Arable Market Report − 4 September

Monday, 4 September 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

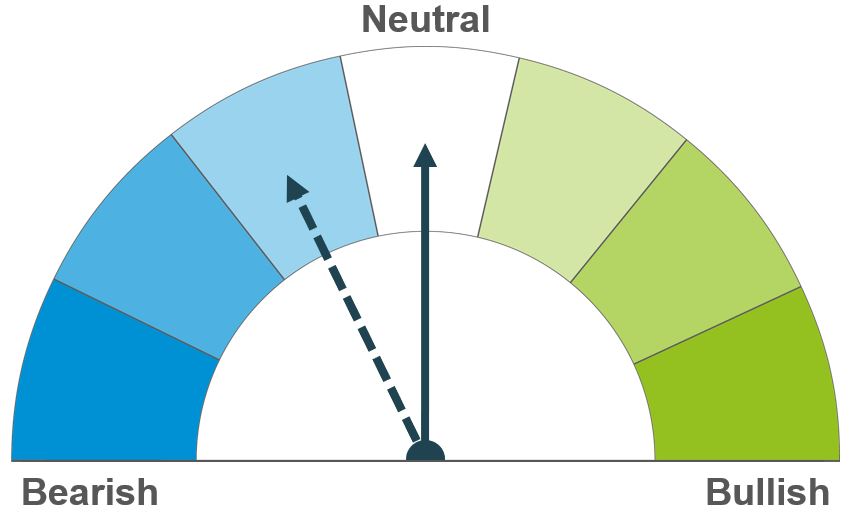

Wheat

Maize

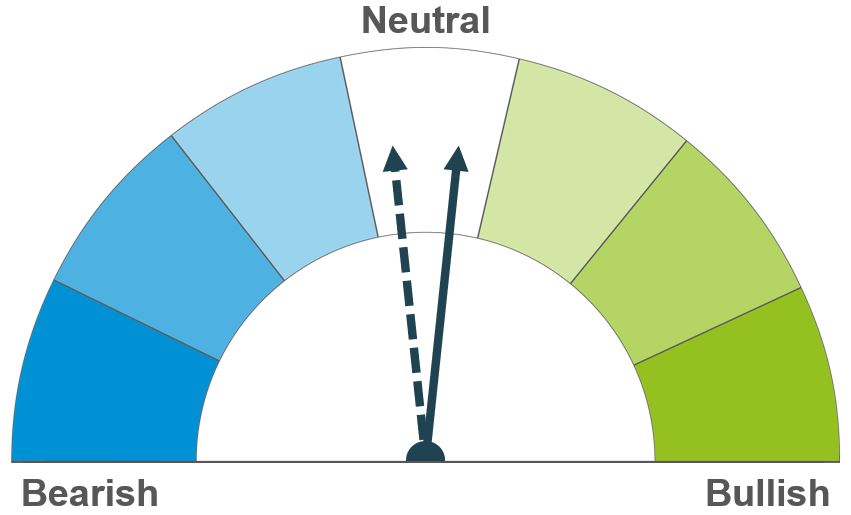

Barley

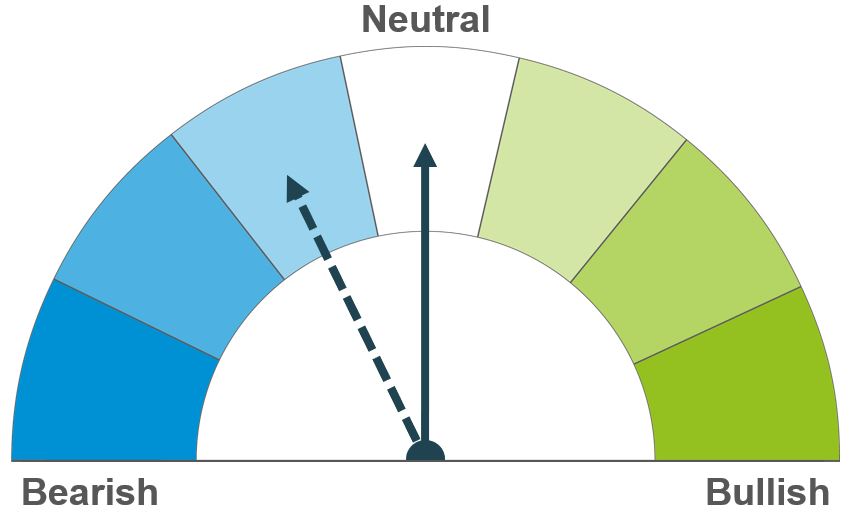

Markets will remain reactive to any news on Black Sea supplies. Global supply and demand looks to be tightening, though plentiful maize supply will likely pressure feed wheat markets longer term. The outlook for milling prices will depend on quality results from northern hemisphere harvests.

US weather remains a watchpoint in the short term. Longer term, large US and Brazilian crops will likely weigh on the market.

Due to plentiful maize supply expectations, the feed grain market seems well supplied. Barley will continue to follow the wider grains market.

Global grain markets

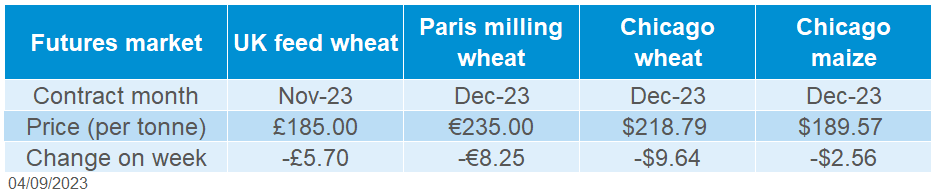

Global grain futures

Global wheat and maize markets were pressured last week. Chicago wheat futures (Dec-23) were down 4.2% Friday-to-Friday. Chicago maize futures (Dec-23) were down 1.3% over the same period.

Much of the pressure at the beginning of the week was a result of better-than-expected US crop condition scores published last Monday. Despite ongoing hot and dry weather, 56% of the US maize crop was rated good-to-excellent, a smaller decline than predicted by analysts (Refinitiv). As most crops are still to mature, adverse weather could still impact yield potential over the next couple of weeks. Over the next seven days, temperatures are expected to remain unseasonably high. Though there is forecast to be some welcome rain in the US Midwest, this will remain something to watch.

Talks between Turkish President Erdogan and Russian President Putin are expected to take place today in Sochi. It’s reported that the Turkish President will try to convince Putin to return to a Ukrainian grain export deal: the previous deal expired in July. Grain markets will remain reactive to any news on this over the next few days.

Competitive Russian grain supplies continue to weigh on the global market. Egypt’s General Authority for Supply Commodities (GASC) bought around 480 Kt of Russian wheat on Friday in a tender. The wheat was bought for c.$270/t, with traders reporting this could be below the unofficial floor set by Russia’s government (Refinitiv).

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) is due to release its latest crop forecasts tomorrow. Analysts and traders are expecting Australia to lower its wheat production forecast for 2023/24 by around 1 Mt from June’s estimate of 26.2 Mt (Refinitiv). The anticipated cut to production is a result of the El Niño weather event reducing yields. More analysis will be available on this in tomorrow’s Grain market daily.

UK focus

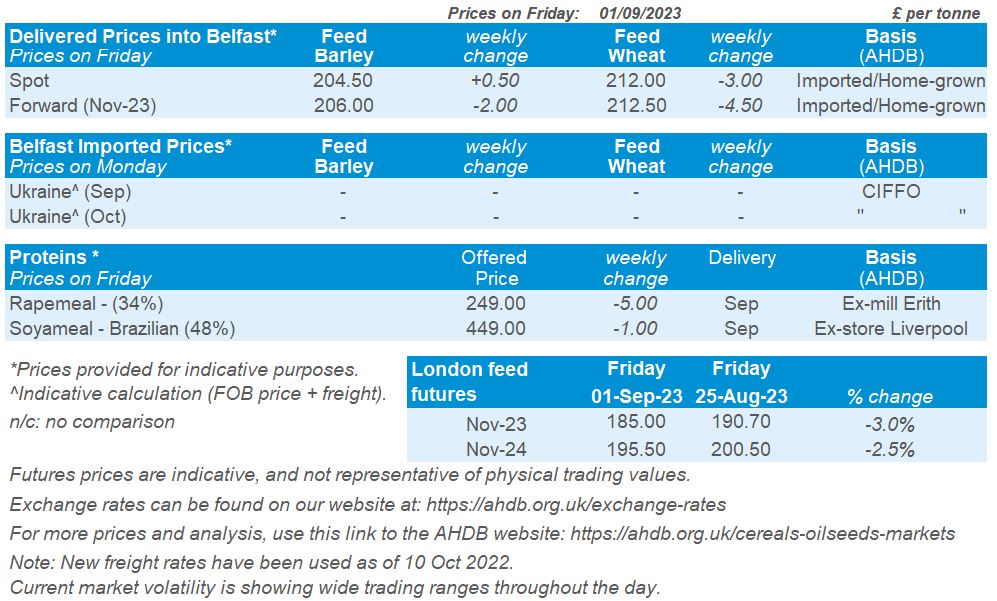

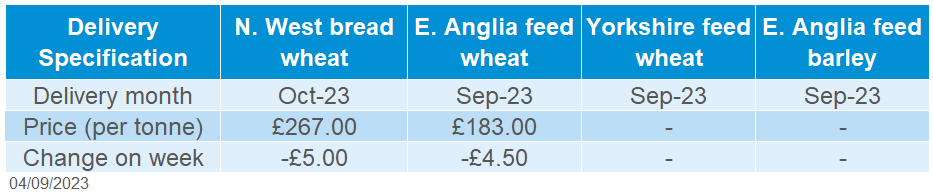

Delivered cereals

UK feed wheat futures followed global price movement down last week. The Nov-23 contract fell £5.70/t last week to close on Friday at £185.00/t. The Nov-24 contract closed at £195.50/t on Friday, down £5.00/t over the same period.

Delivered feed wheat prices followed futures price movement Thursday-to-Thursday last week. Feed wheat into East Anglia for November delivery was quoted at £187.00/t, down £3.00/t. Reports suggest UK milling wheat quality is very variable; this is reflected in delivered bread wheat prices. Bread wheat into the North West for November delivery was quoted at £268.00/t on Thursday, down £5.00/t on the week. This price was at a £82.00/t premium to Nov-23 UK feed wheat futures, historically high for this time of year.

Drier weather over the past two weeks allowed the GB harvest to make good progress, says the latest AHDB harvest progress report. However, the report also shows variable quality, including some lower Hagberg Falling Numbers (HFN) for winter wheat and germination levels for spring barley. Read the full report here.

On Thursday, Defra released its arable crop areas for England as at 1 June. The stand-out for this data release is the lower-than-expected wheat area for the 2023 harvest, estimated to be 1,580 Kha, down 5% on the year. The total barley area in England for 2023 is estimated at 799 Kha, up 2% on the year. Over the coming weeks, there will be further analysis and insight from these figures on what domestic availability could be for 2023/24.

Oilseeds

Rapeseed

Soyabeans

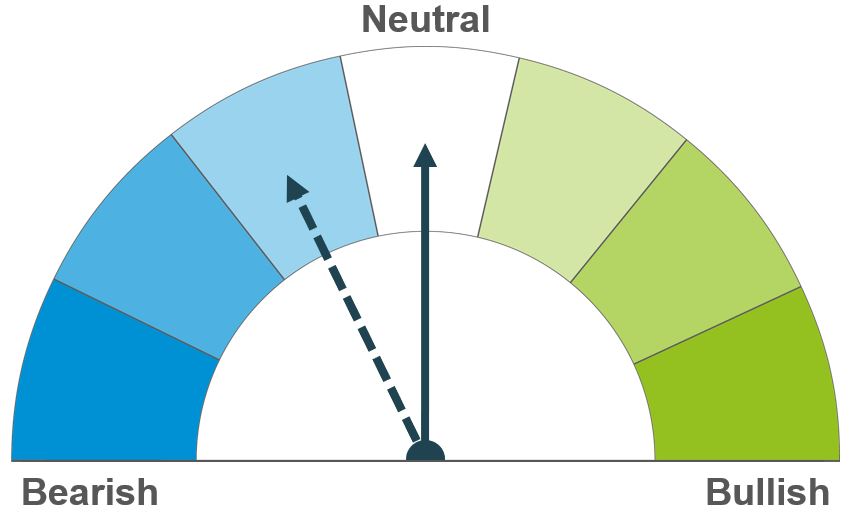

Despite cuts to Canadian and EU crops, the global rapeseed market is well supplied for 2023/24. Longer-term, price direction will largely be dictated by the soyabean market direction.

Short-term, US weather is the driver as the crop is in critical development stages. The longer-term price direction is bearish, with large South American crops expected into 2024.

Global oilseed markets

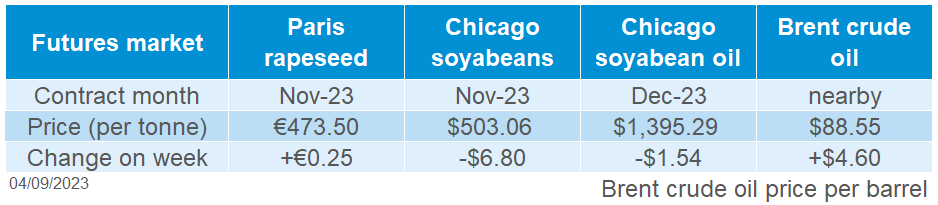

Global oilseed futures

It was a week of pressure for Chicago soyabean futures. The Nov-23 contract ended down 1.3% across the week, closing Friday at $503.06/t. The main driver was that US soyabean crop conditions were not as bad as anticipated, plus traders were squaring positions before the end of the month. There was slight support on Friday as the focus was on tighter US ending stocks.

Although there was a weekly decline for soyabeans, the Nov-23 contract still gained 2.8% across the month of August. The rise is from the hot and dry weather across the US Midwest, which has posed questions over crop damage. There has also been strong export demand for US-origin soyabeans.

Last Monday (week ending 27 August), the USDA rated 59% of the US soyabean crop as in good-to-excellent condition, down 1% from the week before. Markets subsided as there were expectations that this rating would have dropped by 3% (Refinitiv).

US export sales (to week ending 24 August) were pegged at 1.1Mt, in line with trade expectations. Demand remains buoyant for US soyabeans, which could tighten US soyabean ending stocks for 2023/24 even further. This is keeping the US market supported.

In other news, StoneX upped its estimate of the 2023/24 Brazilian soyabean crop to 163.6 Mt, up from 163.4 Mt. This is further adding to this bearish outlook longer term.

There was support across the week for Malaysian palm oil futures. There has been hot and dry weather in the region recently from the El Niño weather event intensifying, which could hinder supply from the region. There is also high demand from the festive season in India.

Rapeseed focus

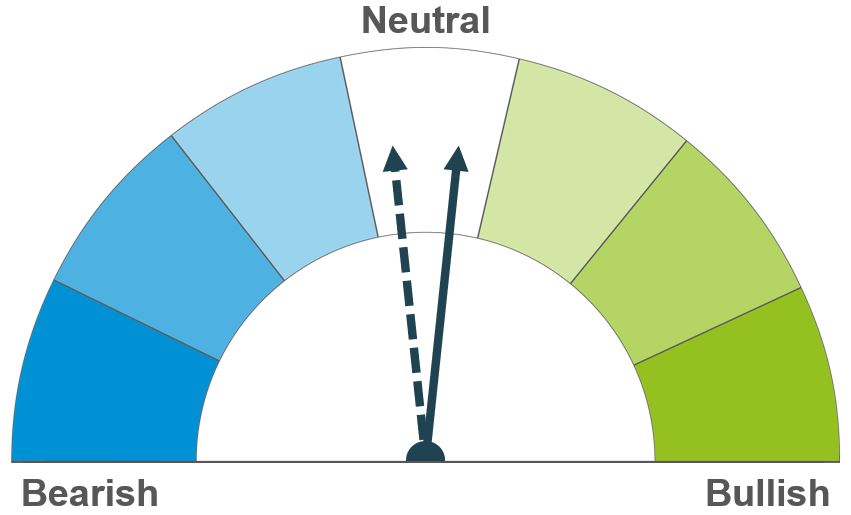

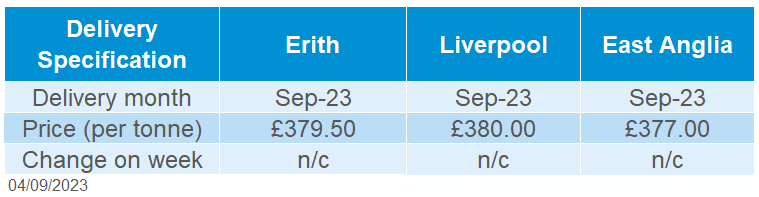

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed Friday at €473.50/t, gaining €0.25/t across the week. Futures came under pressure at the start of the week but recovered towards the end of the week.

Delivered rapeseed (into Erith, Nov-23) was quoted Friday at £389.00/t, down £1.50/t across the week.

Statistics Canada (based on satellite and agroclimatic data) last week estimated Canada’s canola crop at 17.6 Mt, down 6.1% year-on-year. Despite this downward revision due to recent dry weather in the Canadian Prairies, the estimate was still above the average trade expectation of 17.4 Mt.

The latest Stratégie Grains oilseed report has further lowered its outlook for this year’s oilseed crops in the EU. This report cites disappointing harvest results for rapeseed and dry weather impacting sunflower and soyabean crops in some regions (Refinitiv).

In the report the consultancy pegged EU OSR production at 18.9Mt, down from the 19.3Mt forecast a month earlier. This means production is now down 2.7% from the 2022 harvest. It’s been noted that the rapeseed harvest was notably disappointing in France, Germany, and Romania.

Domestically, the latest GB harvest progress report (data to week ending 29 August) showed the winter oilseed rapeseed harvest is near complete. Only very few fields remain in the North East. The typical GB average yield is currently estimated at 2.8–3.0 t/ha, unchanged from the last report but below the five-year average.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.