop harvesting wrapped up.

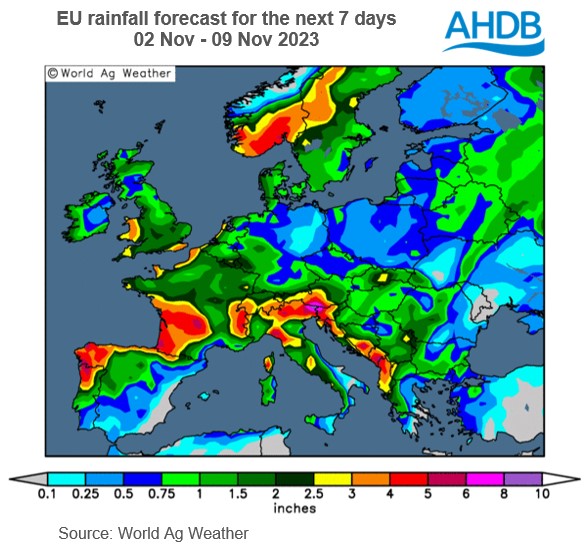

Daily average temperatures were the warmest on record from 01 September to 15 October for regions of France, Italy, Germany, Poland, European Russia, Czechia, Austria and Slovakia. Though this was also matched with a rain deficit for many areas too, previously accumulated soil moisture saw dry and warm conditions have little or no significant impact to crops. For France especially, like the UK, Storm Ciarán will be in focus this week.

Though for eastern Romania and Bulgaria, hard and dry topsoil created from a lack of rainfall and higher temperatures has hampered seedbed preparation. If rain arrives in the coming weeks, campaigns can still be completed on time. For Finland and Estonia, rain has delayed field preparations and drilling when the campaign should be all but complete, and excessively wet soil conditions have reportedly compromised some sown cereals.

For rapeseed, in France and Germany warmer-than-usual weather and adequate soil moisture has provided favourable conditions for early development. Though for southern Germany, rainfall is now needed to maintain acceptable soil water levels. Though southern-eastern Romania and southern Ukraine has been very dry, bringing into focus impact to germination and early development. The EU Commission add re-sowing may be required if so.

US winter wheat conditions start well

To 29 October, 84% of US winter wheat had been planted according to the USDA, just 2 percentage points (pp) behind last year and 1 pp behind the five-year average. Of the 2024 winter wheat in the ground, 47% of this is rated ‘good’ to ‘excellent’ condition. This is the highest condition rating since 2019 for this early point in the season, and above the recent five-year average of 44%. A much more positive start than last year’s historically low condition scores at this point. Though condition scores are not directly linked to yield outcomes, it gives us an indication of how crops are starting the season.

Though drought conditions are still ongoing, with 49% of winter wheat in drought currently. Across the High Plains, and top winter wheat producer Kansas, drought looks much improved from this point last year. Average or slightly above average rain is expected over the next few months.

Though we are early in the season, the market will continue to follow crop development progress for key producers. Ultimately by May 2024, new crop focus will have become much more prominent for grain market movements.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.