US weather remains in focus: Grain market daily

Wednesday, 30 August 2023

Market commentary

- UK feed wheat futures (Nov-23) closed at £187.45/t yesterday, down £3.25/t from Friday’s close. The Nov-24 contract closed at £197.55/t, down £2.95/t over the same period.

- US and European grain futures were pressured yesterday after better-than-expected US crop condition scores, read more on this below. However, prices have firmed slightly this morning after reports of falls in Canadian wheat production this season. Statistics Canada (StatCan) released its August estimates of production yesterday and pegged total wheat production for 2023 at 29.5 Mt, down 14.2% on the year.

- Paris rapeseed futures (Nov-23) fell €9.50/t yesterday, ending the session at €464.75/t. The Nov-24 contract closed at €479.00/t, down €6.00/t over the same period. These falls were also driven by better than anticipated US soyabean conditions.

- StatCan estimated Canada’s total canola production to sit at 17.6 Mt for 2023, down 6.1% on the year.

US weather remains in focus

As has been well documented, over the last few weeks US weather has been a key driver in both grain and oilseed markets, with soyabean and maize conditions being closely monitored. With little to no rain and extreme heat due in key producing regions over the next week, it’s important to look at the impact this adverse weather could have on crops, and how this might affect global prices.

Maize

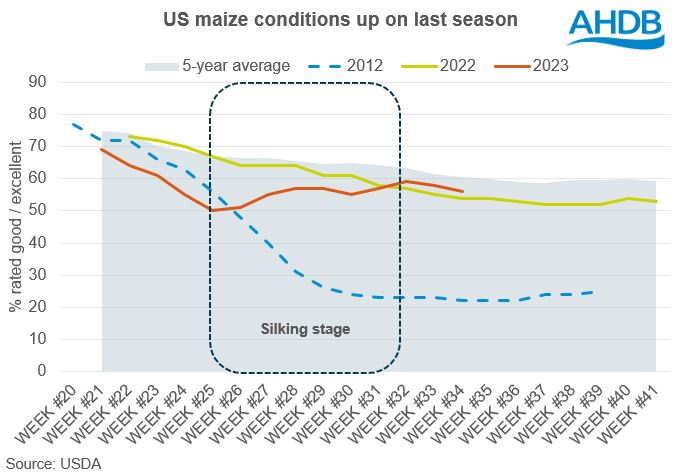

Following a generally warm and dry summer so far, as at 22 August, 43% of the US maize area was affected by drought. This is the largest US maize area impacted by drought since 2012, when 80% of the planted area was affected. Reports from the Pro Farmer Crop Tour last week also indicated that yields could be lower than the USDA had estimated in its World Agricultural Supply and Demand Estimates (WASDE) earlier this month. However, markets were pressured yesterday as the USDA’s weekly crop condition score for maize didn’t decline as much as expected.

Analysts on average had expected a 3 percentage point (pp) decline on the week to 55% in good/excellent condition (Refinitiv). However, in Monday’s report the crop was rated at 56% in good/excellent condition.

As shown above, the condition of the crop is now ahead of the same point last season and just under the five-year average. Even though temperatures in Chicago last week reached highs not seen since 2012, maize conditions remain much higher than then. On 26 August 2012, 22% of the US maize crop was rated in good/excellent condition, with a larger area being impacted by drought (as noted above).

The US maize crop is also now out of its ‘silking phase’ where the crop is the most sensitive to temperature and moisture stresses. Most of the crop is now finishing ‘doughing’, with some earlier-sown crops starting to mature.

Over the next few weeks, with the crop out of its crucial growth stage, we could see US weather have a declining impact on global grain markets as more of the crop matures. While a bumper US crop is still expected, shorter term, yield potential in some of the later sown crops could still be impacted by extreme weather over the next few days. This will remain something to watch.

Soyabeans

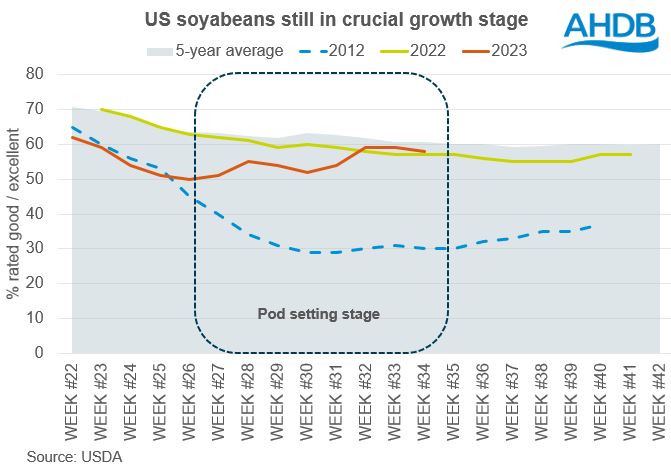

As of 22 August, 38% of the US soyabean area was affected by drought conditions, again the largest soyabean area impacted by drought since 2012 (when 79% of the area was in drought). Much like maize, reports from the Pro Farmer Crop Tour last week suggested that yields were being impacted by the adverse weather as of late.

Following the tour, analysts on average expected soyabean crop conditions to fall to 56% in good/excellent condition, down 3pp on the week (Refinitiv). In Monday’s scores, 58% of the crop was rated good/excellent, down just 1pp.

At this point in the season, soyabean crop conditions are relatively in-line with last year and just under the five-year average. However, much of the US soyabean crop is still coming to the end of the ‘pod setting’ stage. This means the crop is still sensitive to moisture and temperature stresses and will likely be impacted more by the forecast hot and dry weather than maize might be and more rain is needed to improve yields.

In terms of what this means for UK farmers, volatility in US soyabean markets due to the weather over the coming weeks will likely filter through into rapeseed markets, so US weather will remain a key watchpoint at least in the short term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.