Analyst Insight: Speculative traders betting on wheat and maize price falls

Tuesday, 3 October 2023

Market commentary

- Nov-23 UK feed wheat futures ended trading yesterday almost unchanged, down £0.15/t at £185.95/t. There were opposing trends in global markets, with Paris wheat futures falling but Chicago wheat and maize futures both rising. The French market remained focused on competition from Black Sea exports and the larger-than-expected US wheat crop. Meanwhile, Chicago wheat futures prices bounced after falling sharply on Friday, at least in part due to buying by speculative traders.

- Nov-23 Paris rapeseed futures rose €5.00/t to close at €447.50/t, pulled up by Chicago soyabean futures, which edged higher ahead of the weekly US crop progress report.

- The US maize and soyabean harvests are now both 23% complete as of 1 October (USDA), both ahead of their five-year averages. However, these fell short of market expectations of 25% complete according to a poll by Refinitiv (an LSEG business). Planting of the 2024 winter wheat crop reached 40% complete 1 October (USDA).

- Brazil’s 2023/24 soyabean crop could reach 164.1 Mt according to StoneX. This is 0.7 Mt above its previous forecast and 1.1 Mt above the USDA. Brazil is currently planting soyabeans at a record pace (AgRural). Though it’s still early days at 5% complete, this increases the chance of the forecast area being planted. Meanwhile, StoneX trimmed its first and second maize crop forecasts by a combined 1.4 Mt. At 139.2 Mt StoneX’s total production forecast is still 10.2 Mt above the USDA.

- The 2023 EU-27 rapeseed crop is pegged at 19.5 Mt by Stratégie Grains. This is up from 18.9 Mt a month ago and follows better than expected results in several countries, including Romania and Poland. The EU Commission increased its estimate last week.

Speculative traders betting on wheat and maize price falls

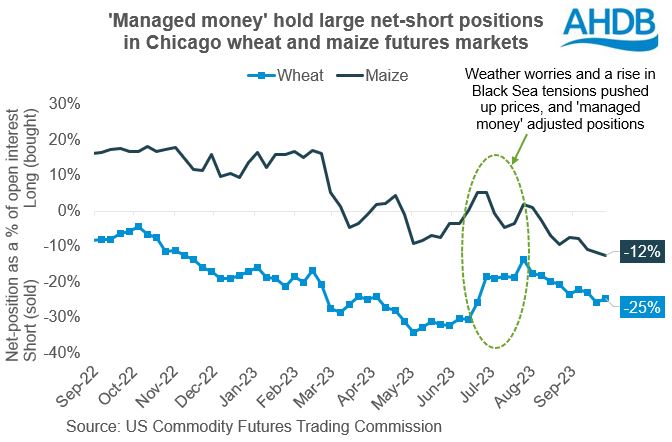

Speculative traders hold large net-short positions in Chicago wheat and maize futures, which can be seen as predicting a bearish outlook for wheat and maize prices. They also hold a (smaller) net-short in Paris wheat futures, equating to -7% of open interest.

Since early August, traders classed as ‘managed money’ have increased their net short position in Chicago wheat futures. While less than it was before the June weather worries and the rise in Black Sea tensions, this is still a sizeable net-short.

Over the same period, managed money traders have also built the largest net-short percentage in Chicago maize futures since the end of June 2020. This is despite ongoing uncertainty over US maize yields. But it potentially reflects the forecasts for high global maize output, including record South American crops.

A ‘short’ position will profit a speculative trader if the price of wheat falls after they agree to be the sellers of a wheat futures contract. The speculative trader can then buy back the contract for less than they sold it for, pocketing the difference. Conversely, if a speculative trader buys a futures contract or takes a ‘long’ position, they will profit if the price rises after they bought.

Holding this scale of bearish positions in wheat might seem surprising, given wheat stocks in major exporting countries are expected to fall this season. But it could reflect that US wheat stocks are expected to rise over the 2023/24 season and expectations for large global maize supplies. Some industry sources are also predicting a larger US wheat area for harvest 2024.

That said, speculative traders don’t necessarily follow the fundamental factors of the markets. Often, they rely on historical price trends to show what may happen next, which doesn’t always happen. This is especially the case when market shocks, such as weather events, happen.

If speculative traders continue to hold large net-shorts, but the market rises, this could lead to losses. As a result, they may need to re-position, buying back previous-sold positions, known as short-covering. This can add to the speed or scale of price changes in the short-term, though longer term, the underlying supply and demand sets prices.

A market rise is not certain, but below are a few things in the near future that could trigger price rises:

- If the US maize crop comes in smaller than expected in the USDA’s next World Agricultural Supply and Demand Estimates on 12 October.

- The potential for the Argentine or Australian wheat crops to be smaller than expected due to less-than-ideal weather conditions.

- Disruption to Black Sea exports from the ongoing war in Ukraine.

If a market event triggers price rises, any extra momentum from short covering could provide a selling opportunity. A market event would need to notably shift the global supply and demand situation or sentiment, to alter the market direction beyond the short term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.