Brazil is supporting your rapeseed price: Grain market daily

Thursday, 16 November 2023

Market commentary

- UK feed wheat futures (May-24) closed yesterday at £200.05/t, down £2.45/t on Tuesday’s close. New crop futures (Nov-24) closed at £208.75, down £0.75/t over the same period.

- The domestic market was down with both Paris and Chicago wheat futures yesterday, which fell due to strong competition from Black Sea origin wheat. Prices were further pressured as FranceAgriMer forecast that French wheat stocks would hit a six-year high due to lower animal feed demand and exports to EU countries. The French agency also raised its export forecast outside the EU by 300 Kt; this is due to a larger estimate of French wheat being sold to China and Egypt.

- Paris rapeseed futures (May-24) closed yesterday at €448.00/t, down €3.50/t on Tuesday’s close. Prices were pressured with falls for Chicago soyabean futures, as rains are forecast in Brazil at the end of the week. Read more below as to why this has recently been driving oilseed prices.

Brazil is supporting your rapeseed price

A few weeks ago I discussed that Brazilian weather was a critical watchpoint for oilseed markets, as farmers plant what is forecast to be a record soyabean crop.

Since then (31 Oct), Chicago soyabean futures (May-24) have gained 5.4% and the contract hit its highest point since the end of August on Tuesday. Over this same period Paris rapeseed futures (May-24) have felt support, albeit not as much, but the contract has gained 1.8% over the same period, in sterling terms this is c.£6.00/t.

We have reported that this (2023/24) Brazilian crop is forecast to be a record one for months and months. But, is the current weather really a concern for oilseed markets and could it have the ability to keep bullish sentiment in the market?

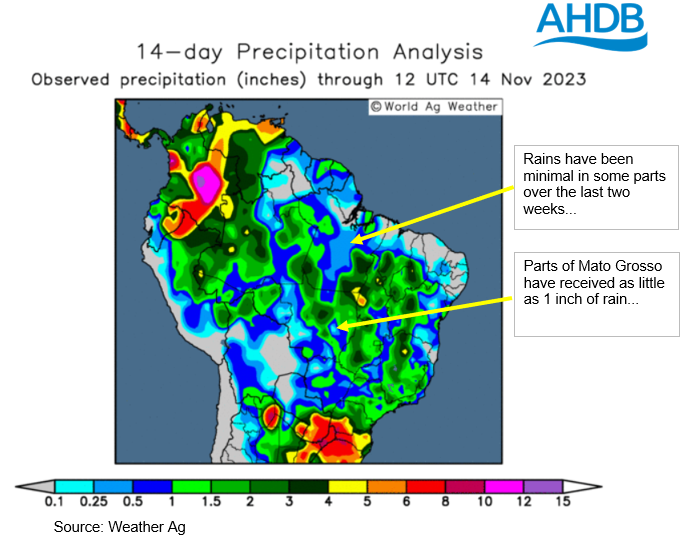

So, over the last two weeks there has been some rains in Northern parts of Brazil, where a sizable amount of soyabean production is grown, however in parts this has been minimal. Conditions across the region have been sweltering. Furthermore, in the south which is equally as important to production, rains have been excessive, slowing planting.

For example, in the Mato Grosso region (largest producing soyabean region) some areas have received as little 1 inch of rain. This has been at times where temperatures in the region have been approaching near 40°C . Possibly not the most ideal conditions for a soyabean crop that has just been sown. Planting in the region is 88.1% complete, behind the same point last year when 97.4% of the crop had been sown (Conab).

Could this continue to support rapeseed?

This Brazilian crop is forecast by many forecasters to be 160 Mt or more, which is above the record 154.6 Mt produced last year.

I think it’s too early to make any brash outlooks that there is going to be large cuts to forecasts. However, some revisions are already underway. At the start of this week Ag Rural estimated the Brazilian crop at 163.5 Mt, down from 164.6 Mt estimated in October. The consultants also cited that new cuts were possible before the end of this month depending on weather.

The weather outlook for Brazil is looking more positive. At the end of this weekend widespread rains are expected over many major soyabean producing regions, which could ease concerns.

Another point to add, is that although this dry weather has been supporting prices, Brazilian 2023/24 soyabean ending stocks are currently estimated at 39.7Mt (USDA). This is an increase of 6.3 Mt on last year (2022/23) and the highest ever. Partly because of the anticipated rise in Brazil, global 2023/24 ending stocks of soyabeans are estimated at 114.5Mt, the highest since 2018/19 (USDA). Is the current Brazilian weather supportive of prices…? Yes. Are the recent production cuts enough to wipeout the large global surplus of soyabeans…? Not yet, as trims so far have been minimal. This is something to continue monitoring as it will drive rapeseed prices going into 2024.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.