Weather swaying prices as speculative traders react: Grain market daily

Tuesday, 21 November 2023

Market commentary

- UK feed wheat futures dipped yesterday following the trend in global wheat markets. Paris wheat futures declined due to improved weather for winter planting after marked rain delays, plus export concerns. Chicago wheat futures also came under pressure from selling by speculative traders. A small rise in Chicago maize futures, due to rises in soyabean futures, helped limit losses

- Old crop (May-24) UK feed wheat futures fell £2.90/t to £196.75/t yesterday, while new crop prices (Nov-24) were down £2.50/t to £205.80/t

- Chicago soyabean futures (May-24) lifted yesterday on renewed worries about the weather in Brazil (see below). However, most of the rises came after the end of the European trading day. As a result, Paris rapeseed futures (May-24) fell €3.75/t to €437.50/t to yesterday, with the stronger euro against the US dollar also potentially a factor

- Markets are mulling what the election of Javier Milei as Argentina’s next President on Sunday may mean. Milei campaigned under the promise of radical change, including for monetary policy

Weather swaying prices as speculative traders react

Contrasting weather conditions and the responses of speculative traders remain key market influences this week. However, the effects vary by crop.

For soyabean prices, and so rapeseed prices too, the critical issue is the uneven rainfall in South America. This is slowing soyabean planting in Brazil and makes for challenging growing conditions. In Brazil, soyabean planting is now 65% complete (Conab) but still well behind the past few years. More rain is expected this week and next, but there’s uncertainly about how much and where.

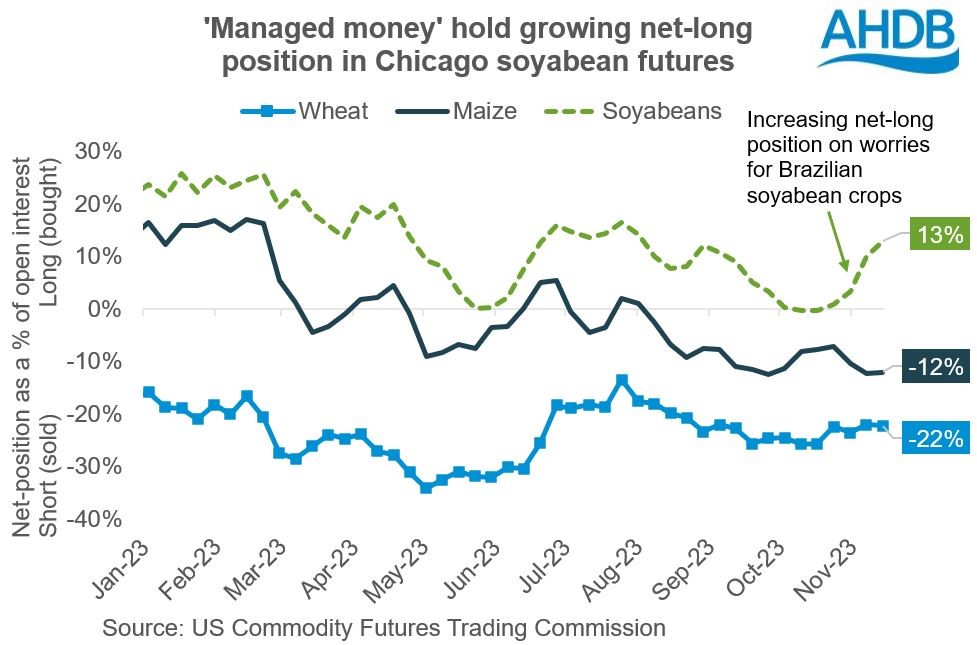

Reflecting the recent price rises, speculative traders are buying into Chicago soyabean futures, potentially adding further support to the upward movement. As of last Tuesday, ‘managed money’ held a sizeable net-long in Chicago soyabean futures, a tactic often used by speculative traders to profit from price rises.

The weather is also likely to impact maize production as most Brazilian maize is planted after the soyabeans are harvested, known as the Safrinha crop. For now, this has only given maize prices a small lift. But speculative traders are still net-short in Chicago maize and have been for a few months now, a tactic often used to profit if prices fall. So, if Brazilian weather concerns spark a rally in global maize prices, speculative traders may need to adjust their positions in Chicago maize futures, which could well add to any rally.

Meanwhile, US wheat futures prices remain under pressure. As of last Tuesday, speculative traders held a net-short position in Chicago wheat futures, and anecdotal reports suggest they may have extended this over the past week (LSEG).

This arguably reflects the recent pace of US export sales, plus a good start for the 2024 US winter wheat crop. 48% of the crop is in good / excellent condition (as of 19 Nov) according to the USDA. This is up from 47% a week before and the best for the time of year since the 2020 crop. This said, maize will influence the outlook for wheat prices. If maize prices rise, sooner or later wheat needs to follow to avoid too much animal feed demand switching from maize to wheat.

Both the weather in South America, especially Brazil, and the positions held by speculative traders are likely to influence prices for both grains and oilseeds over the coming weeks. However, US futures markets are closed on Thursday and Friday due to Thanksgiving, and traded volumes are also usually lower on Friday (Black Friday). So we can expect markets to be more variable in the next few days and early next week as traders re-position ahead and after the US holiday.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.