Australian wheat crop trimmed with more dry weather ahead: Grain market daily

Tuesday, 5 September 2023

Market commentary

- UK feed wheat futures (Nov-23) fell £1.00/t yesterday to £184.00/t.

- European wheat futures lacked direction as the Chicago futures markets were closed for the US national holiday, Labor Day. The US holiday, along with talks between the Presidents of Russia and Turkey to discuss Black Sea exports, meant prices drifted lower. There’s been no breakthrough in the talks, but the potential for easier exports from Ukraine is dampening market sentiment.

- Welcome rain fell in Argentina over recent days according to the Rosario Grains Exchange. Following earlier dry weather, the rain will help stabilise wheat crops and could mean an early start to maize planting.

- Paris rapeseed futures (Nov-23) fell €8.25/t to €465.25/t yesterday. The closure of the Chicago futures markets, plus a fall in palm oil prices weighed on the Paris futures.

Australian wheat crop trimmed with more dry weather ahead

Australia’s wheat crop will be smaller than forecast in June according to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), and there is more dry weather ahead.

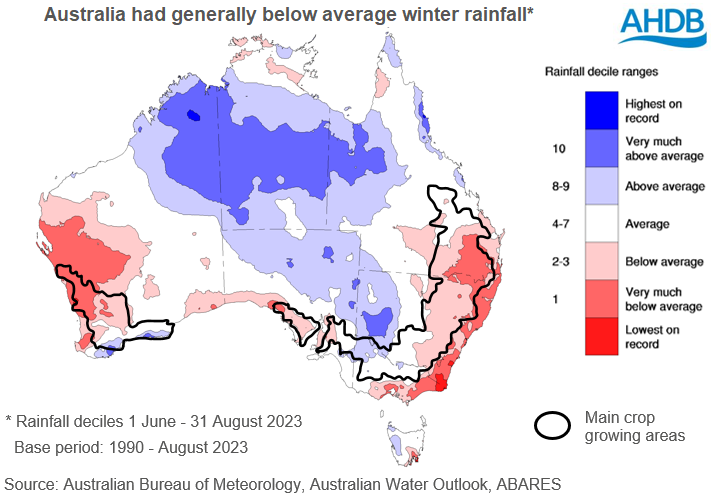

After several years of particularly high rainfall, due to the La Niña weather event, drier conditions have returned to many key cropping regions. Queensland, northern New South Wales, and the northern and eastern cropping regions of Western Australia all recorded below-average rainfall this winter (June–August).

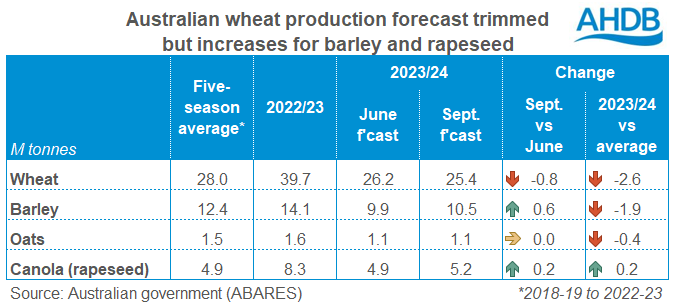

As a result, ABARES now expects its 2023/24 wheat crop to be 0.83 Mt smaller than it forecast in June. This is a smaller decrease than was generally anticipated by the industry. At 25.4 Mt, the current crop would be the smallest since 2019/20 but a long way above that year. In 2019/20 output fell to 14.5 Mt, after several years of drought severely squeezed the planted area and yields.

Barley and rapeseed output are both pegged higher than in June due to higher yields in Victoria. Victoria, which produced 20% of Australian barley and 21% of the country’s rapeseed over the past five years, had good winter rainfall. Average or above average rainfall also fell in southern parts of western Australia and New South Wales over winter, helping offset lower yields in other areas.

The oat production forecast is unchanged from June. Despite this, the output of oats and barley will still be smaller than last year’s historically large levels. The rapeseed crop is also smaller than last year, but larger than average due to the third-largest area on record.

However, drier and hotter than normal weather is forecast across Australia for the next three months, which are critical for winter crop yields. This raises the question of whether production could yet slip lower.

Market impact?

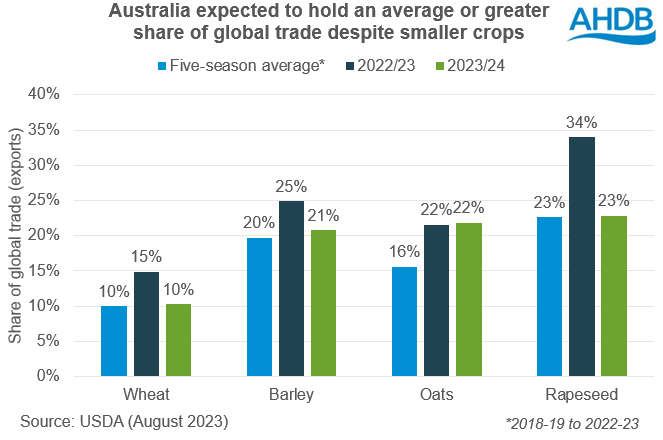

A fall in Australian output, especially for wheat, has been long priced into the market. With smaller crops than last year, Australia’s share of global exports is already projected to fall.

The latest wheat crop forecast from ABARES is some 3.6 Mt below the USDA’s August forecast. This suggests that Australia may not have as much to export this year as predicted, which could put even more pressure on other origins to meet global demand. While exports continue to flow from the Black Sea, the impact will be lessened. But if that export flow is disrupted again, lower exports from Australia will be keenly felt, especially if the Australian crop shrinks further; that, in turn, could push up prices.

ABARES also expects the Australian oat crop to be 0.4 Mt smaller than the USDA. If confirmed, this would deepen the global production deficit and likely push up prices relative to other grains to reduce demand.

The picture is slightly different for barley and rapeseed. The new ABARES forecasts are 0.5 Mt and 0.3 Mt larger than the USDA predicted in August. This suggests a little more room for manoeuvre in global supply and demand for these crops.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.