Canadian weather impacting rapeseed prices? Grain market daily

Wednesday, 9 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £202.20/t, gaining £2.70/t on Monday’s close. New crop futures (Nov-24) closed at £204.55/t, gaining £2.90/t over the same period.

- The domestic market followed up both the Chicago and Paris market yesterday. The Paris market edged higher with support from a weakening Euro and while traders weighed up war risks and their implications on Black Sea exports.

- Egypt’s state grain buyer (GASC) reported on Tuesday that they had purchased 235 Kt of Russian wheat in an international tender.

- Paris rapeseed futures (Nov-23) closed yesterday at €463.75/t, down €2.50/t on Monday’s close. Rapeseed followed the pressure in Malaysian palm oil futures, the market is awaiting the data from the Malaysian Palm Oil Board, which is out tomorrow. A Reuters survey estimates July Malaysian palm oil inventories to rise from last month.

- Chicago soyabean futures gained due to a technical bounce, gains were kept in check from improving crop conditions from the latest USDA crop progress report.

Is Canadian weather impacting rapeseed prices?

Rapeseed prices have been pressured since the start of the year, with ending stocks forecast to grow for this marketing year (2023/24).

Global stocks-to-use (STU) ratios of rapeseed are going to grow year-on-year to 7.5% for 2023/24, with large crops from Europe, Ukraine, Canada and Australia (El Niño severity dependant) expected.

However, in Canada, rainfall has been limited, bringing production potential into focus. Although they haven’t had the ongoing blazing heat of 2021, which impacted their canola (rapeseed) crop severely.

Weather conditions across Western Canada early in this growing season were volatile as a cold and dry March and April was followed by a near-record hot May. Rains this growing season have been infrequent in some of the most productive canola crop regions.

At the end of July, Canadian canola was entering the critical blooming period where the crop is more sensitive to heat exposure. Crop conditions remained relatively favourable across Western Canada in early July despite an abnormally hot June.

However, in Manitoba rains have been scattered, which is reflected in variable soil moisture conditions, resulting in much of the provinces' most productive canola area getting abnormally less rain. There are reports that lower canola yields are expected, and the majority of the crop is expected to be sub-par.

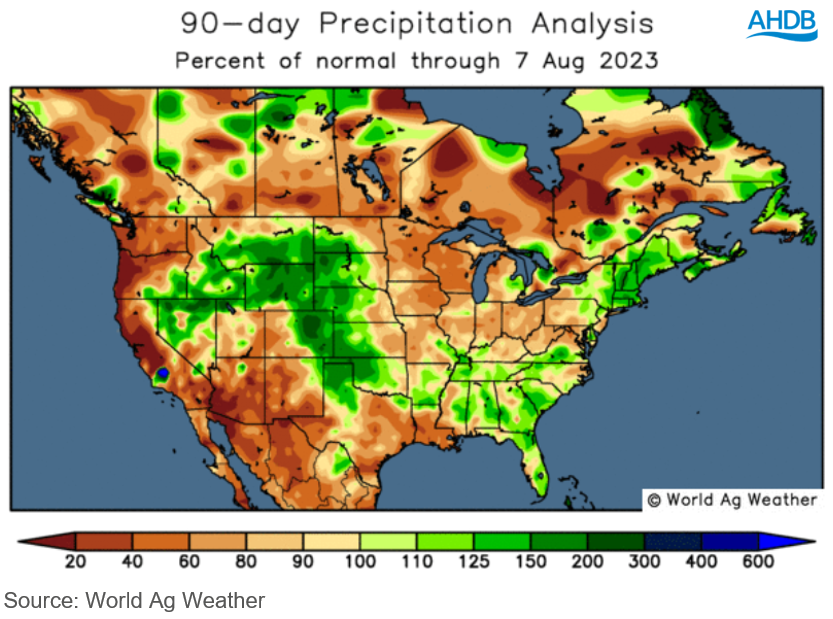

As the graphic shows, rain has been lacking across the Canadian Prairies when analysing the previous 90-day rain analysis. So, it poses the question: is Canada actually expected to produce the 18.8 Mt that StatCan are currently forecasting with a larger area year-on-year forecast, based on trend yields and normal abandonment?

Large portions of the Western Canadian prairies remain significantly drier than normal with the seasonal forecasts calling for a continued hot and dry summer.

Although rains have been infrequent, the temperature for the most part has not been consistently abnormally high, limiting concerns that we may see production cuts. However, as noted above, much of this crop is not expected to be as good as initially forecast.

If cuts are realised, this could reduce Canadian ending stocks for 2023/24 which in turn could tighten the global STU. If this happens though, it will likely just limit rapeseed’s current respective discount to soyabeans on the continent.

Going into the 2023/24 marketing year, EU rapeseed supply looks ample. Beginning rapeseed stocks in Europe are high, they are also expected to import a substantial amount of Ukrainian rapeseed, which is currently being harvested. This high availability is likely to weigh on continental prices which will feed into our domestic pricing of rapeseed.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.